Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Wednesday, crude oil lost 0.25% after the EIA showed in its weekly report that crude stockpiles rose more-than-expected last week and stood at their highest level in 83 years. In reaction to this, light crude extended losses and dropped to slightly above $101 per barrel. Will the proximity to the psychological barrier of $100 encourage oil bulls to act in the near future?

Yesterday, the U.S. Energy Information Administration showed in its weekly report that crude oil inventories rose by 3.52 million barrels in the week ended April 18, beating expectations for a build of 2.27 million barrels. Thanks to this increase, total U.S. crude oil inventories stood at 397.7 million barrels (well above the average range for this time of year) at their highest level since May 1931. As mentioned earlier, this news had a negative impact on light crude and pushed the price lower - to slightly above $101 per barrel.

Having discussed the above, let’s move on to the technical changes in the crude oil market (charts courtesy of http://stockcharts.com.)

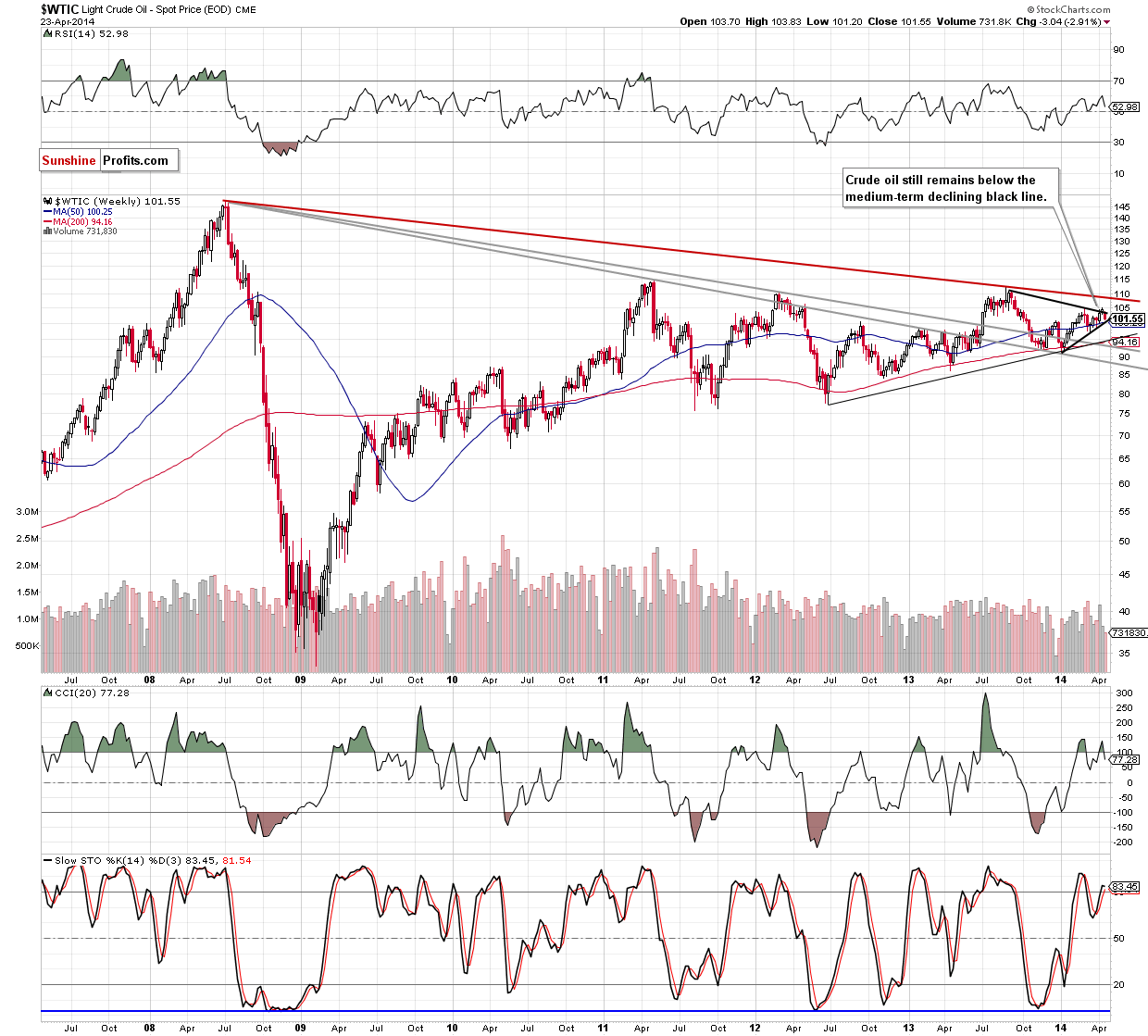

As you see on the weekly chart, the situation hasn’t changed much. Therefore, what we wrote in our previous Oil Trading Alert is still up-to-date.

(…) crude oil gave up the gains and declined below the medium-term resistance line (marked with black). With this move, the commodity invalidated the breakout above this support line, which is a bearish signal. Taking this fact into account, it seems that we may see further deterioration and the downside target for the sellers will be the lower line of a triangle, which corresponds to the 50-week moving average at the moment (around $100.25).

Having disscussed the above, let’s zoom in on our picture and move on to the daily chart.

In our previous Oil Trading Alert, we wrote the following:

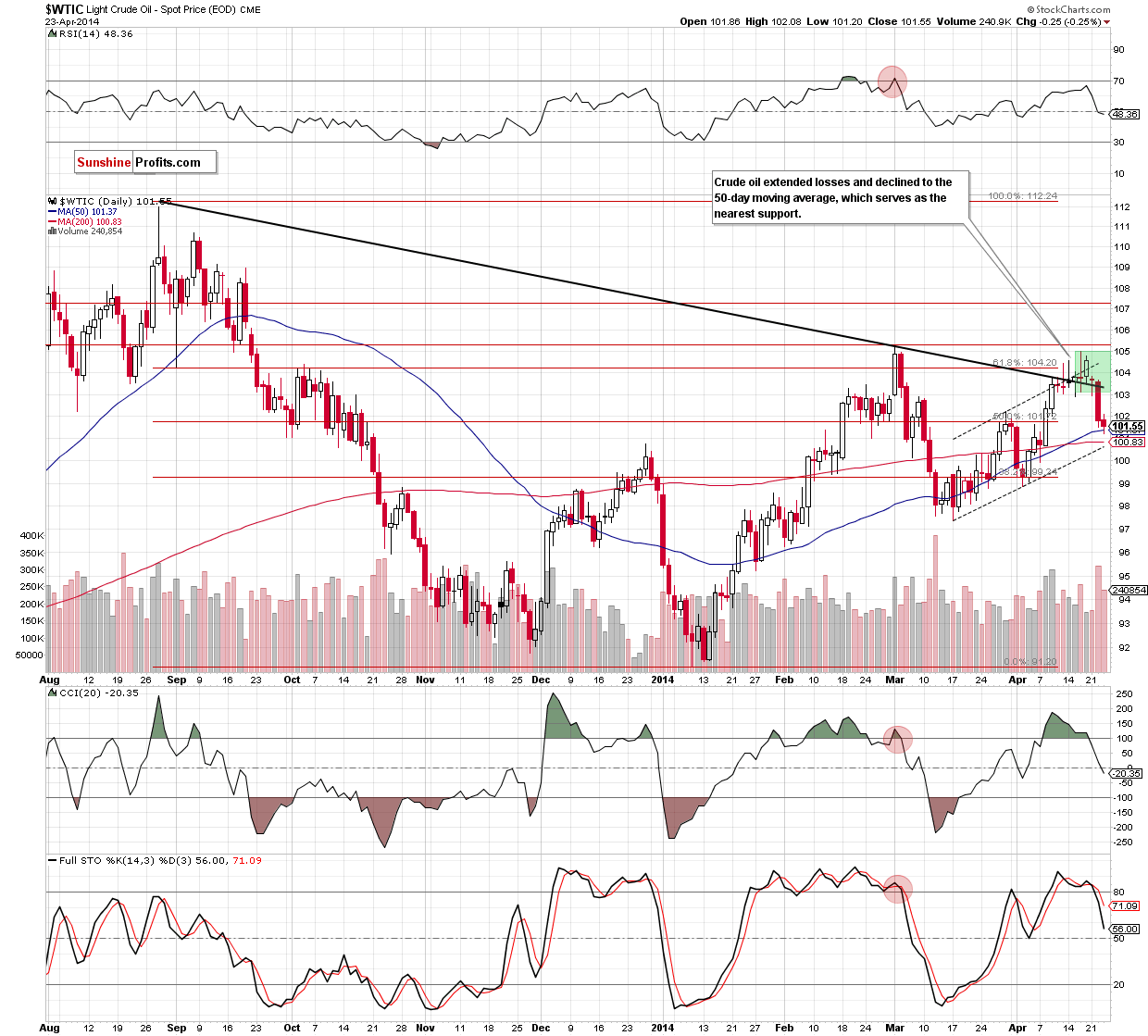

(…) the commodity also dropped below the lower line of the consolidation (marked with green). According to theory, such price action may trigger a decline to around $101.30.

Looking at the above chart, we see that although oil bulls tried to push the price higher after the market open they failed, which resulted in further deterioration. As you see on the daily chart, crude oil declined below the 50-day moving average and hit an intraday low of $101.20 (quite close to our $101.30 immediate-term target). In this way, the sellers realized the above-mentioned bearish scenario, which reduced the selling pressure. In reaction to this, the buyers managed to trigger a corrective upswing that took back light crude above the 50-day moving average. If this support holds and encourages oil bulls to act, we may see an increase to around $102.65, where the 38.2% Fibonacci retracement (based on the recent declines) is. However, if it is broken, the next downside target for the sellers will be the 200-day moving average (currently at $100.83). Please keep in mind that sell signals generated by the indicators remain in place, supporting the bearish case.

Summing up, crude oil extended losses and declined below the 50-day moving average. However, as it turned out in the following hours, this deterioration was only temporarily. As mentioned earlier, if it holds, we may see an increase to around $102.65 (the 38.2% Fibonacci retracement based on the recent declines). However, if it is broken, the next downside target for the sellers will be the 200-day moving average at $100.83. As a reminder, if this area is broken, the next price target will be the lower line of a triangle marked on the weekly chart (currently around $100.25). If this strong support is broken, we’ll consider opening short positions.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): In our opinion no positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts