Trading position (short-term; our opinion): In our opinion no positions are justified from the risk/reward perspective.

On Monday, the price of crude oil dropped to an intraday low of $93.05 after disappointing new home sales report. Despite unrest in Ukraine and in the Middle East, the commodity is still trading in the narrow range as oil continues to flow. Will we see another sizable move in the nearest future?

Yesterday, the U.S. Commerce Department reported that new home sales dropped by 2.4% to 412,000 units last month, missing expectations for an increase of 5.7%. Because of these disappointing numbers, light crude slipped to slightly above $93 per barrel. Although the commodity rebounded in the following hours, ongoing concerns over a supply glut keep the price in the narrow range. Are there any technical factors that could drive it higher or lower in the nearest future? Let’s check (charts courtesy of http://stockcharts.com).

The situation in the medium term hasn’t changed as crude oil still remains below the 200-week moving average and the rising, long-term support line, near a seven-month low of $92.50. Today, we’ll focus on the very short-term changes.

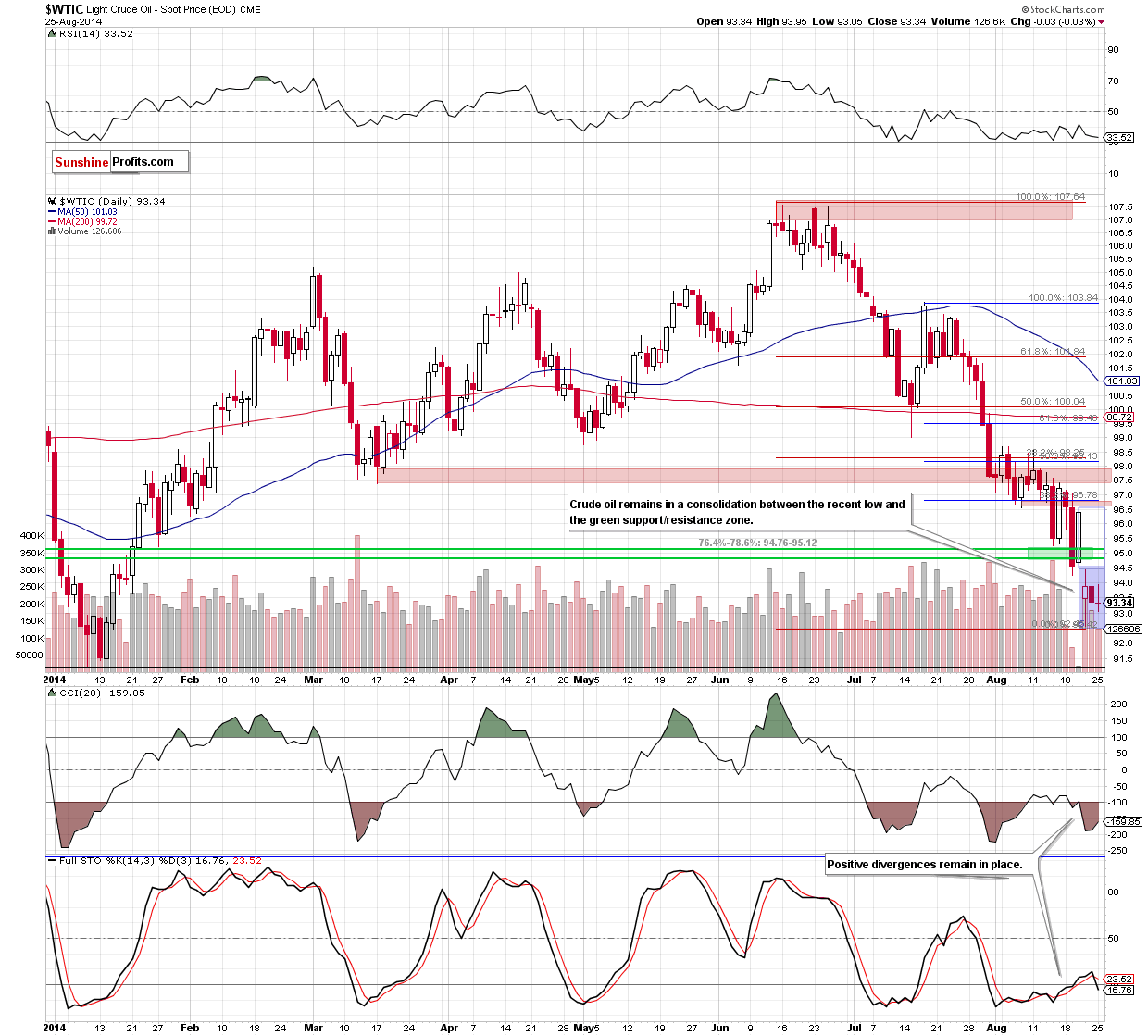

Looking at the above chart, you may ask: what changes? As you see on the daily chart, despite yesterday’s price action, the commodity remains in a consolidation (marked with blue) between the recent low and the green support/resistance zone. This is the point where we usually consider two scenarios. On one hand, if oil bulls manage to push the price above the upper line of the formation, we’ll see an attempt to invalidate the breakdown below the green area. If they succeed, the initial upside target will be around $96.60, where the size of the upswing will correspond to the height of the consolidation (it’s worth noting that slightly above this level is the 38.2% Fibonacci retracement based on the Jul-Aug decline, which may pause further improvement). On the other hand, if crude oil extends losses and drops below the recent low, we’ll see further deterioration and a test of the strength of the Jan low of $91.24. Which scenario is more likely? From the technical point of view, oil bulls have only positive divergences on their side. Meanwhile, their opponents have a breakdown below two very important medium-term support levels and a confirmation of the breakdown below the previous lows and the green area (which serves as the nearest resistance). So, what’s next for crude oil? Taking into account this unclear very short-term technical picture, we think that the next move will appear after the EIA weekly report, which will help oil investors to gauge the strength of oil demand from the world’s largest consumer.

Summing up, despite yesterday’s price action, the overall situation remains unchanged as crude oil is trading in the consolidation. As we mentioned earlier, the commodity could go both north or south from here, but we think that tomorrow's the EIA report will bring a breakthrough and will indicate the direction of future moves. Meanwhile, in our view, staying on the sidelines waiting for another profitable opportunity is the most appropriate investment strategy at the moment.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: bullish

Trading position (short-term): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts