Trading position (short-term; our opinion): No positions.

On Monday, crude oil lost 0.24% as ongoing concerns over the global economic outlook and its impact on future demand prospects weighed on the price. As a result, light crude slipped below the long-term support line, but then invalidated the breakdown. Is this the first sign that a trend reversal is just around the corner?

Yesterday, there were no disturbing news or fundamental developments that could drive the price of crude oil higher or lower. Therefore, ongoing concerns over signs of an abundance of light crude in combination with a soft demand pushed the price little lower. Despite this deterioration, the commodity is still trading in a consolidation. Where will it head next? (charts courtesy of http://stockcharts.com).

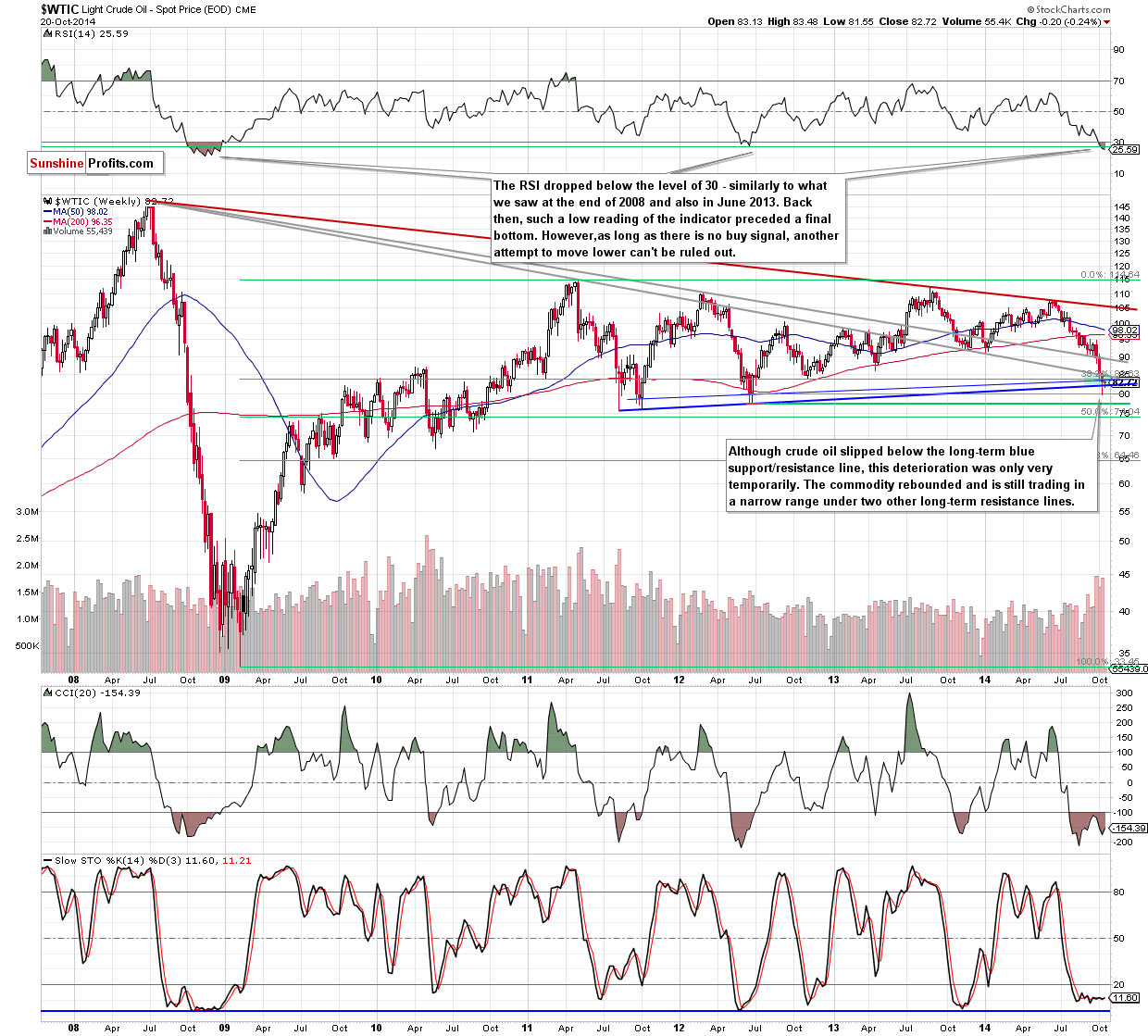

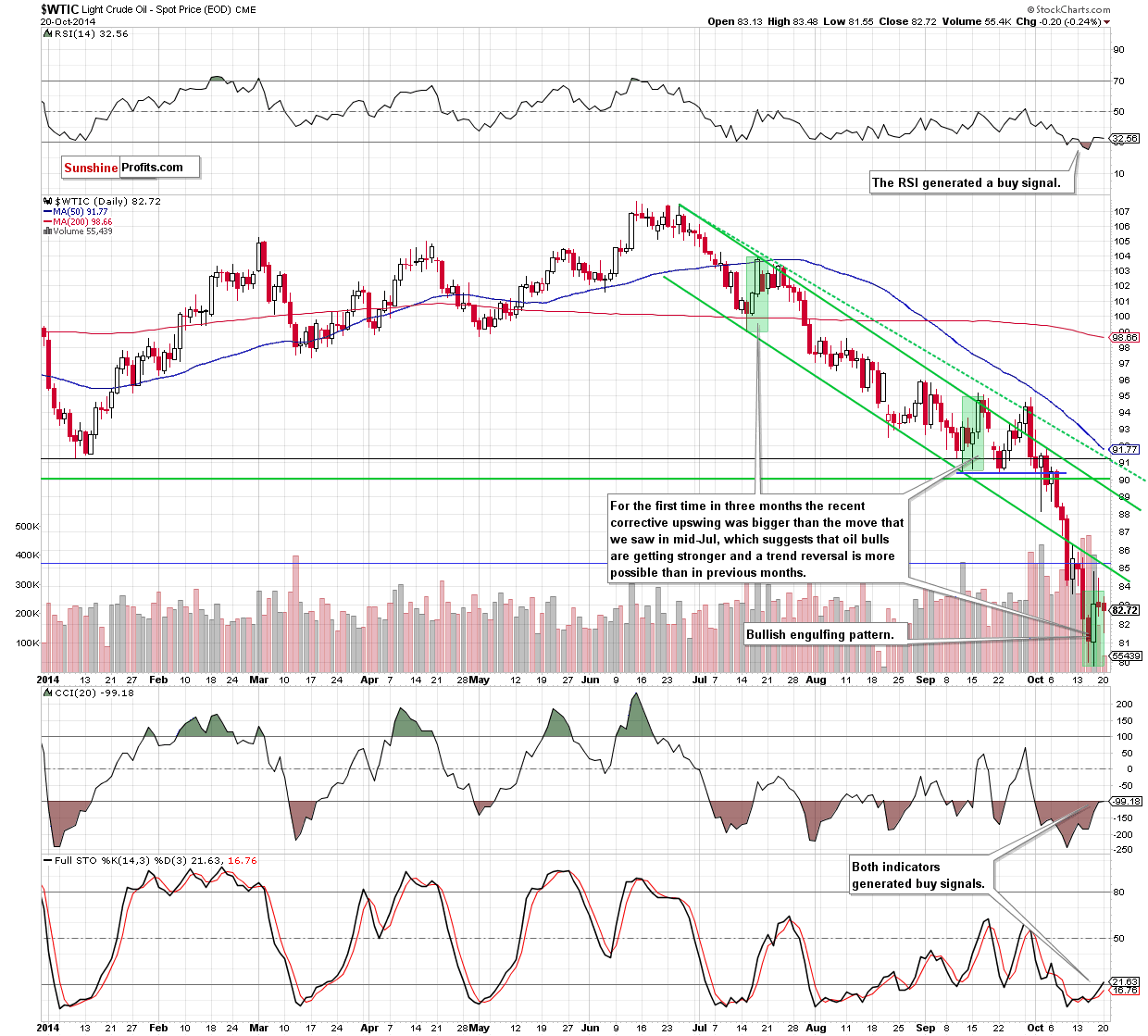

Looking at the above charts, we see that the overall situation hasn’t changed much. Although crude oil moved lower and slipped below the long-term blue support/resistance line, this deterioration was only temporarily and light crude rebounded, invalidating earlier small breakdown. As you know this is a positive sign (especially when we factor in the bullish engulfing pattern and buy signals generated by the daily indicators), which suggests that oil bulls are getting stronger and defend this area. Will we see further improvement in the coming days? In our opinion, a bigger upward move will be more likely if the commodity breaks above $84.80. Why this level is important? When you take a closer look at the charts, you will see that in this area is currently the lower border of the declining trend channel, the second long-term grey resistance line and the upper border of the current consolidation seen on the daily chart (based on the Oct 16 high). Therefore, a breakout above such solid resistance zone would be a strong bullish signal that should trigger further improvement and an increase to at least $88.50-$89, where the next resistance zone (created by the upper line of the declining trend channel and the first long-term grey declining line) is. However, as long as there is no such breakout, another test of the strength of the long-term blue support/resistance line can’t be ruled out.

Summing up, from today’s point of view, we think that the most important event of yesterday’s trading day was an invalidation of the small breakdown below the long-term blue support/resistance line. Although this is another optimistic signal, the commodity is still trading under the solid resistance zone, which keeps gains in check. Therefore, we think that staying on the sidelines and waiting for the confirmation that the declines are over is the best choice at the moment.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts