Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 and initial (!) target price at $35.72 are justified from the risk/reward perspective.

On Wednesday, crude oil lost 1.44% as larger-than-expected build in crude oil inventories pushed the price lower. As a result, light crude extended losses and slipped to its important support area. What’s next?

Although the U.S. Energy Information Administration reported that gasoline inventories decreased by 1.5 million barrels last week and distillate dropped by 2.6 million, a larger-than-expected build in crude oil inventories (U.S. crude stockpiles surged by 8 million for the week ending on Oct. 16) pushed the price of the commodity lower. With this move, light crude hit an intraday low of $44.86 and dropped to important support area. North or south? Let’s take a look at the charts and find out (charts courtesy of http://stockcharts.com).

Quoting our Monday’s Oil Trading Alert:

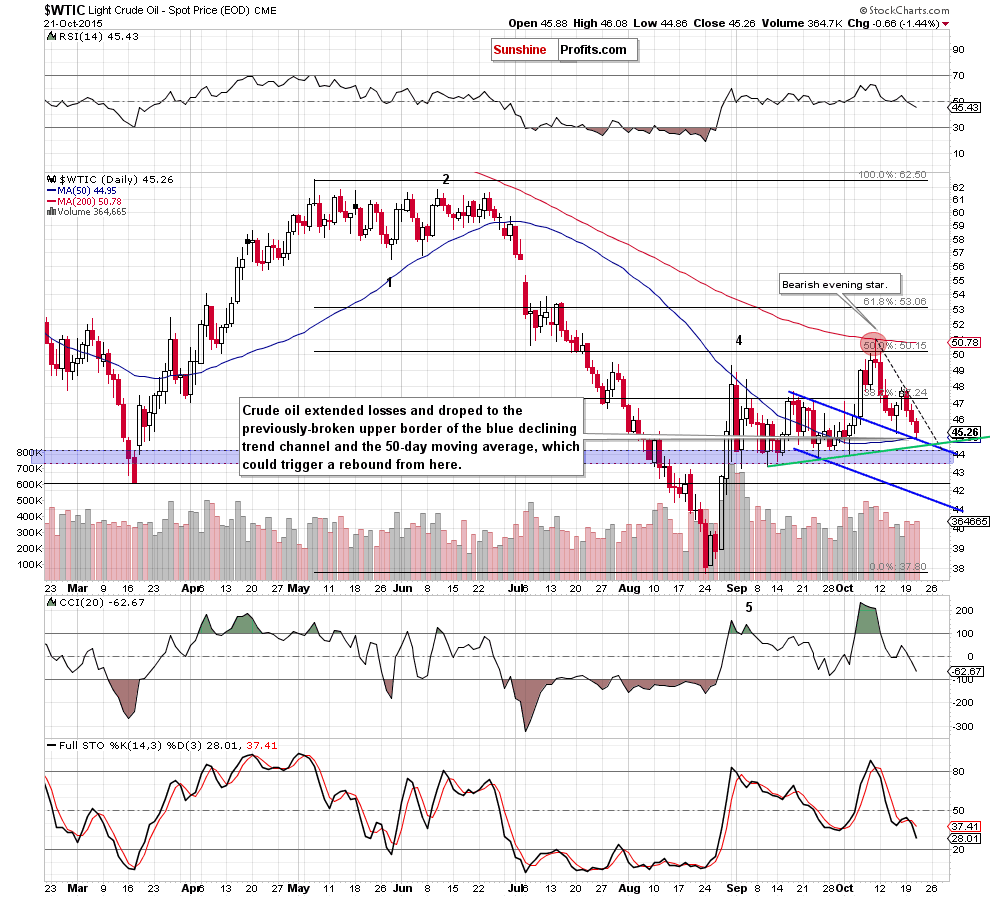

(…) How low could the pair go? In our opinion, the initial downside target would be around $45, where the blue support line (the upper border of the declining trend channel) currently is.

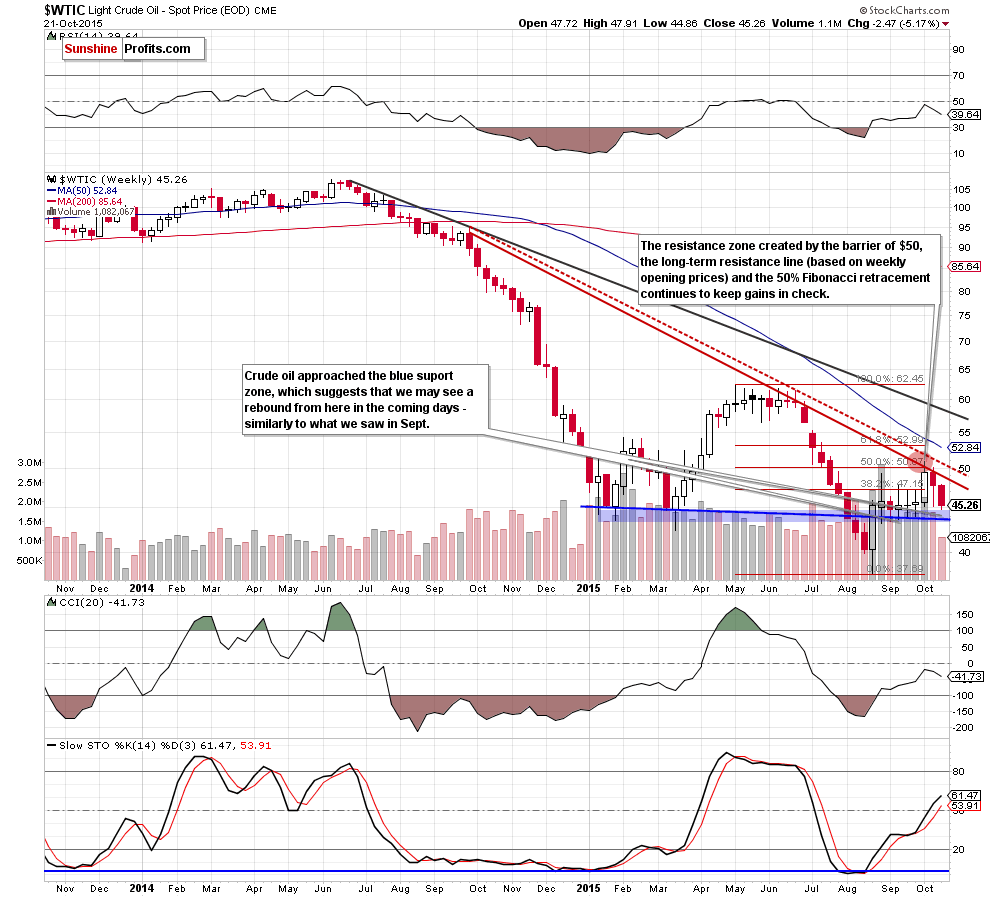

Looking at the daily chart we see that the situation developed in line with the above scenario and crude oil reached our initial downside target yesterday – the upper border of the blue declining trend channel. Additionally, with this downward move, light crude approached the blue support area (marked on the weekly chart), which was strong enough to stop oil bears several times in Sept. As you see on the daily chart, this area is also supported by the 50-day moving average, which together suggests that we may see a rebound from here in the coming day(s).

Nevertheless, even if we see such price action, we should keep in mind that yesterday’s drop materialized on a bigger volume than Tuesday’s decline, which confirms oil bears’ strength. Additionally, the Stochastic Oscillator generated a sell signal, which is another negative signal. On top of that, even if crude oil rebounds from here, the space for increases seems limited as the black dashed resistance line is quite close.

Summing up, crude oil extended losses and reached important support area, which could pause further deterioration. Nevertheless, even if we see a rebound from here, the first resistance line is quite close. Therefore, we believe that further deterioration is more likely than not and short positions continue to be justified from the risk/reward point of view.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 and initial (!) target price at $35.72 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts