Trading position (short-term; our opinion): Short. Stop-loss orders for crude oil and also for WTI Crude Oil (CFD): $102.95.

On Thursday, crude oil gained 1.17% as positive service sector data and doubts over the oil export from Libya pushed the price higher. In this way, light crude erased all Wednesday losses and closed the day above $100 per barrel.

Yesterday, the Labor Department said in its report that initial claims for jobless benefits increased by 10,000 to a seasonally adjusted 326,000 last week, while analysts had expected an increase of 7,000. Additionally, a separate report showed that the U.S. trade deficit unexpectedly widened to $42.3 billion in February from a deficit of $39.28 billion the previous month. Despite these disappointing numbers, the price of crude oil moved higher as the Institute of Supply Management showed that its non-manufacturing PMI rose to 53.1 in March from a reading of 51.6 in February.

As mentioned earlier, another bullish factor, which pushed light crude higher was the situation in Libya as hopes that oil ports (held by armed protestors) along the coast may begin shipments soon faded.

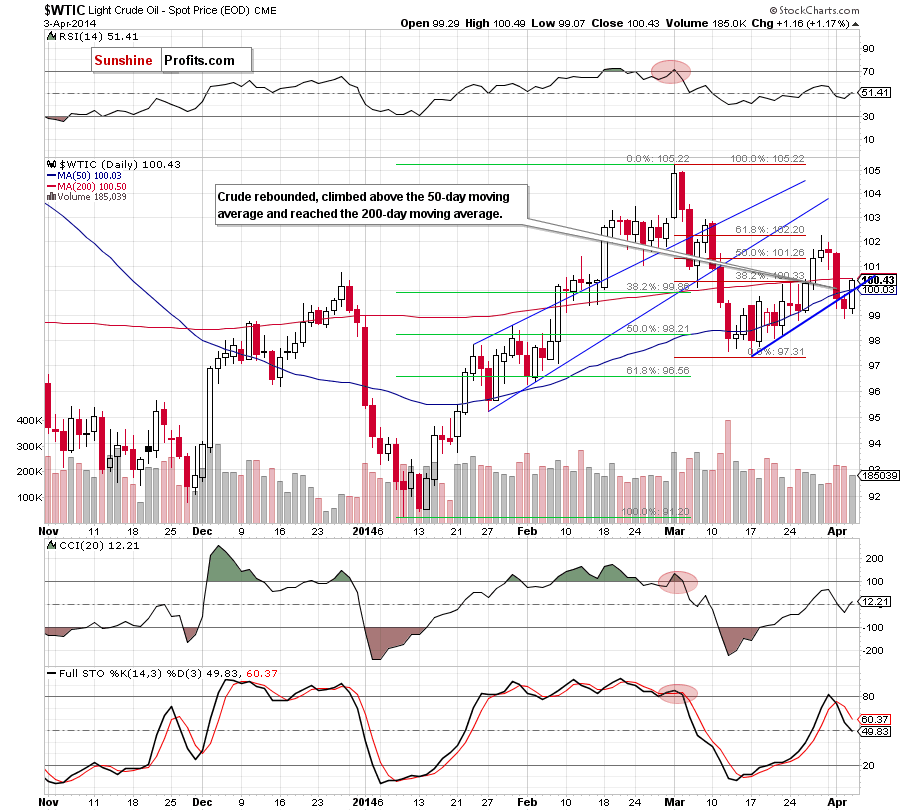

Having discussed the above, let’s move on to the technical changes in the crude oil market (charts courtesy of http://stockcharts.com.)

On the above chart, we see that crude oil reversed and climbed above the previously-broken blue resistance line (which serves as support now) and the 50-day moving average, which is a bullish signal. With this upswing, light crude reached the 200-day moving average, which is the major resistance at the moment. If it holds, we will likely see a pullback in the coming day (the nearest support is the blue support line, which intersects the 50-day moving average and the next one is Wednesday’s low). However, if it is broken, the next upside target for oil bulls will be around $101.57, where the Apr. 1 high is. Please note that yesterday’s upswing materialized on smaller volume than Wednesday’s decline, which suggests that the sellers are still stronger than the buyers. Additionally, sell signal generated by the Stochastic Oscillator remains in place, supporting oil bears.

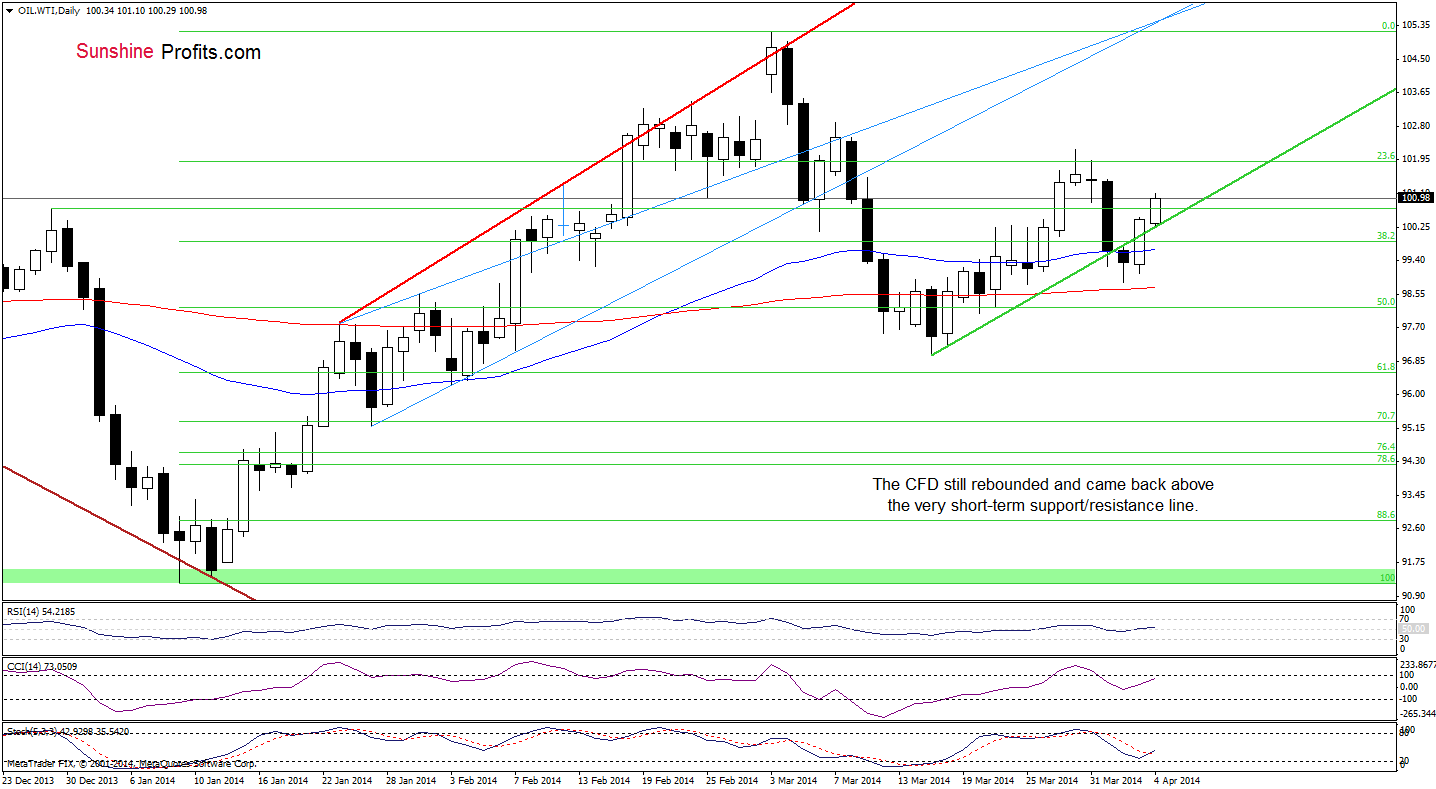

Having discussed the current situation in light crude, let’s take a look at WTI Crude Oil (the CFD).

As you see on the daily chart, WTI Crude Oil reversed and came back above the 50-day moving average and the very short-term support/resistance line yesterday. Earlier today, the CFD extended gains and approached Tuesday’s high, which serves as the nearest resistance. If it encourages oil bears to act, we will likely see a pullback to the green support line. However, if it is broken, we may see an increase to the March 28 high.

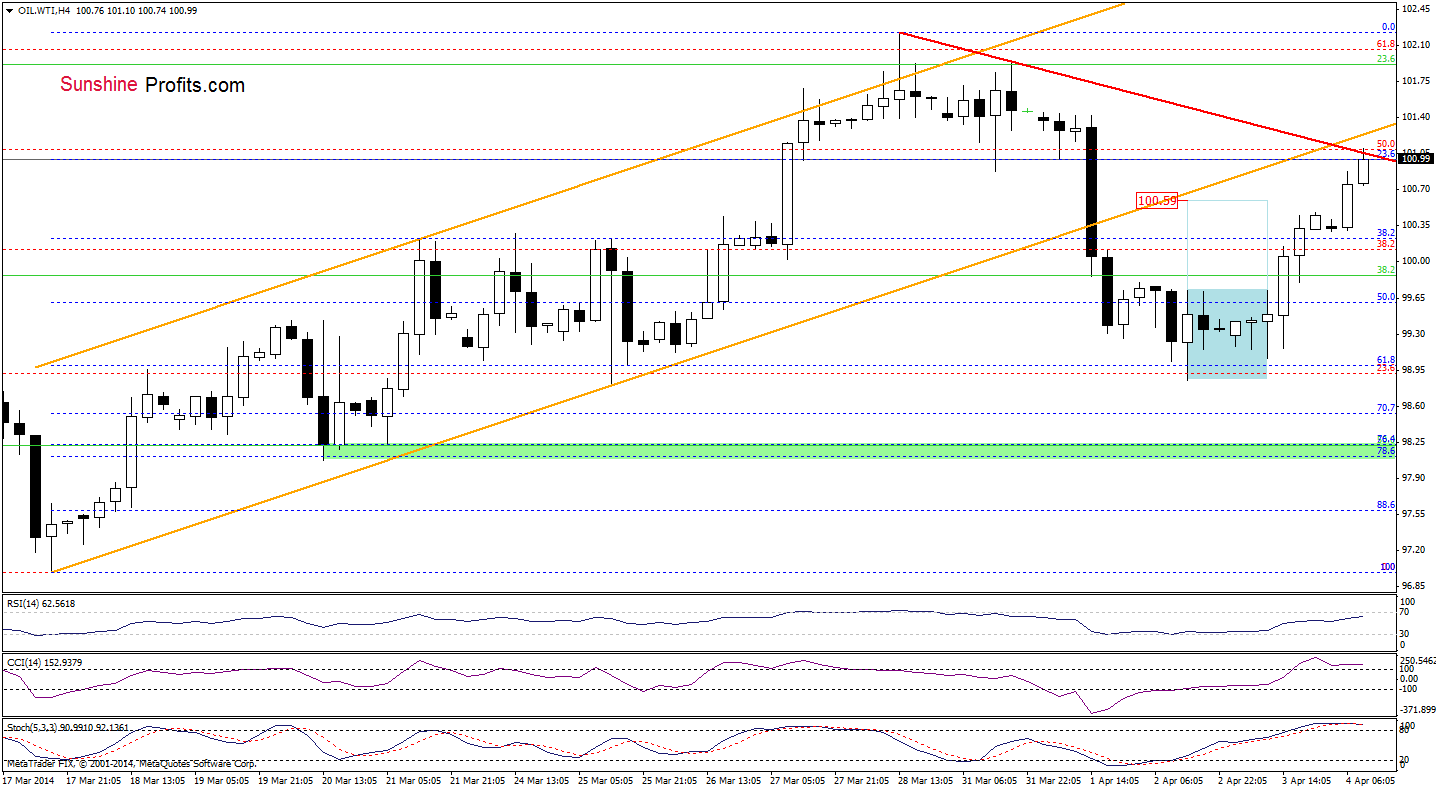

Before we summarize today’s Oil Trading Alert, let’s take a look at the 4-hour chart.

From this perspective, we see that the CFD broke above the upper line of a consolidation, which triggered an increase not only to the upside target (around $100.59), but also to the red declining resistance line based on the recent highs. As you see on the above chart, slightly above it is the lower border of the rising trend channel, which serves as major resistance at the moment. If this resistance zone encourages sellers to act, we will likely see a pullback to the previously-broken upper line of a consolidation (around $99.72). However, if the buyers do not give up and push the CFD higher, we may see an increase to around $101.94 or even to the March 28 high. Please note that the CCI and Stochastic Oscillator are overbought, while the RSI approached the level of 70, which suggests that we may see a pause (or a pullback) in the following hours.

Summing up, the short-term situation has improved slightly as crude oil reversed and came back above the blue resistance line and the 50-day moving average. Despite these positive circumstances, light crude still remains below the 200-day moving average, which serves as the major resistance at the moment. Additionally, yesterday’s upswing materialized on smaller volume than Wednesday’s decline, which is not as positive as it seems at the first glance. However, taking into account today’s improvement in WTI Crude Oil, we will likely see an increase in light crude after the market open.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): Short. Stop-loss orders for crude oil and also for WTI Crude Oil (CFD): $102.95. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts