On Tuesday, crude oil lost 0.72% as concerns that U.S. inventories will increase once again weighted on price. In this way, light crude dropped o its daily low of $93.43 and closed the day below $94 per barrel.

In our last Oil Investment Update, we wrote that this week investors would be closely watching a flurry of U.S. data to further gauge the strength of the economy and the need for stimulus from the Federal Reserve. Yesterday, investors received a series of reports on the housing sector and data on consumer confidence.

The U.S. Commerce Department said that the number of building permits issued in October rose 6.2% to a seasonally adjusted 1.034 million, the highest since June 2008, from September’s total of 0.970 million. Separately, Standard & Poor’s with Case-Shiller said its house price index rose at an annualized rate of 13.3% in September from a year earlier, the strongest increase since February 2006 and above forecasts for an increase of 13%.

However, after these upbeat U.S. housing data, investors get the disappointing confidence data. The Conference Board said in a report that its index of consumer confidence declined to a seven-month low of 70.4 in November from a reading of 72.4 in October, and the latter figure was revised up from 71.2. Meanwhile, analysts had expected the index to rise to 72.9 this month.

After the release of mixed U.S. economic data, crude oil fluctuated between slight gains and losses, which showed that oil investors tried to puzzle out the impact of the data on the economy's progress. Nevertheless, later in the day, light crude declined on concerns that U.S. inventories are set to increase again at a time when refiners normally ramp up output of heating oil. Therefore, market players awaited key U.S. weekly supply data to gauge the strength of oil demand.

Yesterday, the American Petroleum Institute said crude inventories rose by 6.9 million barrels last week, while today the U.S. Energy Information Administration (EIA) report could show crude stockpiles rose by 900,000 barrels. Please note that if we see such (or lower) increase, the price of light crude will likely move higher – similarly to what we saw a week ago. However, if the data is better-than-expected, crude oil will probably re-test the November low.

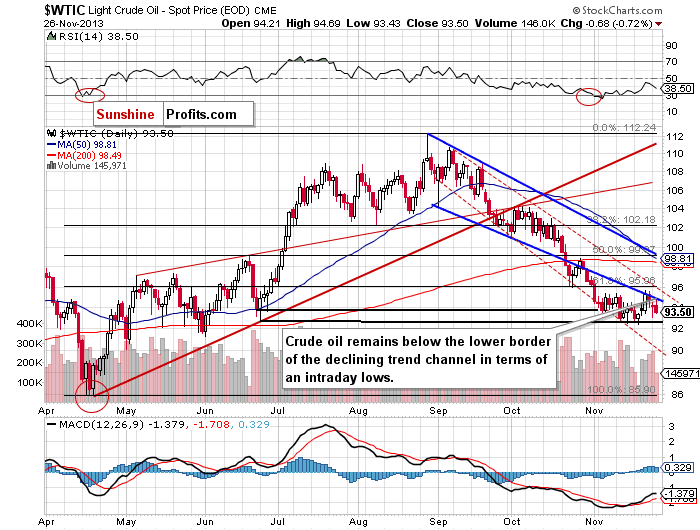

Having discussed the above, let’s move on to the technical changes in the crude oil market (charts courtesy of http://stockcharts.com).

Looking at the above chart, we see that yesterday after the market open oil bulls pushed the price higher and crude oil reached the lower border of the declining trend channel (in terms of an intraday lows). In our yesterday’s Oil Trading Alert, we wrote that as long as this strong resistance is in play, further growth is limited and a bigger pullback is unlikely.

As you can see on the above chart, buyers didn’t manage to break above this strong resistance, which encouraged oil bears to trigger a downswing. In the following hours, crude oil bounced off the lower border of the declining trend channel and dropped below $94. From this point of view, it seems that yesterday’s pullback (after the open) might be a confirmation of a breakdown that we saw on Friday. In this case, we may see further deterioration and a re-test of the November low.

Without a doubt, this is not a positive sign for the buyers. However, when we take a closer look at yesterday’s downswing, we see that it materialized on relatively low volume and, from this perspective, it’s not as bearish as it might seems at first glance.

Please note that the November low is a major support level – slightly below the bottom of the corrective move that we saw back in June (in terms of intraday lows). The next support zone is at the lower border of the declining trend channel (currently around $90.58).

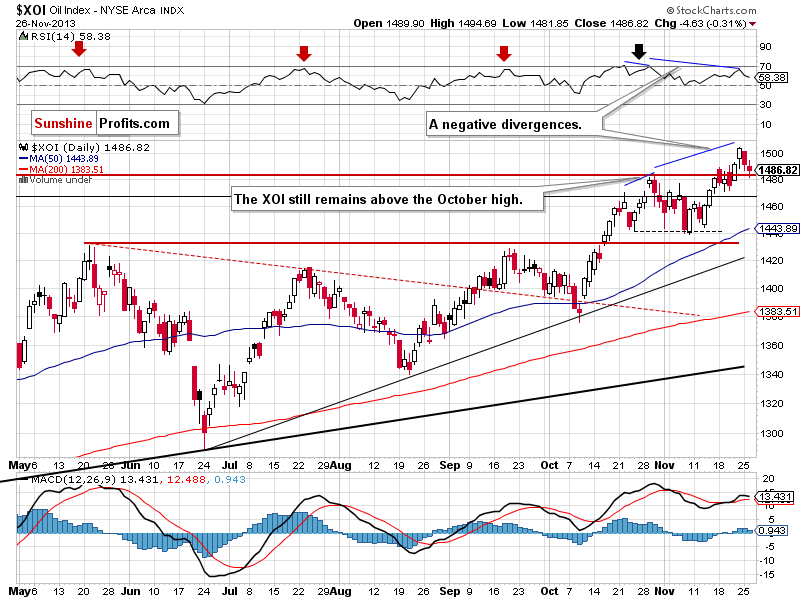

Once we know the current situation in crude oil, let’s take a look at the NYSE Arca Oil Index (XOI) weekly chart.

As we wrote in our yesterday’s Oil Trading Alert:

(…) the medium-term resistance line encouraged sellers to act and triggered a corrective move, which took the XOI below 1,500. In this way, the breakout above the psychological barrier was invalidated, which is a bearish sign. (…) as long as the oil stock index remains above the October high, space for further declines seems limited.

Looking at the above chart, we see that yesterday the oil stock index extended its decline and dropped below the October high on an intraday basis. In spite of this drop, in the following hours we saw a pullback, which pushed the XOI above this support level.

Please note that if the oil stock index breaks below the October high in terms of daily closing prices, we will likely see further deterioration. In this case, the first target for the sellers will be the bottom of the previous correction (around 1,470). On the other hand, if the support level created by the October high encourages buyers to act, we may see a pullback to the 2013 high (or at least to 1,500).

Summing up, although crude oil has dropped below $94, the situation hasn’t changed much. Light crude still remains between major short-term resistance (the lower border of the declining trend channel in terms of intraday lows) and important short-term support (the November low). From this point of view, it seems that as long as this strong resistance is in play, further growth is limited and a bigger pullback is unlikely. On the other hand, as long as crude oil remains above the long-, medium- and short-term support levels, space for further declines seems limited. Therefore, the very short-term picture is unclear.

Very short-term outlook: mixed

Short-term outlook: bearish

MT outlook: bearish

LT outlook: unclear

Trading position (short-term): If we see a confirmed breakout in crude oil above the lower border of the declining trend channel in terms of intraday lows (marked with the blue bold line), we will consider opening long positions. Taking into account the long-, medium- and short-term support lines, we do not suggest opening short positions at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Sunshine Profits' Crude Oil Expert

Oil Investment Updates

Oil Trading Alerts