On Thursday, crude oil gained 1.63% as signs of strength in the U.S. economy helped support prices. This is light crude’s biggest one-day gain since Oct. 2. In this way, crude oil climbed to its highest level since the beginning of the month and closed the day above $95 per barrel.

Yesterday, the price of crude oil shot up after the Department of Labor reported that the number of individuals filing for initial jobless benefits in the U.S. last week fell by 21,000 to a seasonally adjusted 323,000, beating expectations for a decline of 9,000. On top of that, crude oil prices climbed to their highest levels of the session after preliminary data showed that U.S. manufacturing activity improved to an eight-month high of 54.3 in November from a reading of 51.8 in October. These news sparked demand for oil by stoking hopes for a more robust U.S. economy.

On Thursday, oil investors continued to monitor talks between Iran and six major powers in Geneva aimed at curbing Tehran’s nuclear program and relaxing sanctions against the oil producer. So far, there is no agreement from Iran nuclear-program talks, which supports the price of light crude. As a reminder, the main concern for oil market investors is that a possible deal could lead to the return of more than one million barrels of oil to an already well-supplied global market. If it happens, the long-, medium- and short-term support levels could be broken. In this case, the price of light crude would probably fall to at least $86 (where the next major medium-term support level is) or even to around $82 (where the long-term rising support line is).

Having discussed the above, let’s move on to the technical changes in the crude oil market (charts courtesy of http://stockcharts.com).

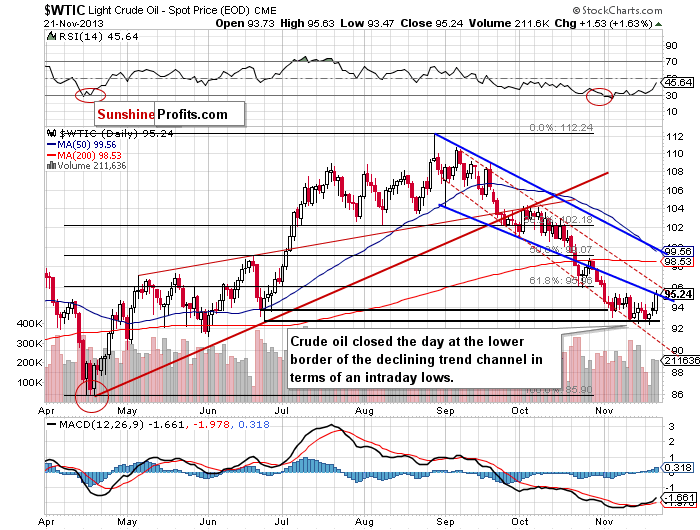

Yesterday, after the market open crude oil moved lower and hit its daily low of $93.47. However, this deterioration was only temporary. Crude oil quickly reversed course and rose in the following hours to its daily high of $95.63. In this way, light crude broke above the Nov. 15 high of $94.55.

Quoting our previous Oil Trading Alert:

(…) recent days have formed a consolidation. If oil bulls manage to push the price above the Nov. 15 high, we will likely see further improvement. In this case, the first strong resistance will be the Nov. 11 high, which intersects with the lower border of the declining trend channel in terms of intraday lows (marked with the blue bold line).

As you can see on the above chart, we saw such price action. Crude oil broke above these resistance levels and came back in the range of the declining trend channel in terms of intraday lows. However, the proximity to the upper border of the declining trend channel in terms of daily closing prices (marked with the red dashed line) encouraged oil bears to act and light crude moved to the previously-broken resistance line without breaking it, which is a positive signal.

Please note that crude oil still remains in the range of the declining trend channel in terms of daily closing prices (marked with the red dashed line). The major support is the November low – slightly below the bottom of the corrective move that we saw back in June (in terms of intraday lows). The next one is the lower border of the declining trend channel (currently around $90.58).

Once we know the current situation in crude oil, let’s move on to the XOI daily chart.

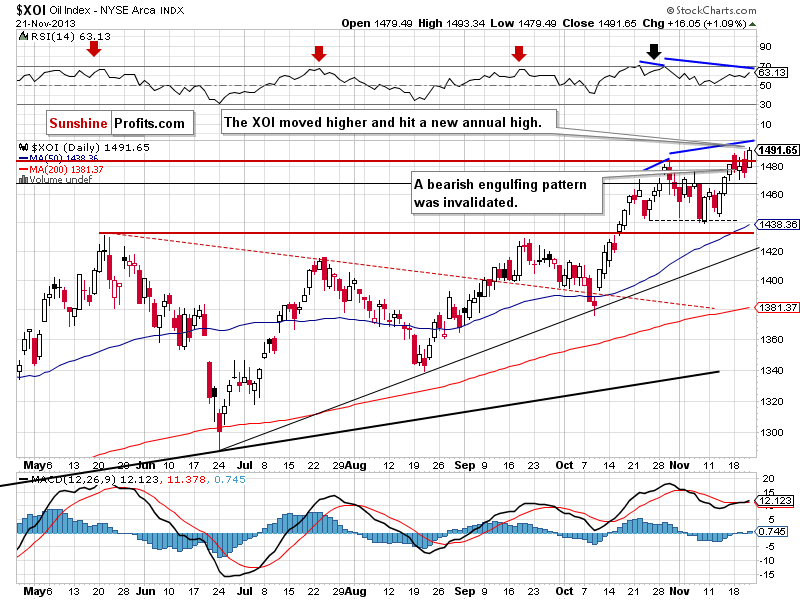

As you can see on the above chart, yesterday after the open the XOI moved higher and hit a fresh annual high at 1,493. In this way, a bearish engulfing pattern was invalidated, which is a bullish sign. Looking at the position of the RSI, we see that there is still space for further growth, which also supports the bullish case. However, when we take a closer look at the indicator, we notice a negative divergence between it and the oil stock index (marked with blue lines). We saw similar price action at the end of October, however, back then a negative divergence wasn’t as evident as it is now. Therefore, from this point of view, recent increases might be not as bullish as they seem at first glance.

Please note that this situation may be a mirror image of what we saw in recent weeks in crude oil. As a reminder, light crude dropped to a new low and after that we saw an upward corrective move. This situation repeated itself several times during this month. Despite this downswing, we didn’t see a heavy decline. Instead, we only noticed small breakdowns below previous lows. In case of the XOI, we saw similar price action earlier this week. The oil stock index broke above the previous high and then corrected. We saw such price action on Monday, Wednesday and also yesterday. Connecting the dots, we can conclude that if the buyers do not push the XOI above the major medium-term resistance level, we will likely see a correction in the coming days.

And speaking of the major medium-term resistance level... We wrote about it in our previous Oil Trading Alert:

(…) the upper line of the smaller rising wedge on the weekly chart, which successfully stopped growth at the end of October, is still in play. (…) the XOI remains below this line, which serves as strong resistance (currently around 1,495). Therefore, we should keep an eye on the oil stock index because the sellers may lock profits and trigger another correction in the coming days.

Summing up, the very short-term situation has improved as crude oil drifted away from the November low and reached the lower border of the declining trend channel in terms of intraday lows. This strong resistance may encourage oil bears to correct yesterday's gains. However, as long as crude oil remains above the long-, medium- and short-term support levels, space for further declines seem limited.

Very short-term outlook: mixed

Short-term outlook: bearish

MT outlook: bearish

LT outlook: unclear

Trading position (short-term): If we see a confirmed breakout in crude oil above the lower border of the declining trend channel in terms of intraday lows (marked with the blue bold line), we will consider opening long positions. Taking into account the long-, medium- and short-term support lines, we do not suggest opening short positions at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Sunshine Profits' Crude Oil Expert

Oil Investment Updates

Oil Trading Alerts