Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 and initial (!) target price at $35.72 are justified from the risk/reward perspective.

On Tuesday, crude oil lost 1.83% as a bearish outlook from the International Energy Agency weighed negatively on the price. Thanks to these circumstances, light crude invalidated earlier breakout above the Fibonacci retracement and closed the day under $47. How low could the commodity go in the coming days?

Yesterday, the International Energy Agency said that despite declines in output from non-OPEC producers (the agency expects a drop of 500,000 barrels per day in 2016), the global oil market would remain oversupplied for at least another year. This bearish news weighed on investors’ sentiment and pushed the price of the commodity below $47. How low could the commodity go in the coming days? Let’s examine charts and find out (charts courtesy of http://stockcharts.com).

Yesterday, we wrote the following:

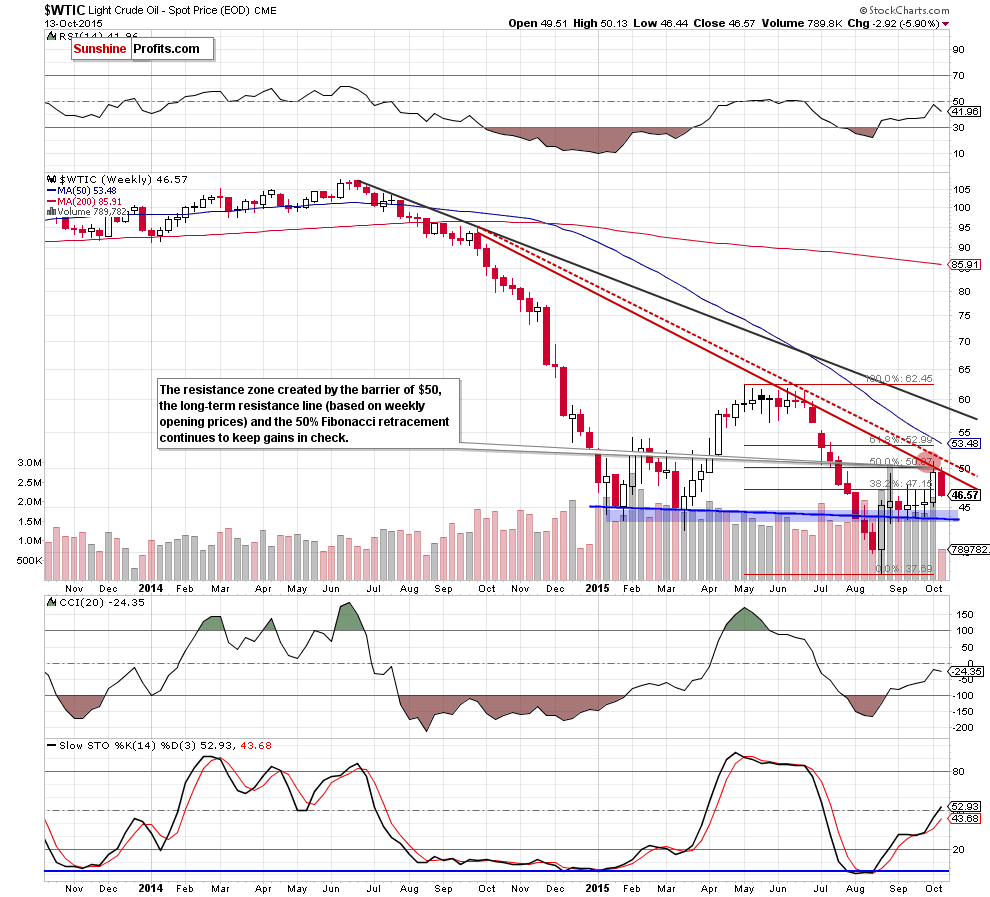

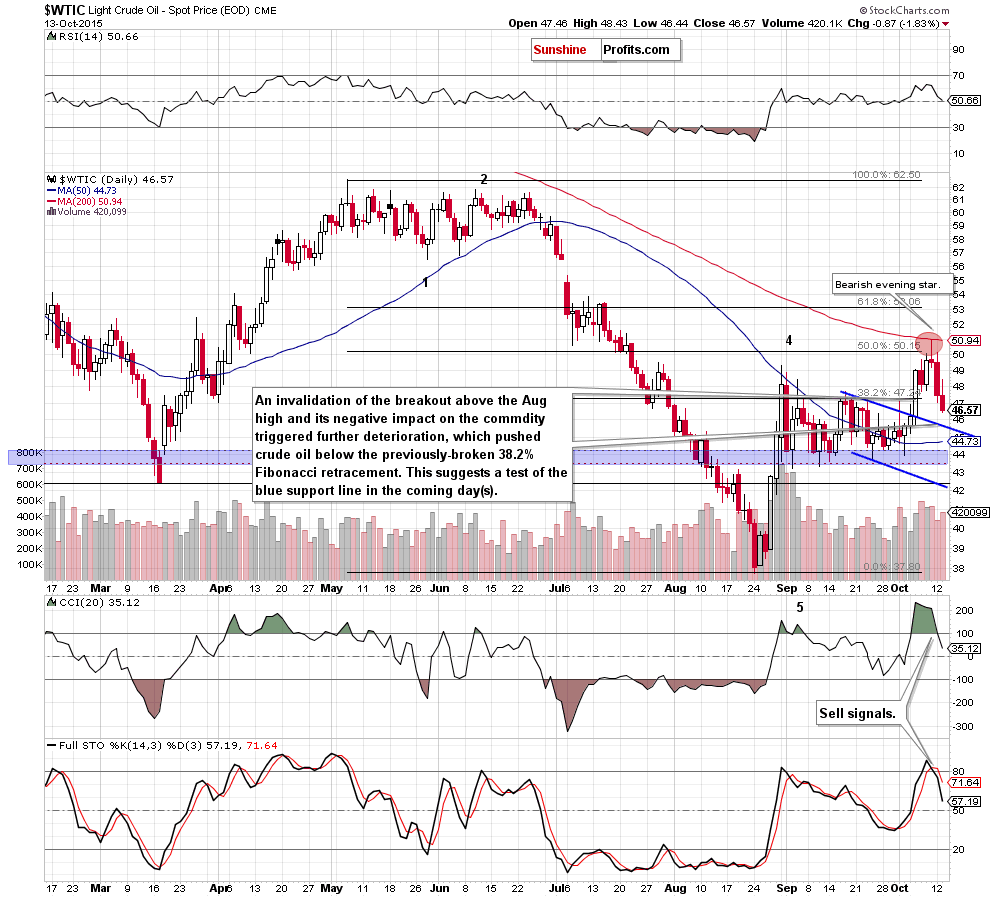

(…) the combination of the key resistance zone and the sell signal generated by the Stochastic Oscillator encouraged oil bears to act (as we had expected). As a result, light crude declined sharply, invalidating the breakout above the Aug high, which is a negative signal. Additionally, recent candlesticks formed a reversal pattern (an evening star) on the daily chart, while the CCI generated a sell signal, which doesn’t bode well for the commodity and suggests further deterioration.

Looking at the charts, we see that the situation developed in line with the above scenario and crude oil extended losses as an invalidation of the breakout above the Aug high in combination with sell signals generated by the indicators triggered further deterioration. With this downswing, light crude slipped under $47, invalidating earlier breakout above the 38.2% Fibonacci retracement, which is an additional bearish sign that suggest that our downside target from yesterday’s alert will be in play in the coming day(s):

(…) If (…) light crude declines from here, the initial downside target would be around $45.70, where the previously-broken upper border of the declining blue trend channel currently is.

Summing up, crude oil extended losses and declined below the 38.2% Fibonacci retracement, invalidating earlier breakout. Taking this negative factor into account, and combining it with sell signals generated by the daily indicators, we believe that further deterioration is more likely than not and short positions continue to be justified from the risk/reward point of view.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 and initial (!) target price at $35.72 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts