Trading position (short-term; our opinion): no positions are justified from the risk/reward perspective.

On Thursday, crude oil slipped little lower as weaker-than-expected Chinese data and an increase in domestic oil reserves weighed on the price. Although light crude hit a fresh five-week high, oil bulls didn’t manage to hold gained levels. Does it mean that they waned? What can we infer from the size of the volume?

Yesterday, crude oil slipped little lower as weaker-than-expected Chinese data fueled concerns over a slowdown in the world’s second largest oil consumer. Official data showed that China’s overall exports unexpectedly fell for the second month in March, while imports dropped sharply. Additionally, China’s crude oil imports fell to a five-month low in March, declining to 5.55 million barrels a day, while oil-product imports fell to 540,000 barrels a day.

Also yesterday, the U.S. Energy Information Administration said that estimates of proven domestic oil reserves increased 15% to 33 billion barrels in 2012, the largest increase in more than four decades, thanks to additions in Texas and North Dakota. The increase was the fourth year in a row, and reserves now stand at their highest level since 1976.

Having discussed the above, let’s move on to the technical changes in the crude oil market (charts courtesy of http://stockcharts.com.)

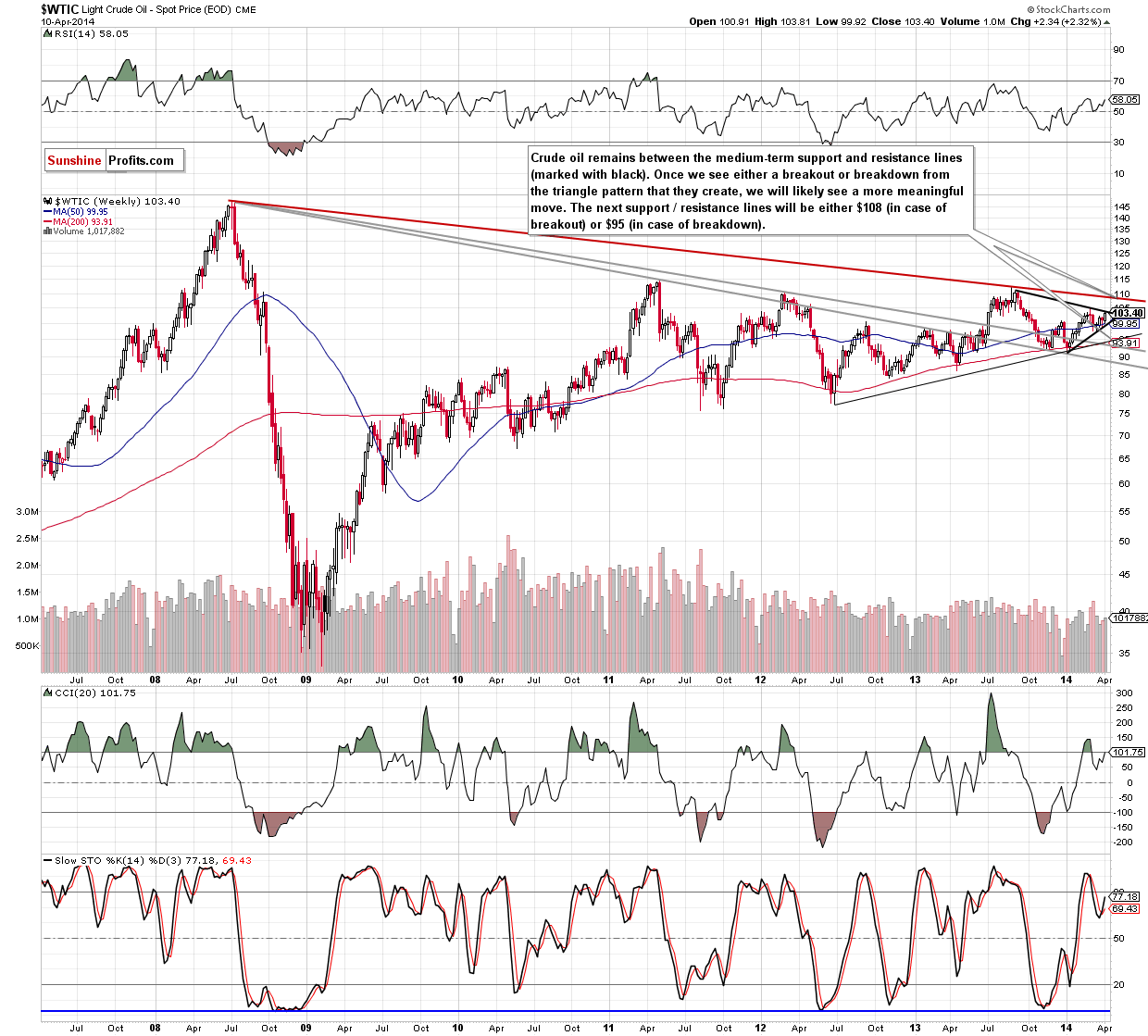

From the weekly perspective the situation hasn’t changed. Therefore, what we wrote in our last Oil Trading Alert is still-up-date.

(…) crude oil reached the resistance line based on the September and March highs, which is also the upper line of a triangle. Taking this fact into account, we should consider two scenarios. On one hand, if oil bulls do not give up and succesfully push the price of light crude above this important line, we will likely see an increase to around $108, where the long-term resistance line (marked with red) is. However, if they fail, we may see a pullback to the previously-broken 50-week moving average (currently at $99.95). Please note that this area is supported by the medium-term support line (based on the January and March lows), which is also the lower border of the black triangle. Looking at the current position of the indicators, we see that they still support buyers as buy signals remain in place.

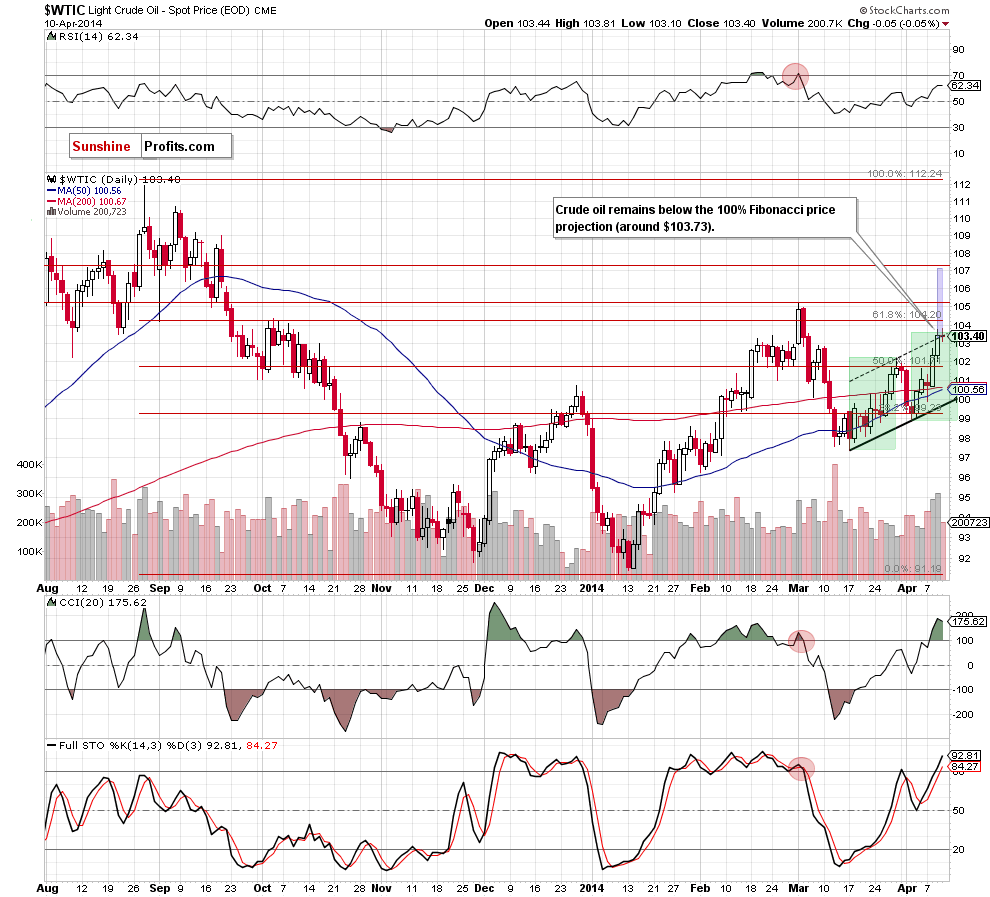

Just like a day before, let’s zoom in on our picture and move on to the daily chart.

From this perspective, we see that the situation hasn’t changed much. Although crude oil extended gains and hit a fresh five-week high of $103.81, the commodity reversed and slipped to the upper line of the rising trend channel, finishing the day 5 cents below Wednesday’s closing price. However, as you see on the above chart, this downsing materialized on relative small volume (especially when compared to the previous days), which suggests that the buyers are still stronger than the sellers. On top of that, the breakout that we saw on Wednesday was not invalidated, which means that what we wrote in our previous Oil Trading Alert is still valid.

(…) According to theory, if this breakout is not invalidated, we may see an increase to around $107, where the price target is (and corresponds to the height of the trend channel).

Nevertheless, we should keep in mind that light crude still remains below the black resistance line (marked on the weekly chart) and the 100% Fibonacci price projection (around $103.73). If these resistance levels encourage sellers to act, we may see another attempt to break below the upper line of the rising trend channel in the coming day (or days).

Summing up, the situation hasn’t changed much as crude oil remains between the upper line of the rising trend channel and the medium-term resistance, which may trigger a consolidation in the coming days.

Very short-term outlook: bullish

Short-term outlook: bullish

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): In our opinion no positions are justified from the risk/reward perspective. We plan to open the speculative positions once we see either a breakout or breakdown on the long-term chart. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts