Trading position (short-term): In our opinion no positions are justified from the risk/reward perspective.

On Thursday, crude oil gained 0.97% as solid U.S. jobless claims data weighted on the price. In this way, light crude rose for the first time in three days and erased 38.2% of the recent decline, finishing the day slightly below $102 per barrel.

Yesterday, the Department of Labor reported that the number of individuals filing for initial jobless benefits last week fell by 26,000 to 323,000 from the previous week’s revised total of 349,000 (while analysts have expected a drop of 11,000 to 338,000 last week). The better-than-expected reading supported crude oil and pushed the price above $101.

Today, investors will receive a highly-anticipated nonfarm payrolls report for February. Economists expect that the report will show a job gain of 150,000 this month, faster than the 113,000 added in January. Forecasters also expect the February unemployment rate to fall to 6.5% from January's 6.6%. If so, it would be the lowest jobless rate since October 2008. However, if the data disappoint, it will be a worrying sign (especially after job growth came in below expectations in December and January), which underline concerns over the strength of the labor market and will likely have a negative impact on the price of crude oil.

Having discussed the above, let’s move on to the technical changes in the crude oil market (charts courtesy of http://stockcharts.com.)

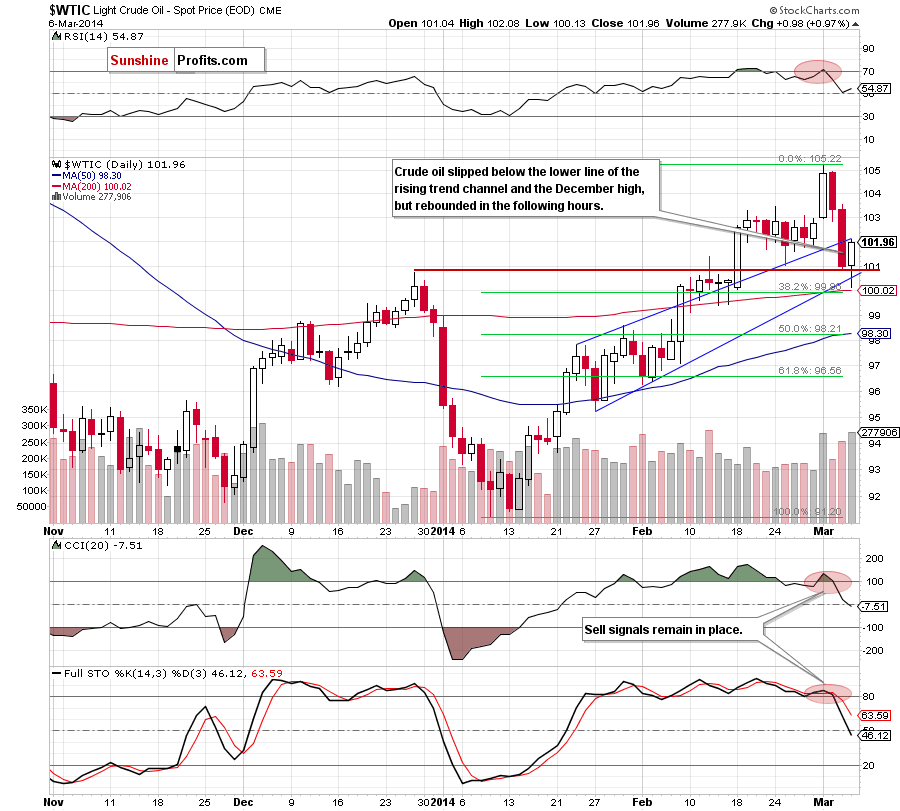

Quoting our last Oil Trading Alert:

(…) crude oil not only dropped to the upper line of the rising trend channel, but also reached the December high. If this support line is broken, we will see further deterioration and the first downside target will be the lower border of the rising trend channel, which is slightly above the 38.2% Fibonacci retracement level based on the recent rally (which corresponds to the 200-day moving average at the moment). Looking at the position of the indicators, we see that the CCI generated a sell signal (while the Stochastic Oscillator declined below the level of 80), which supports sellers and suggests that the bearish scenario is likely to be seen in the coming day.

Yesterday, crude oil extended losses and hit a session low of $100.13 after the market open. With this downswing, light crude slipped below the lower border of the rising trend channel and approached a support zone (created by the 38.2% Fibonacci retracement and the 200-day moving average). However, the proximity to this strong support encouraged buyers to push the order button and triggered a corrective upswing, which took light crude to the upper line of the rising trend channel (which corresponds to the 38.2% Fibonacci retracement based on the recent decline at the moment). On one hand, if this resistance encourages oil bears to act, we will likely see another drop to the lower border of this formation. On the other hand, if it is broken, we may see further improvement and an increase to around $102.67 (where the next Fibonacci retracement is). Looking at the current position of the indicators, we see that sell signals remain in place and support sellers.

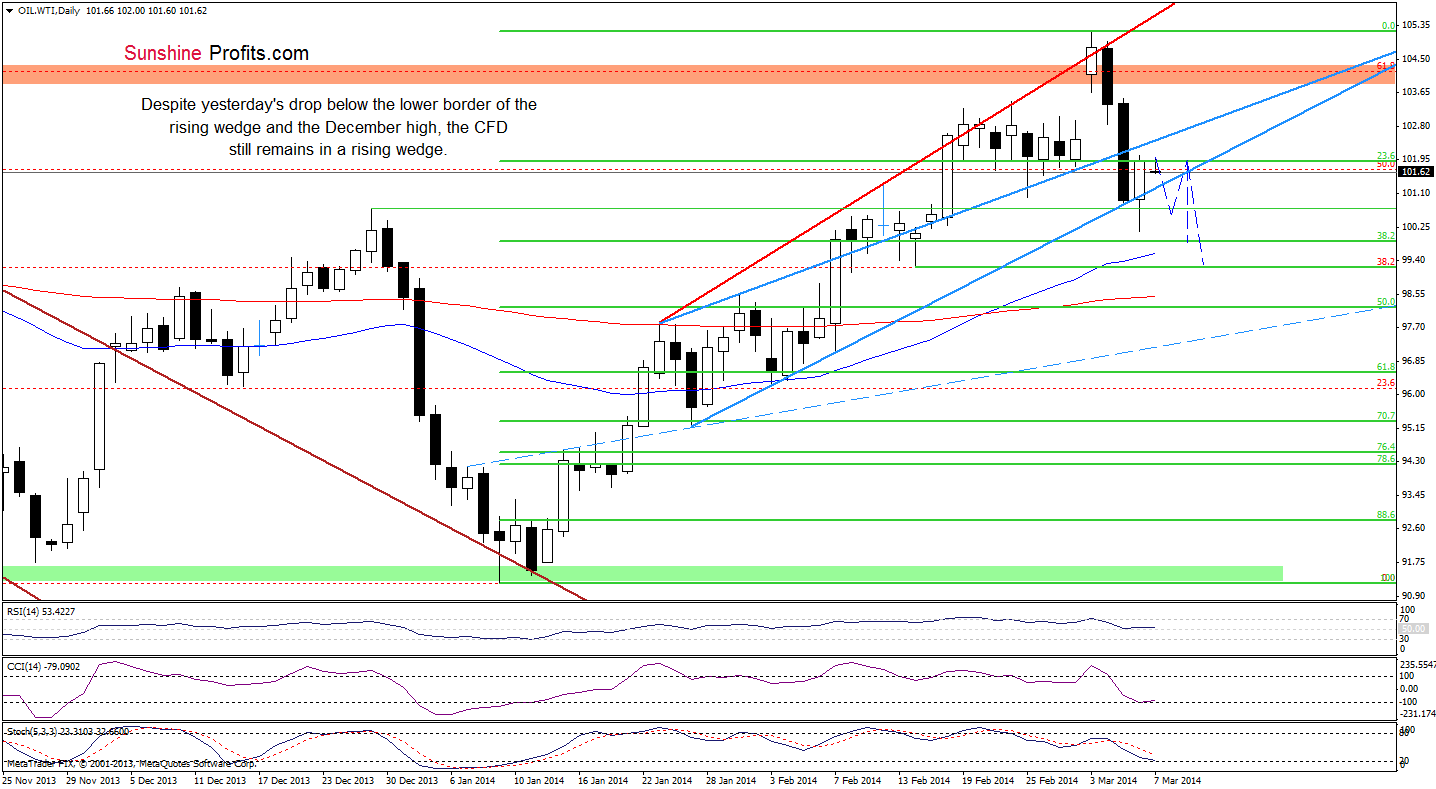

Having discussed the current situation in light crude, let’s take a look at WTI Crude Oil (the CFD).

In our previous Oil Trading Alert, we wrote the following:

(…) oil bears not only pushed the CFD under the upper line of the rising wedge, but also approached the lower border of this formation. If this support line encourages buyers to act, we may see a corrective upswing to one of the previously broken support lines, which serve as resistance at the moment. However, looking at the position of the indicators (sell signals remain in place, supporting sellers), it seems that further deterioration is more likely. If this is the case, the first downside target will be the 38.2% Fibonacci retracement based on the entire rally.

As you see on the above chart, oil bears didn’t give up and managed to push the CFD below the lower border of the rising wedge. Despite this drop, they didn’t reached the downside target because the proximity to the 38.2% Fibonacci retracement encouraged buyers to act (similarly to what we saw on the crude oil chart). In the following hours, oil bulls triggered a corrective upswing and WTI Crude Oil came back to a range of the rising wedge. Looking at the current position of the indicators, we see that they still support sellers, which suggests that we may see another attempt to move lower. If oil bears do not reach their downside target later today, we will likely see another upswing. If the indicators do not generate by signals in the coming days, we may see a consolidation at current levels in the near future. However, from today’s point of view, it seems that the sellers will likely push the CFD to the 38.2% Fibonacci retracement or even to the Feb.14 low sooner or later.

Summing up, the very short-term outlook for crude oil has improved slightly as crude oil rebounded above the December high and invalidated a small breakdown below this important support. Despite this increase, light crude still remains below the upper line of the rising trend channel, which is reinforced by the 38.2% Fibonacci retracement (based on the recent decline). As mentioned earlier, from the current level, crude oil may increase to the next Fibonacci retracement or reversed to the lower border of the trend channel. Looking at the position of the indicators and combining it with the current situation in the CFD, it seems that oil bears have a few more arguments on their side, so another attempt to move lower should not surprise us.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: bullish

LT outlook: mixed

Trading position (short-term): In our opinion, if crude oil drops below the 38.2% Fibonacci retracement level and the 200-day moving average, we will consider opening short positions. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts