Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Although crude oil moved higher after the market’s open, the bearish EIA weekly report dampened investors’ sentiment and pushed the commodity to slightly above the barrier of $30 once again. Will it withstand the selling pressure in the coming days?

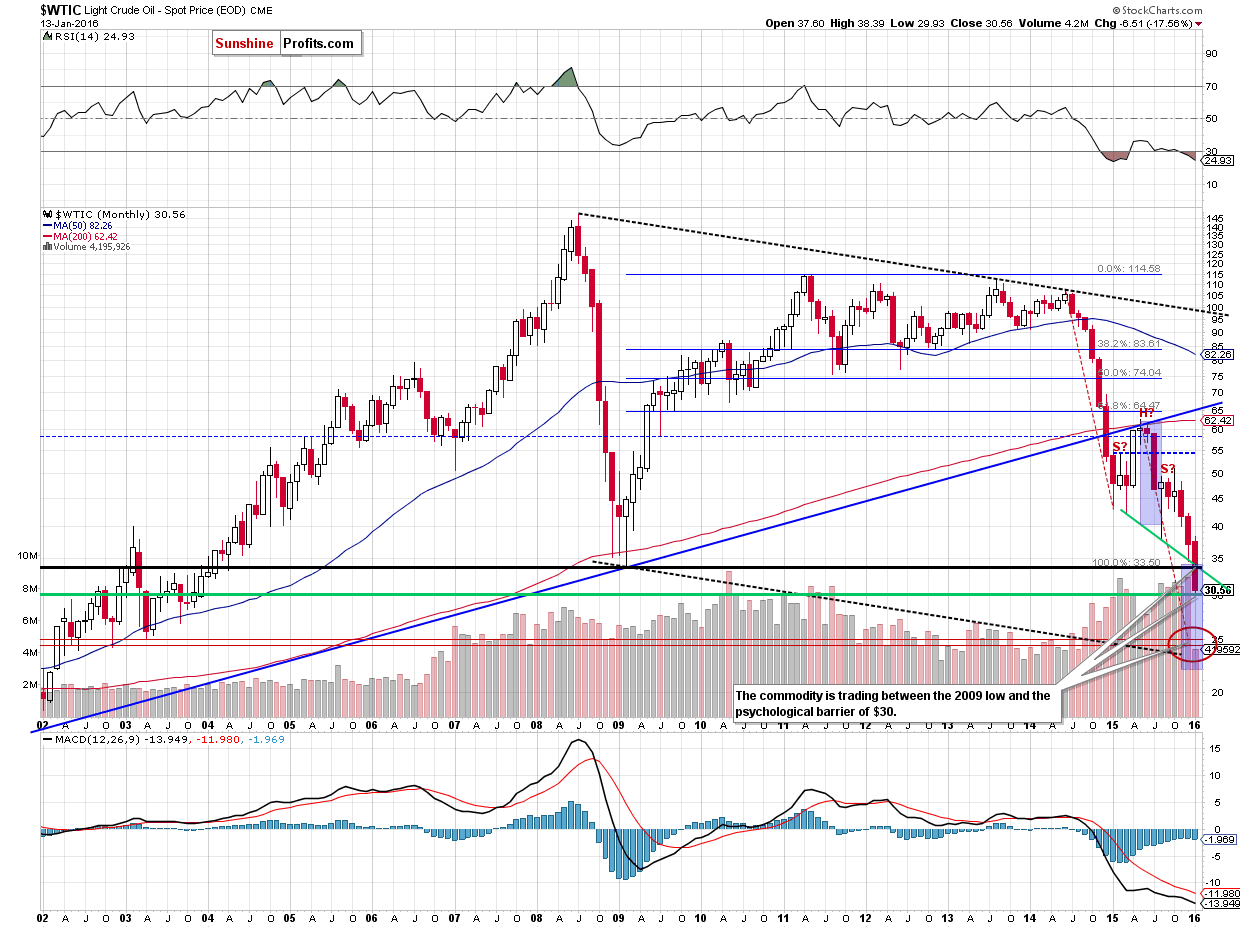

Yesterday, the U.S. Energy Information Administration reported that U.S. crude oil inventories increased by 0.2 million barrels for the week ending on January 8. Although this gain was smaller-than-expected (analysts forecasted a build of 2.5 million barrels), it was overshadowed by news on gasoline and distillate fuel inventories. The report showed that gasoline inventories surged by 8.4 million barrels, missing analysts' expectations for an increase of 2.7 million (as a reminder, a week ago gasoline inventories rose by more than 10 million barrels, which was the largest weekly build since 1993). On top of that, distillate fuel inventories, increased by 6.1 million barrels and climbed above the upper limit of the average range for this time of the year. Thanks to these bearish circumstances, light crude erased earlier gains and slipped to slightly above the barrier of $30 once again. Will it withstand the selling pressure in the coming days? Let’s examine charts and find out what can we infer about future moves (charts courtesy of http://stockcharts.com).

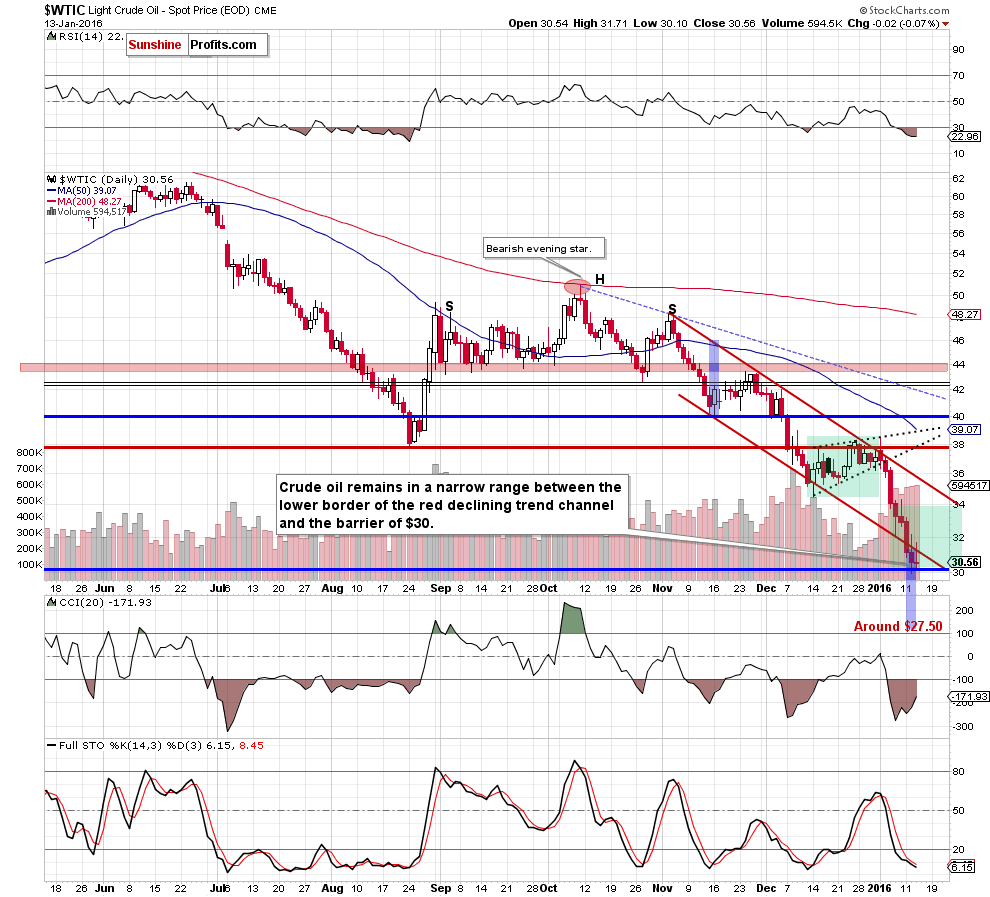

Looking at the above charts, we see that although crude oil moved higher after the market’s open, oil bulls didn’t manage to hold gained levels, which resulted in reversal and a sharp decline. With this downswing, light crude came back below the lower border of the red declining trend channel and slipped to an intraday low of $30.10, closing another day above the barrier of $30.

Therefore, we think that what we wrote yesterday is up-to-date:

(…) the commodity closed the day slightly above the barrier of $30, invalidating earlier small breakdown. Taking this fact into account, and combining it with the current position of the daily indicators (the RSI dropped to its lowest level since the end of Aug, while the Stochastic Oscillator is oversold), we think that corrective upswing is just around the corner. Additionally, there were seven consecutive sessions in which crude oil lost more than 17% (making our short positions more profitable), which increases the probability of a rebound – especially when we factor in the proximity to the barrier of $30.

As you see on the daily chart, a drop to the barrier of $40 encouraged oil bulls to act, which resulted in a corrective upward move. Therefore, in our opinion, if crude oil moves higher from here, the initial upside target would be around $33.16, where the 38.2% Fibonacci retracement (based on the Jan decline) is.

Summing up, although crude oil moved lower once again, the barrier of $30 continues to keep declines in check, which suggests that we could see a corrective upward move in the coming days.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Np positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts