Trading position (short-term; our opinion): In our opinion no positions are justified from the risk/reward perspective.

On Thursday, crude oil lost 0.53% as smaller-than-expected drop in crude oil inventories and a stronger U.S. currency weighed on the price. Although light crude reversed and slipped below $95, the commodity is trading in a consolidation. Is this a sign of strength or rather the last stop before new lows?

Yesterday, the European Central Bank unexpectedly cut interest rates to a record-low 0.05% from 0.15% to stimulate an economic recovery in the eurozone. As a result, the U.S. dollar inreased to its highest level since July 2013 against the euro. Additionally, later in the day, the Institute for Supply Management showed that its services index rose to 59.6 in August from 58.7 in July, far surpassing market forecasts for a downtick to 57.5. Thanks to these circumstances, a stronger U.S. dollar made crude oil more expensive to investors holding other currencies and pushed the commodity lower.

On top of that, the EIA weekly report showed that U.S. crude oil dropped by 0.9 million barrels in the week ending Aug. 29 from the previous week, missing analysts‘ forecasts for a decline of 1.1 million barrels, which affected negatively light crude, fueling fears that the U.S. and global economy is awash in the commodity. Did these numbers change the very short-term outlook? Let’s examine charts and find out (charts courtesy of http://stockcharts.com).

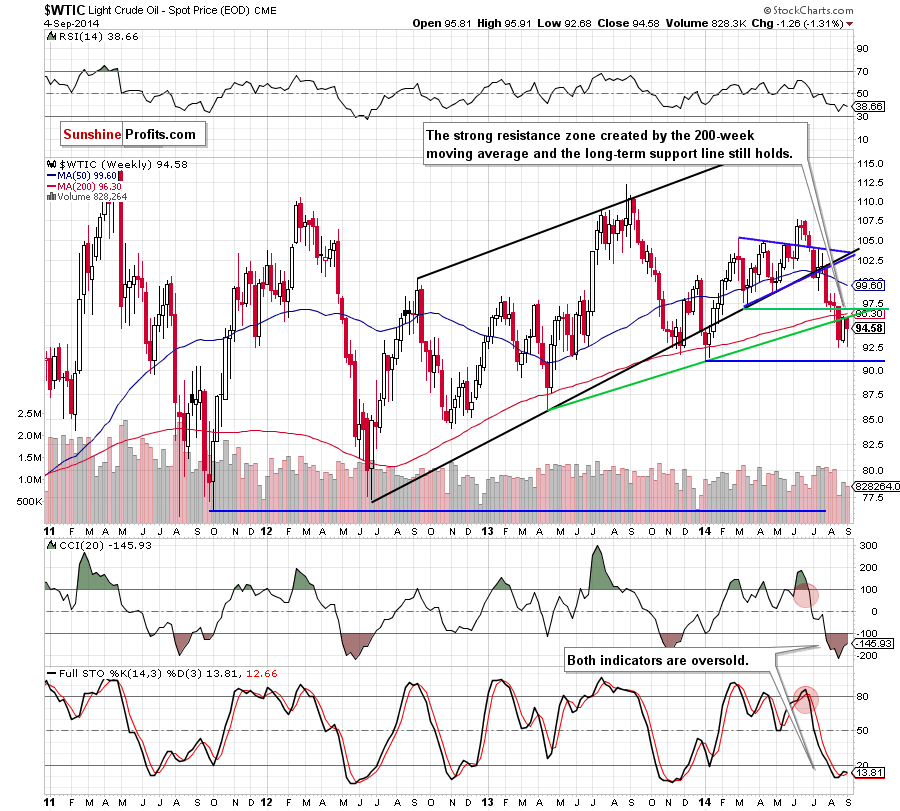

From this perspective, we see that the situation in the medium-term remains unchanged as crude oil is still trading below the strong resistance zone created by the previously-broken 200-week moving average and the rising, long-term support line. Therefore, our last commentary is up-to-date:

(…) we still think that as long as there is no invalidation of the breakdown below these levels, the medium-term outlook remains bearish (..) if crude oil drops below the recent lows, the last week’s upswing will be nothing more than a verification of the breakdown and we’ll see a test of the strength of the Jan low of $91.24. Nevertheless, we still keep in mind that the current position of the indicators suggests that a trend reversal is just around the corner (especially when we factor in the fact that the Stochastic Oscillator generated a buy signal).

Will the very short-term chart give us more clues about future moves? Let’s check.

Quoting our yesterday’s summary:

(…) From today’s point of view, this move is nothing more than another one-day rally, which (…) didn’t change the very-short term outlook. Nevertheless, we should keep in mind that the major driving force behind the next move might be today’s the EIA weekly report on crude oil inventories. (…) if the data disappoints, the commodity will likely correct yesterday’s rally (…)

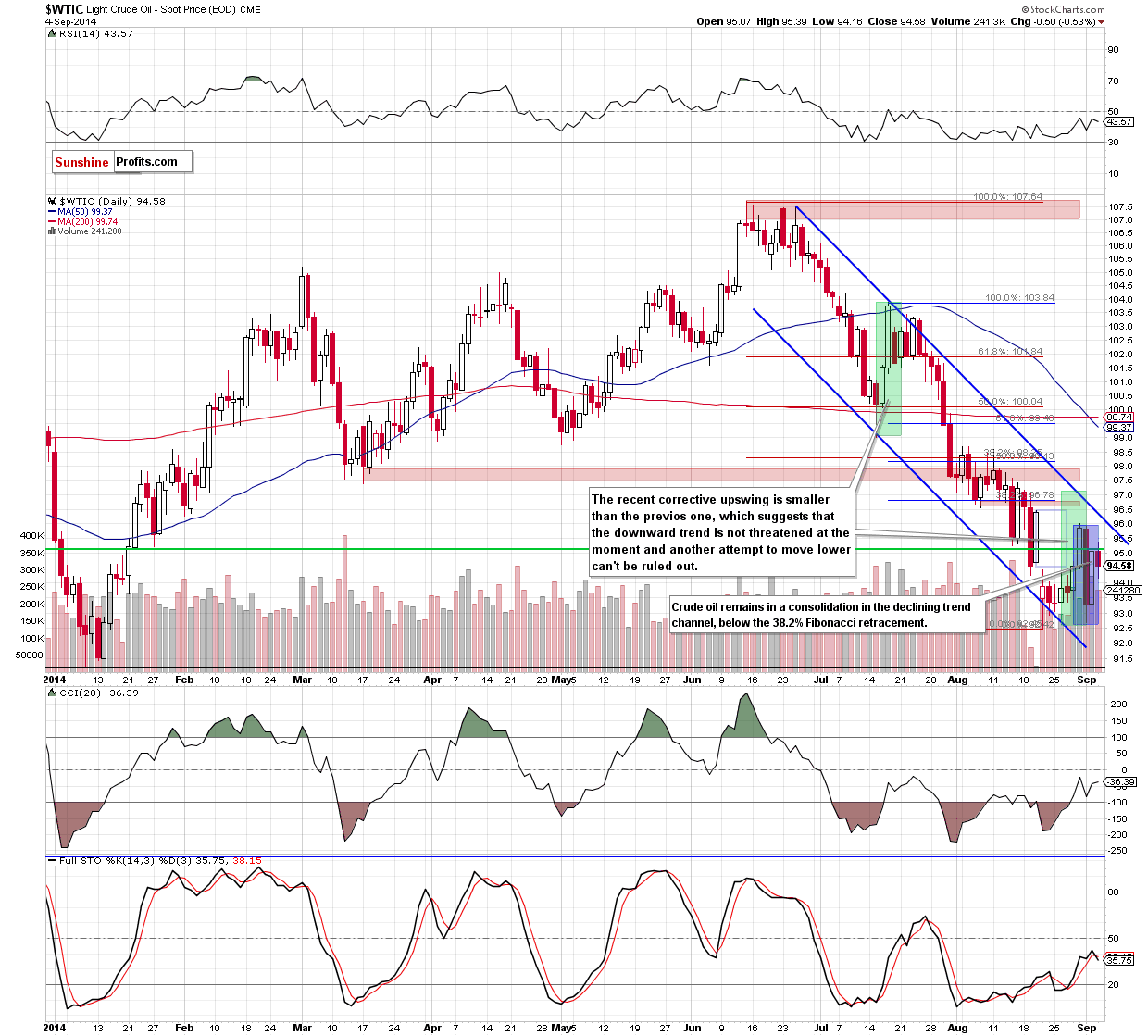

As you see on the above chart, the situation developed in line with the above-mentioned scenario and crude oil erased almost 61.8% of Wednesday’s rally, hitting an intraday low of $94.16. Despite yesterday’s move, the overall situation in the very short-term hasn’t changed as light crude is trading in a consolidation (marked with blue) between Tuesday’ s high of $95.91 and low of 92.68. Taking this fact into account, we think that as long as there is no breakout above the upper line of the formation (or a breakdown below the lower border) another bigger move is not likely to be seen. At this point, it’s worth noting that Tuesday’s high corresponds to the upper line of the declining trend channel at the moment, which makes this area stronger. Nevertheless, if oil bulls manage to push the price above it, we’ll see an increase to at least $98.18-$98.58, where the strong resistance zone created by the Aug highs and the 38.2% Fibonacci retracement based on the entire Jun-Aug decline (and also the 50% of the Jul-Aug downward move) is. What could happen if currency bears show their claws once again? Without a doubt, the initial downside target will be the lower line of the formation. If it’s broken, the commodity will test the strength of the lower border of the declining trend channel, which intersects the Jan low of $91.24 at the moment.

Please keep in mind that the recent corrective upswing is much smaller than the previous one, which means that oil bulls are even weaker than they were in July. Therefore, in our opinion, the downward trend is not threatened at the moment and another attempt to move lower should not surprise us.

Summing up, yesterday’s price action didn’t change the very short-term picture (not to mention the medium-term outlook, which remains bearish), therefore, in our opinion opening long positions is currently not justified from the risk/reward perspective. We should keep in mind that the major driving force behind today’s move might be the U.S. employment report. If it is bullish, the U.S. dollar will strengthen, which may push the commodity lower. On the other hand, if it’s bearish, it will likely fuel worries over the strength of the recovery in the labor market, which may also translate into lower price of crude oil. Taking all the above into account, it seems that the move to the downside is more likely at the moment.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: bearish

LT outlook: mixed

Trading position (short-term): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Oil Trading AlertsGold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates