On Friday, crude oil lost 0.55% and closed the day below $95 as profit taking and hopes that Western and Iranian diplomats will make progress over Teheran’s nuclear program weighted on the price of light crude.

On Friday, crude oil moved lower after investors locked in gains stemming from Thursdays bullish jobless claims report. Additionally, they continued to monitor talks between Iran and six major powers in Geneva. Therefore, hopes that talks will eventually lead to a dismantling of Tehran's alleged nuclear weapons program pushed prices lower as well.

As is well known, any easing of Middle East tensions tends to lead to lower crude prices, therefore, the nuclear deal signed on Sunday will likely have a negative impact on crude oil. This breakthrough deal to curb Tehran's nuclear program in exchange for limited sanctions relief, will not allow any more Iranian oil into the market, or let western energy investors into the country, but it does freeze U.S. plans for deeper cuts to Iranian crude exports and is considered as big step toward a more lasting treaty. The agreement also will allow Iran to regain access to much-needed goods, including parts for aircraft and cars, and will allow the country to sell refined petrochemical products in global markets.

Having discussed the above, let’s move on to the technical changes in the crude oil market (charts courtesy of http://stockcharts.com).

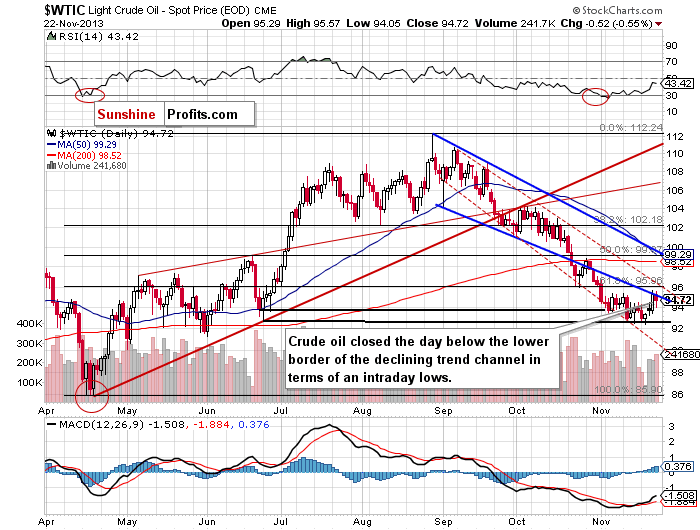

On Friday, after the market open buyers tried to push the price of light crude higher, but their attempts failed and crude oil didn’t even reach Thursday’s top. This show of weakness encouraged oil bears to trigger a downswing, which took light crude to its daily low of $94.05. As you can see on the above chart, this downward move resulted in a drop below the lower border of the declining trend channel (in terms of intraday lows) and the breakout above this line was invalidated. This is not a positive sign for oil bulls – especially when we take into account the fact that Friday’s downswing materialized on relative high volume. Therefore, further deterioration should not surprise us.

Please note that crude oil still remains in the range of the declining trend channel in terms of daily closing prices (marked with the red dashed line). The major support is the November low – slightly below the bottom of the corrective move that we saw back in June (in terms of intraday lows). The next one is the lower border of the declining trend channel (currently around $90.58).

Once we know the current situation in crude oil, let’s take a look at the NYSE Arca Oil Index (XOI) weekly chart.

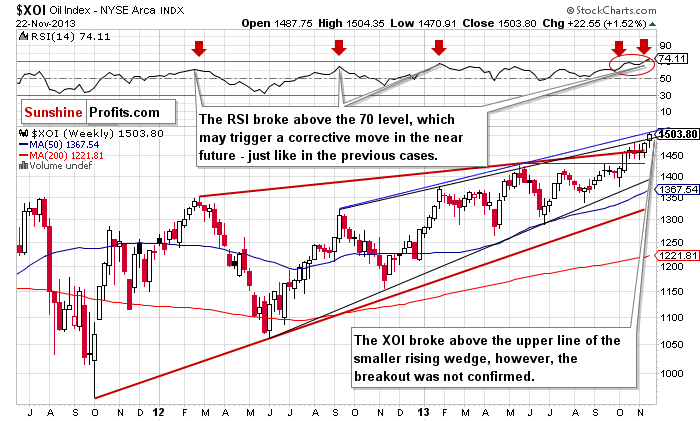

On Friday, the XOI continued its rally and hit a fresh annual high at 1,504. In this way, the oil stock index broke above the major medium-term resistance level (the upper line of the smaller rising wedge – marked with the black line). On top of that, the XOI moved above the psychological barrier at 1,500, which is a strong bullish sign. However, both breakouts are not confirmed at the moment. From this point of view the short-term picture is very bullish.

However, looking at the weekly chart we see that the oil stock index reached another medium-term resistance line created by the September 2012 and May 2013 highs (marked with the blue line). Additionally, the RSI reached its highest level since the beginning of the year and is overbought. Please note that earlier this year, lower readings on the RSI triggered downswings in the XOI. Therefore, from this perspective, another corrective move might be just around the corner.

Summing up, although crude oil dropped below the lower border of the declining trend channel in terms of intraday lows, it is still quite close to a three-week high. As a reminder, as long as crude oil remains above the long-, medium- and short-term support levels, space for further declines seem limited.

Very short-term outlook: mixed

Short-term outlook: bearish

MT outlook: bearish

LT outlook: unclear

Trading position (short-term): If we see a confirmed breakout in crude oil above the lower border of the declining trend channel in terms of intraday lows (marked with the blue bold line), we will consider opening long positions. Taking into account the long-, medium- and short-term support lines, we do not suggest opening short positions at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Sunshine Profits' Crude Oil Expert

Oil Investment Updates

Oil Trading Alerts