On Monday, crude oil lost 0.78% and declined to slightly above the November low as expectations that the Federal Reserve could taper its bond buying program and hopes that Western and Iranian diplomats will make progress over Teheran’s nuclear program weighted on the price of light crude.

On Monday, oil investors focused on comments which fueled expectations the Federal Reserve could taper its bond buying program. Yesterday, crude prices fell quickly in early afternoon after William Dudley, the president of the Federal Reserve Bank of New York, said he was "getting more hopeful" on prospects for U.S. economic recovery. In addition, Charles Plosser, president of the Philadelphia Fed, said that improved economic and labor market conditions suggest the Fed should set a fixed dollar amount on its current bond-buying program and end the program when that amount is reached.

Although Fed Chairman-nominee Janet Yellen signaled last week that the central bank would need stronger evidence of economic growth before tapering, these two comments pushed the price of light crude to slightly above the November low.

Additionally, hopes that Western and Iranian diplomats will make progress in their efforts to end a nuclear impasse and resume the flow of Iranian crude into global markets have also had a negative impact on the price of light crude.

Oil investors awaited news from a meeting beginning on Wednesday between Iran and world powers over ending its nuclear program that may provide insight on whether sanctions against Iran would be lifted and, if so, when. Investors worry that any deal for Iran to curb its nuclear activities could allow some of that oil to be sold, depressing a market that is already well supplied. On Monday, U.S. Secretary of State John Kerry said that he had no specific expectations about world powers reaching a deal with Iran during the talks, but it seems that another round of "tough" talks in Geneva will weight on the price in the following days.

Having discussed the above, let’s move on to the technical changes in the crude oil market (charts courtesy of http://stockcharts.com).

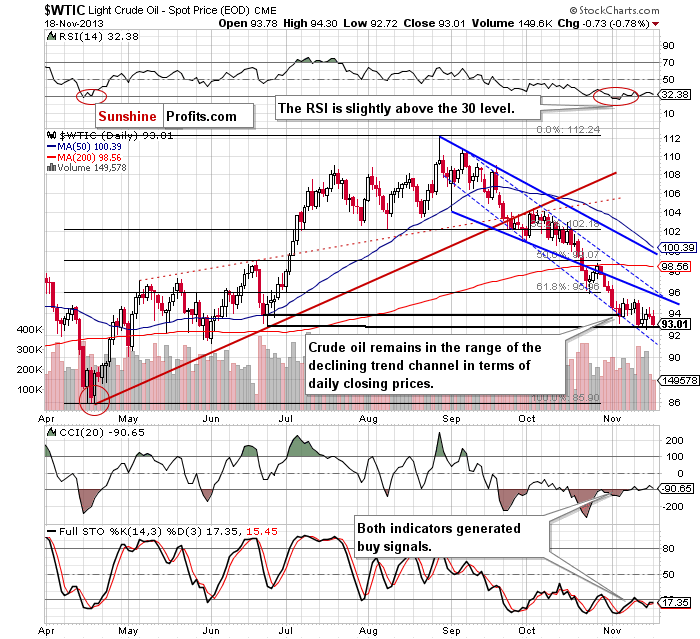

Yesterday, after the market open crude oil moved higher and reached its daily high of $94.30. However, this improvement was only temporary and light crude declined in the following hours to its daily low of $92.72. In this way, crude oil dropped to slightly above the November low, which is not a positive signal for oil bulls. Please note that despite this drop, crude oil remains in the range of the declining trend channel in terms of daily closing prices (marked with the blue dashed line).

The nearest support is the November low – slightly below the bottom of the corrective move that we saw back in June (in terms of intraday lows). The next one is the lower border of the declining trend channel (currently around $91.30).

The first resistance level is the Nov. 11 high, which is slightly below the lower border of the declining trend channel in terms of intraday lows (marked with the blue bold line).

Once we know the current situation in crude oil, let’s move on to the XOI daily chart.

Quoting our previous Oil Trading Alert:

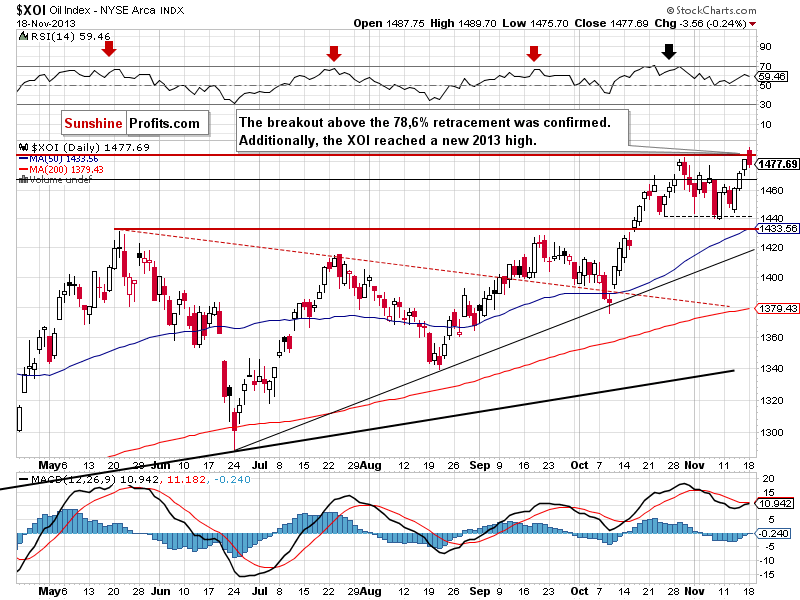

(…) if the buyers manage to break above the 2013 high, we will likely see further growth to 1,495, where the upper line of the rising wedge is.

On Monday, we saw further improvement. After a higher open, the oil stock index continued its rally and hit a new annual high at 1,489. However, after this positive event, we saw a correction, which pushed the oil stock index slightly below the previously-broken high. In spite of this drop, the breakout above the 78.6% retracement level was confirmed, which is a strong bullish sign.

Please note that the upper line of the smaller rising wedge on the weekly chart, which successfully stopped growth at the end of October, is still in play. Despite yesterday’s growth, the XOI remains below this line, which serves as strong resistance (currently around 1,495). Therefore, we should keep an eye on the oil stock index because the sellers may lock profits and trigger another correction in the coming days.

Keep in mind that the nearest support zone is created by Wednesday’s low and the bottom of the recent corrective move (between 1,439 and 1,444).

Summing up, although the situation has deteriorated slightly, crude oil still remains in the declining trend channel in terms of daily closing prices and the long-, medium- and short-term support levels are still in play.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: unclear

Trading position (short-term): Taking into account the medium- and short-term picture, we do not suggest opening any positions.

Thank you.

Nadia Simmons

Sunshine Profits' Crude Oil Expert

Oil Investment Updates

Oil Trading Alerts