Trading position (short-term; our opinion): Speculative short positions in crude oil seem to be justified from the risk/reward perspective.

On Thursday, crude oil shuffled between small gains and losses as investors weighed economic data from two largest oil consumer nations. Because of these circumstances, light crude has been trading in the narrow range. North or south? Who has more technical arguments?

Yesterday, after the market’s open crude oil moved higher on upbeat Chinese manufacturing data, which showed that a preliminary reading of China’s HSBC manufacturing index increased to a five-month high of 49.7 in May, up from a final reading 48.1 in April. Despite this growth, investors figured out that the index still remains below the 50 level separating contraction from expansion, which pushed the price of light crude lower.

On top of that, a flurry of mixed U.S. economic data weakened crude oil as well.

Although the National Association of Realtors reported that existing home sales in the U.S. increased 1.3% to a seasonally adjusted 4.65 million units in April from 4.59 million in March, the data was weaker than analysts had expected. Additionally, the U.S. Department of Labor showed in its report that initial claims for jobless benefits increased by 28,000 last week to 326,000, while analysts had expected an increase of 12,000 to 310,000 last week.

Also yesterday, a separately report showed that the U.S. manufacturing PMI climbed to a seasonally adjusted 56.2 in May from a final reading of 55.4 in April. Despite this growth, earlier disappointing data had a negative impact on crude oil and the commodity closed the day 9 cents below Wednesday closing price. Will we see light crude lower in the coming days? Let’s check the technical picture (charts courtesy of http://stockcharts.com).

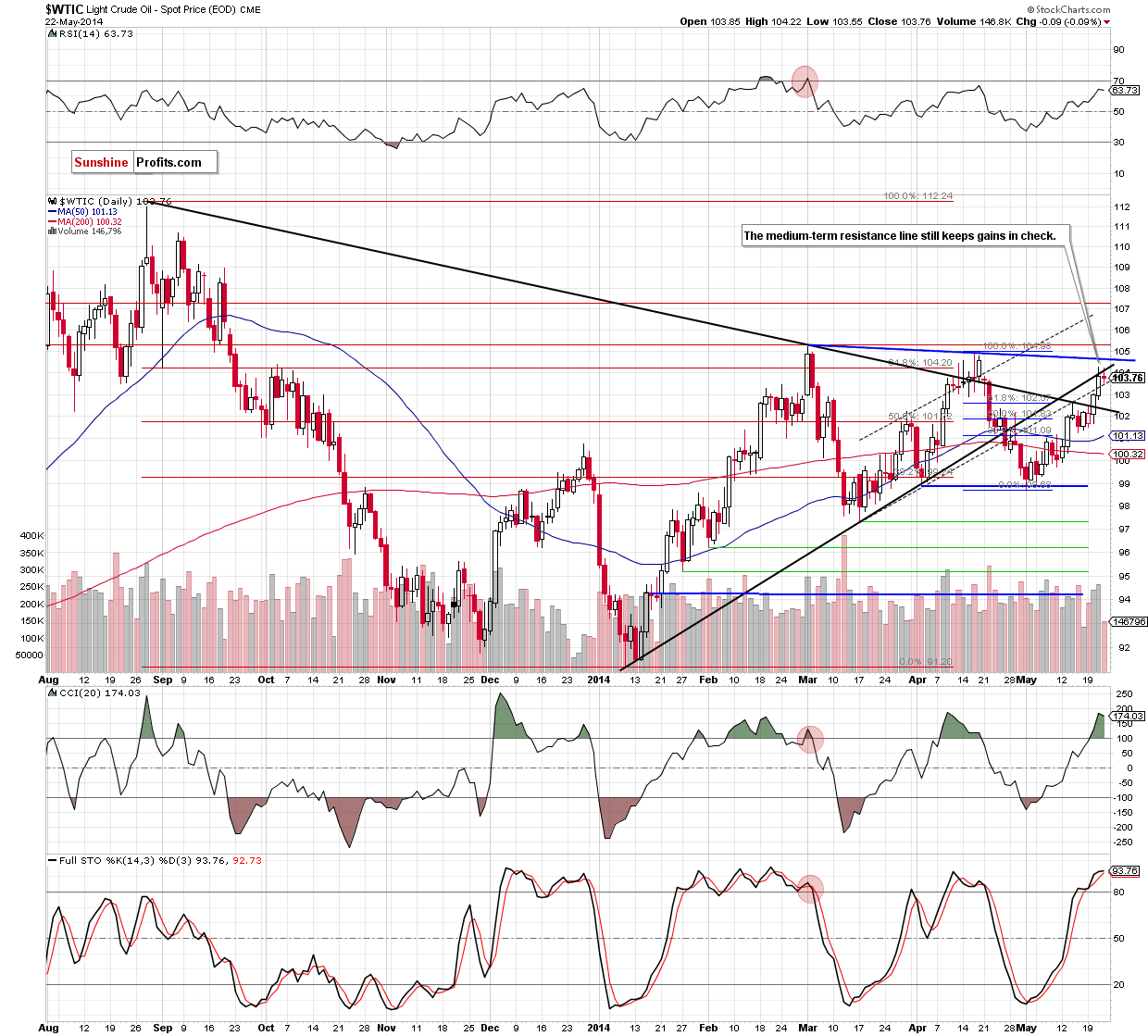

From the medium-term perspective, we can summarize this week in one simple sentence: the lower border of the triangle still keeps gains in check, which means that the situation in the medium term hasn’t changed. Having said that, let’s focus on the very short-term picture.

In our yesterday’s summary, we wrote the following:

(...) as long as light crude remains above the dashed rising line (which serves now as support), another test of the strength of the medium-term resistance can’t be ruled out.

Looking at the above chart, we see that there was such price action yesterday. Despite this try, oil bulls failed and the price reversed, finishing the day below the medium-term resistance once again. Taking this fact into account, we remain convinced that what we wrote yesterday is up-to-date:

(…) This is the point where we should consider two scenarios. On one hand, if the combination of the rising black line and the 88.6% Fibonacci retracement based on th entire recent decline(at $104.28) is strong enough to stop further improvement, we’ll see a pullback in the coming days and the first downside target will be the previously-broken upper line of the triangle (currently around $102.40). In our opinion, it’s quite likely as the CCI and Stochastic Oscillator are overbought, while the RSI reached a similar level as in mid-April. However, if oil bulls succesfully breaks above the lower border of the triangle, we’ll see further improvement and the next upside target will be the April high of $104.99. Alhough this is the less likely of scenarios to play, it cannot be ruled out as an option.

Summing up, although crude oil shuffled between small gains and losses, nothing really happened and the very short-term outlook remains unchanged. Therefore, we are still bearish as crude oil is trading below the key resistance line. Just like we wrote yesterday, the commodity could go both north and south from here, but we think that the bearish scenario is more likely at the moment. Please keep in mind that as long as light crude remains above the dashed rising, another test of the strength of the medium-term resistance can’t be ruled out.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): Short. Stop-loss order to $105.50. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts