Trading position (short-term): In our opinion no positions are justified from the risk/reward perspective.

On Friday, crude oil lost 0.54% after disappointing U.S. home sales data weighted on the price. Despite this drop, light crude closed the day above $102 per barrel and climbed 1.89% during the last week (it was the sixth consecutive weekly gain).

On Friday, crude oil moved lower after the release of U.S. home sales missed analysts' forecasts. The National Association of Realtors said that U.S. existing home sales declined 5.1% to 4.62 million units last month (while analysts had expected a 4.3% drop to 4.68 million units). This disappointing news fueled concerns that the U.S. housing sector, which drove the country into the worst recession since the Great Depression and has dragged on its recovery ever since, continues to face headwinds today and the U.S. economy may demand less fuel and energy than once anticipated.

Having discussed the above, let’s move on to the technical changes in the crude oil market (charts courtesy of http://stockcharts.com.)

As you see on the daily chart, the situation hasn’t changed much as crude oil remains in a consolidation between Wednesday high and low (marked with a light blue rectangle). Although oil bears tried to push the price lower on Friday, light crude rebounded and came back to the consolidation range. Nevertheless, we should keep in mind that crude oil still remains below the 127.2% Fibonacci extension level based on the Dec.-Jan. decline (around $103.34), which serves as the nearest resistance level. If it encourages oil bears to act, we may see further deterioration in the coming day (or days). In this case the first downside target for the sellers would be a support zone created by the December peak, the previous February high and the upper line of the rising trend channel. It’s worth mentioning that his scenario is reinforced by the current position of the indicators, which are overbought. More importantly, the RSI declined below the level of 70, generating a sell signal (we saw similar situation in the case of the Stochastic Oscillator, but it still remains above the level of 80), which suggests that a pause or a correction is likely to be seen in the near future. Please note that even if crude oil climbs once again, it seems that the space for further growth will be likely limited by the 61.8% Fibonacci retracement level.

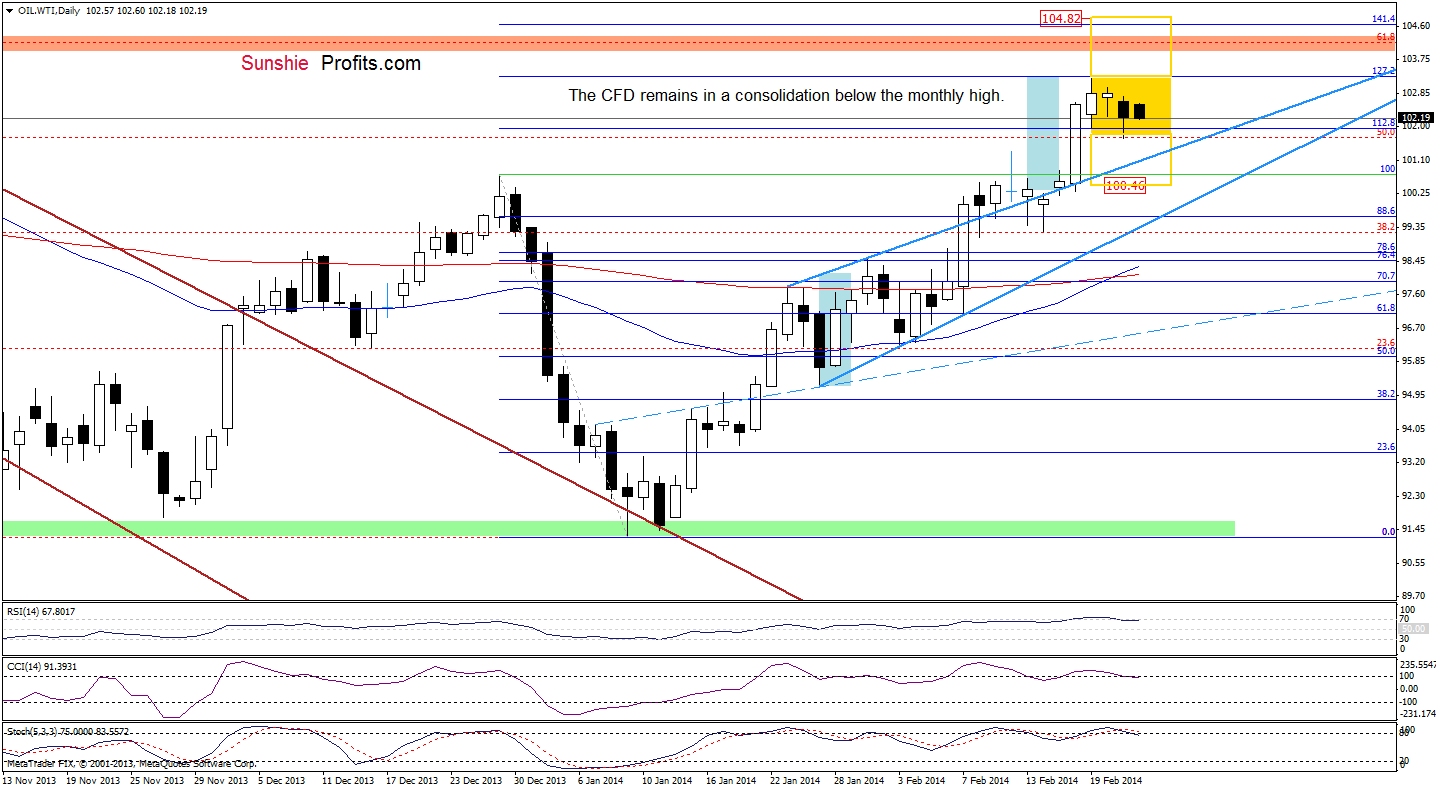

Having discussed the current situation in light crude, let’s take a look at WTI Crude Oil (the CFD).

Looking at the above chart, we see that the situation hasn’t changed much as WTI Crude Oil still remains in a consolidation slightly below the monthly high, which corresponds to the 127.2% Fibonacci extension level (based on the Dec.-Jan. decline). Therefore, if this strong resistance encourages sellers to act, we will likely see a pullback in the coming day (or days) and the first important support will be the previously-broken upper border of the rising trend channel/rising wedge. However, if the CFD declines below the lower border of the consolidation range, the price target for the pattern will be around $100.46, slightly above the Feb.18 low. This scenario is currently reinforced by the position of the indicators – they all generated sell signals earlier today, which provides us with bearish implications.

Summing up, the current situation in crude oil hasn’t changed much as light crude remains in the consolidation range below the 127.2% Fibonacci extension level, which is a strong resistance level. As mentioned earlier, all indicators are overbought, which suggests that a pause or a pullback is just around the corner. This scenario is also reinforced by the current situation in the CFD (all indicators generated sell signals earlier today, supporting the bearish case).

Very short-term outlook: mixed

Short-term outlook: bullish

MT outlook: bullish

LT outlook: mixed

Trading position (short-term): In our opinion, opening long positions at the moment is not a good idea as the space for further growth seems limited and the position of the indicators suggests that we may see a correction in the coming days. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts