On Monday, crude oil closed lower for the fifth day in a row and lost 0.16%. Light crude extended losses as ongoing concerns over rising U.S. inventories and weaker demand in the world's largest oil consumer drove prices lower. In this way, the price dropped to a new four-month low of $94.06.

Last week, crude oil inventories rose by 4.1 million barrels to 383.9 million barrels – the highest level since June. The EIA data also showed that crude oil stocks are near the highest end-October level since 1930. Therefore, investors looked ahead to the release of fresh weekly information on U.S. stockpiles of crude and refined products to gauge the strength of oil demand in the world’s largest oil consumer. Looking at the recent data we can conclude that any increase in inventories will likely put downward pressure on prices.

The American Petroleum Institute will release its inventories report later in the day, while Wednesday’s government report could show crude stockpiles rose by 1.8 million barrels.

Investors also eyed the release of key U.S. economic data later in the week to help assess the timing for a reduction in the Fed’s bond-purchasing program. Please note that the U.S. is set to release preliminary data on third quarter economic growth on Thursday, while October’s highly-anticipated nonfarm payrolls report is scheduled for Friday.

Having discussed the above, let’s move on to the technical changes in the crude oil market (charts courtesy of http://stockcharts.com).

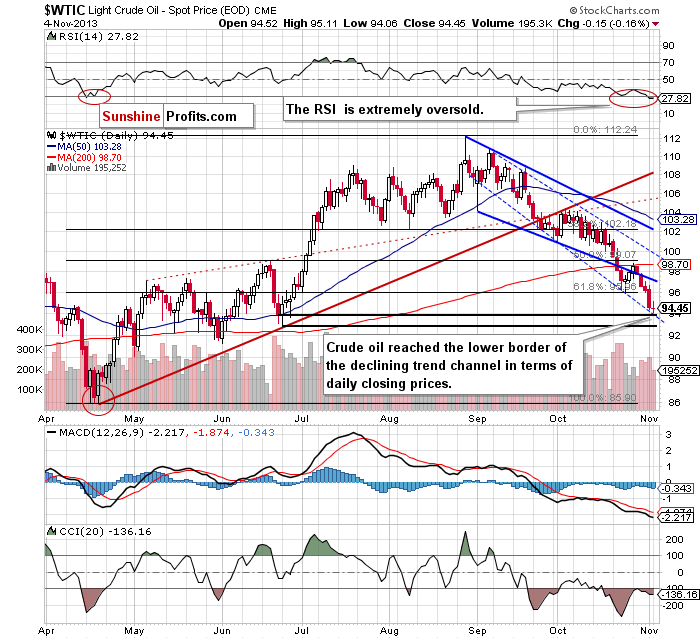

On Monday, the situation deteriorated once again. After the open, oil bulls didn’t manage to push the price higher, which resulted in a further decline and a drop to a new monthly low of $94.06.

In spite of this decline, light crude still remains above the lower border of the declining trend channel in terms of daily closing prices. It’s worth mentioning that this line successfully paused the recent corrective move, as seen on the chart. Additionally, light crude almost reached a support level based on the bottom of the corrective move that we saw in June (in terms of daily closing prices). What’s interesting, when we factor in the Fibonacci price projections, we notice that the downward move from Oct. 3 to Nov. 4 is similar to the corrective move that we saw from Sept. 6 to Sept. 30. It’s worth noting that after the September decline we saw a pullback, therefore if history is to repeat itself, we may see similar price action in the coming days.

At this point, it’s worth mentioning that the RSI declined once again and dropped below the 30 level to its lowest level since April. Back then, such a low value of the indicator had a positive impact on light crude. Looking at the above chart, we may see similar price action in the near future – especially when we take into account a positive divergence in the Commodity Channel Index.

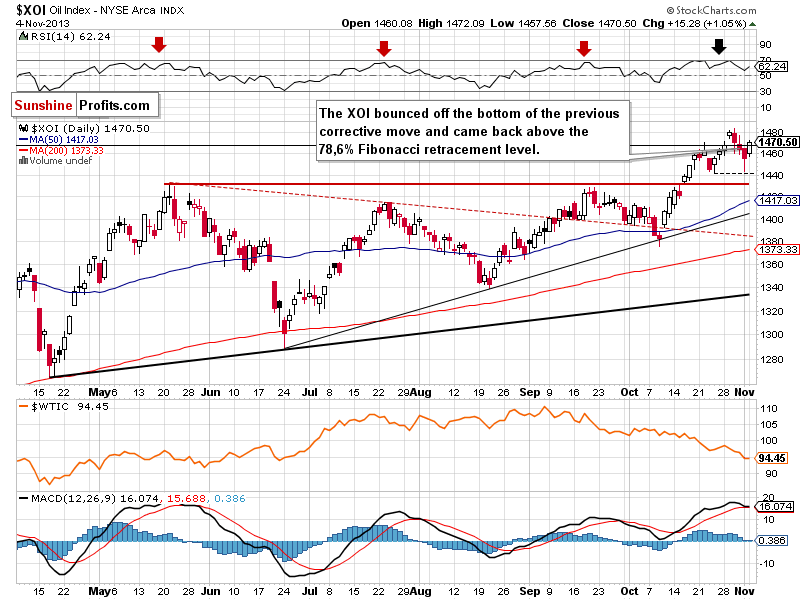

Before we summarize, let’s move on to the XOI daily chart.

Quoting our previous Oil Trading Alert:

(…) the nearest support level encouraged buyers to act and resulted in a pullback to 1,455. If they do not give up, we will likely see further growth to the 78.6% Fibonacci retracement level.

Looking at the above chart, we see that the oil stock index continued its increases on Monday and climbed above the previously-broken 78.6% Fibonacci retracement level (close to 1,467) based on the entire May-October 2008 decline.

Please note that the RSI remains below the 70 level and still has some space for further growth. Therefore, if the buyers do not give up, we will likely see a continuation of the current upswing. In this case, the nearest price target is the 2013 high.

Summing up, on one hand, we just saw a drop to a new monthly low, but on the other hand, crude oil is extremely oversold on a short-term basis. Additionally, it reached important support levels, which may encourage oil bulls to act.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: unclear

Trading position (short-term): Taking into account the short-term picture and the position of the RSI, we do not suggest opening short positions yet.

Thank you.

Nadia Simmons

Sunshine Profits' Crude Oil Expert

Oil Investment Updates

Oil Trading Alerts