Trading position (short-term): In our opinion no positions are justified from the risk/reward perspective.

On Friday, crude oil gained 0.69% as stronger-than-expected U.S. employment data weighted on the price. Thanks to these news, light crude erased 50% of the recent decline and closed the day above $102 per barrel.

In our last Oil Trading Alert, we wrote the following:

(…) if the data disappoints, it will be a worrying sign (especially after job growth came in below expectations in December and January), which underline concerns over the strength of the labor market and will likely have a negative impact on the price of crude oil.

Meanwhile, the Bureau of Labor Statistics showed that the economy added 175,000 jobs in February (well above expectations for a 150,000 increase). Additionally, the U.S. private sector added 162,000 jobs last month (beating expectations for a 154,000 rise). The report also showed that the U.S. unemployment rate rose to 6.7% in February, from 6.6% the previous month.

These better-than-expected numbers eased concerns over the strength of the U.S. economy and have helped push the price of light crude higher. Despite this growth, crude oil lost 0.10% in the previous week and this was the first weekly loss in eight weeks.

Having discussed the above, let’s move on to the technical changes in the crude oil market (charts courtesy of http://stockcharts.com.)

Quoting our last Oil Trading Alert:

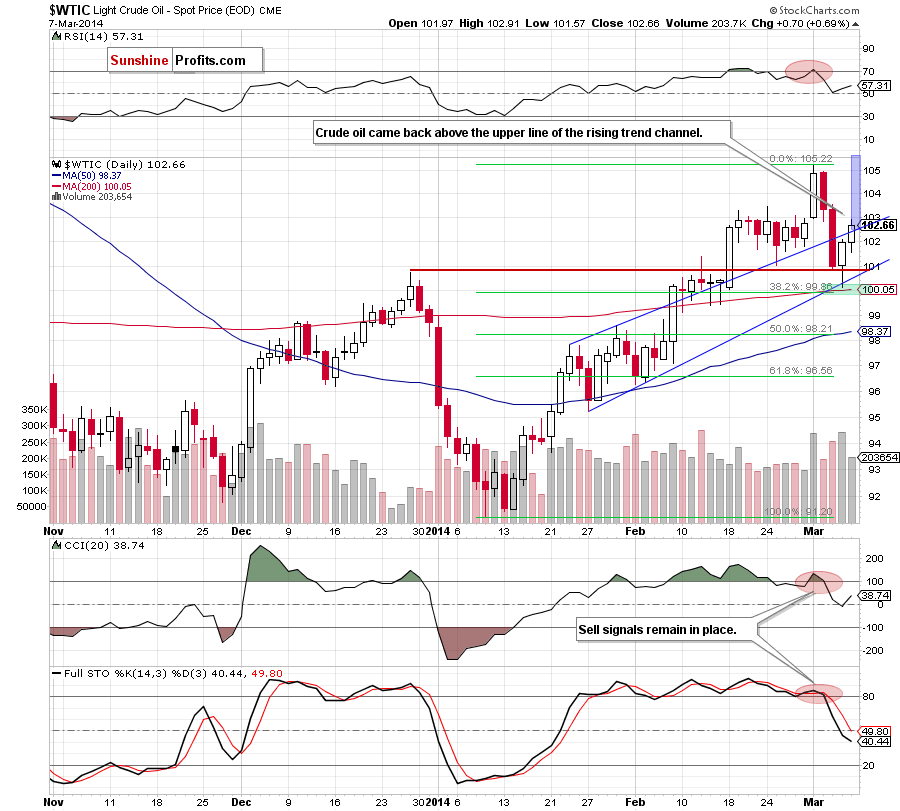

(…) a corrective upswing, (…) took light crude to the upper line of the rising trend channel (which corresponds to the 38.2% Fibonacci retracement based on the recent decline at the moment). (…) if it is broken, we may see further improvement and an increase to around $102.67 (where the next Fibonacci retracement is).

On Friday, oil bulls didn’t give up and successfully realized this pro growth scenario. Crude oil broke above the upper line of the rising trend channel, which is a bullish signal that suggests that we may see another attempt to move higher. If this is the case, the upside target (which corresponds to the height of the trend channel) would be around $105.35 (we marked it with a light blue rectangle). However, we should keep in mind that Friday’s upswing materialized on relative small volume, which doesn’t confirm the strength of the buyers. Additionally, looking at the current position of the indicators, we clearly see that sell signals remain in place and support sellers. Taking all the above into account, it seems that although crude oil came back above the upper line of the rising trend channel, this improvement will be temporarily and we’ll see another attempt to move lower.

Having discussed the current situation in light crude, let’s take a look at WTI Crude Oil (the CFD).

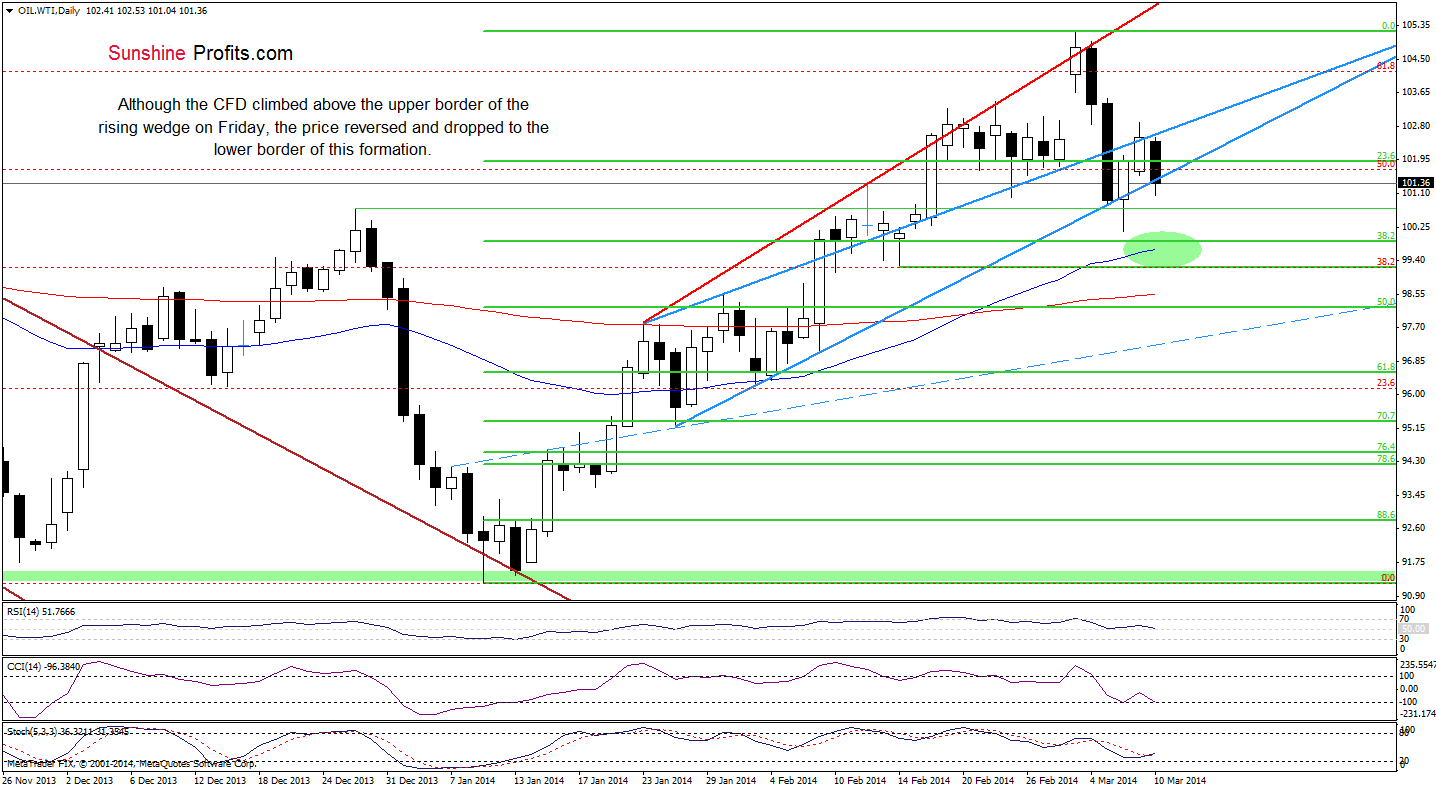

On the above chart, we see that WTI Crude Oil extended gains and (only temporarily) broke above the upper line of the rising wedge. Although the CFD closed the day above this line, the price reversed and declined to the lower border of this formation earlier today . From this perspective, it seems that what we wrote in our last Oil Trading Alert remains up-to-date.

(…) If the indicators do not generate buy signals in the coming days, we may see a consolidation at current levels in the near future. However, from today’s point of view, it seems that the sellers will likely push the CFD to the 38.2% Fibonacci retracement or even to the Feb.14 low sooner or later (we marked this area with a green ellipse).

Please note that although the Stochastic Oscillator generated a buy signal, both other indicators still support sellers.

Summing up, the very short-term outlook for crude oil has improved as crude oil came back above the upper line of the rising trend channel and erased 50% of earlier losses. Despite these positive facts, as mentioned earlier, Friday’s upswing materialized on relative small volume, which suggests that the buyers may not be as strong as it seems at the first glance. Therefore, another attempt to move lower should not surprise us – especially when we factor in the position of the indicators and the current situation in the CFD.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: bullish

LT outlook: mixed

Trading position (short-term): In our opinion, if crude oil drops below the 38.2% Fibonacci retracement level and the 200-day moving average, we will consider opening short positions. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts