On Tuesday, crude oil lost over 2% and hit a fresh monthly low of $92.86 as fears over growing crude supplies, high domestic production and speculation that the U.S. Federal Reserve may ease up on its monetary stimulus program weighted on price. This is light crude’s largest one-day drop since June 20.

Appetite for oil fell on Tuesday on worries about reduced liquidity after Atlanta Fed President Dennis Lockhart said a reduction in the Federal Reserve's monthly $85 billion in bond purchases remained a possibility at the bank's next policy meeting in mid-December.

Additionally, market participants are anticipating another build in U.S. crude inventories, which has also had a negative impact on light crude’s price. Oil stockpiles currently stand at 385.4 million barrels, which is their highest level since the end of June. They have climbed as U.S. production has soared to more than 20-year highs, boosted by hydraulic fracturing and horizontal drilling techniques, which have allowed energy producers to tap supplies in shale-oil fields.

Please note that the American Petroleum Institute will release its report on U.S. oil stocks today and the U.S. Energy Information Administration publishes its data on Thursday - a day later than usual due to the Veteran's Day holiday.

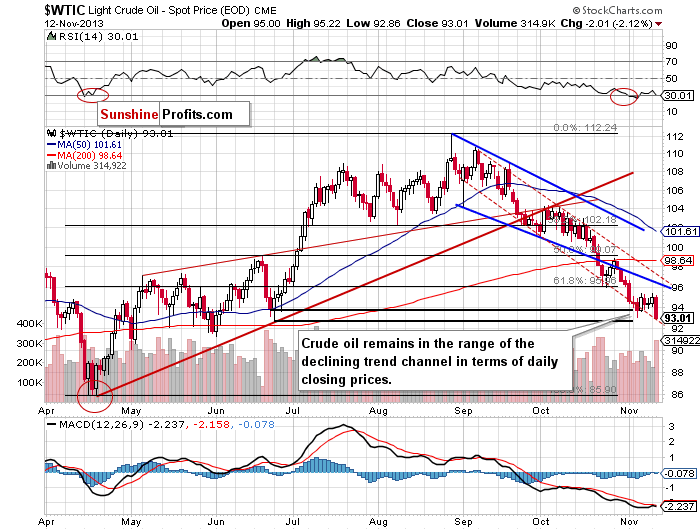

Having discussed the above, let’s move on to the technical changes in the crude oil market (charts courtesy of http://stockcharts.com).

Quoting our previous Oil Trading Alert:

(…) Please note that the recent days have formed a consolidation on the above chart. Therefore, if the oil bulls push crude oil above Wednesday’s top we will likely see an upward move to the lower border of the declining trend channel (in terms of intraday lows – marked with bold blue line) – currently around $96.50. However, if they fail, oil bears will likely make oil test the strength of the November low, which currently intersects with the lower border the declining trend channel (in terms of daily closing process – marked with thin red line).

As you can see on the above chart, yesterday after the market open buyers didn’t manage to push the price above Wednesday’s top once again. This show of weakness encouraged oil bears to trigger another downward move. In the following hours crude oil declined, which resulted in a breakdown below the November low, and hit a fresh monthly low of $92.86.

Looking at the daily chart, we see that despite this drop, light crude still remains in the range of the declining trend channel in terms of daily closing prices (marked with the red dashed line). Additionally, the bottom of the corrective move that we saw in June (in terms of intraday lows) at $92.67 sill serves as support.

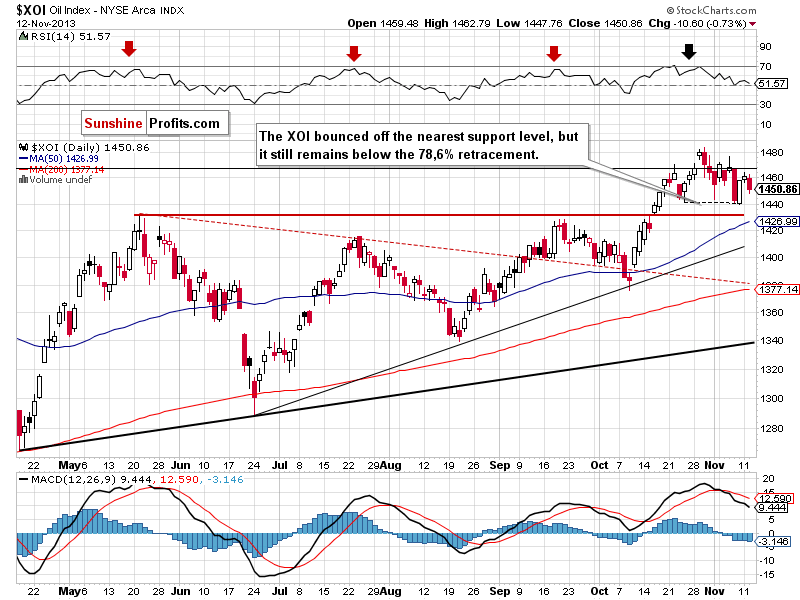

Once we know the current situation in crude oil, let’s move on to the XOI daily chart.

Quoting our previous Oil Trading Alert:

(…) the oil stocks index continued its rally on Monday. In spite of this growth, it didn’t move above the 78.6% retracement, which still serves as strong resistance. Therefore, it seems that as long as the XOI remains below this level, further increases are limited.

Please note that the MACD generated a sell signal for the first time since the beginning of October. We also saw similar situations at the end of May and at the beginning of August. In all previous cases the result was further deterioration. If history repeats itself once again, we will likely see another corrective move in the coming days.

Looking at the above chart, we see that yesterday in spite of a small increase after the market open, the oil stock index didn’t even reach the previously-broken 78.6% retracement. This negative event encouraged sellers to act and the XOI declined in the following hours. Taking into account a sell signal generated by the MACD and a strong resistance level further declines should not surprise us.

The nearest support level is the bottom of the recent corrective move at 1,439. The nearest resistance level is the previously-broken the 78.6% retracement and the next one is the 2013 high.

Summing up, the situation is unclear. On one hand, crude oil hit a fresh monthly low and the decline materialized on relatively big volume, which is a bearish sign. On the other hand, light crude remains in the declining trend channel in terms of daily closing prices and the long-, medium- and short-term support levels are still in play.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: unclear

Trading position (short-term): Taking into account the medium- and short-term picture, we do not suggest opening short positions yet.

Thank you.

Nadia Simmons

Sunshine Profits' Crude Oil Expert

Oil Investment Updates

Oil Trading Alerts