Trading position (short-term; our opinion): No positions.

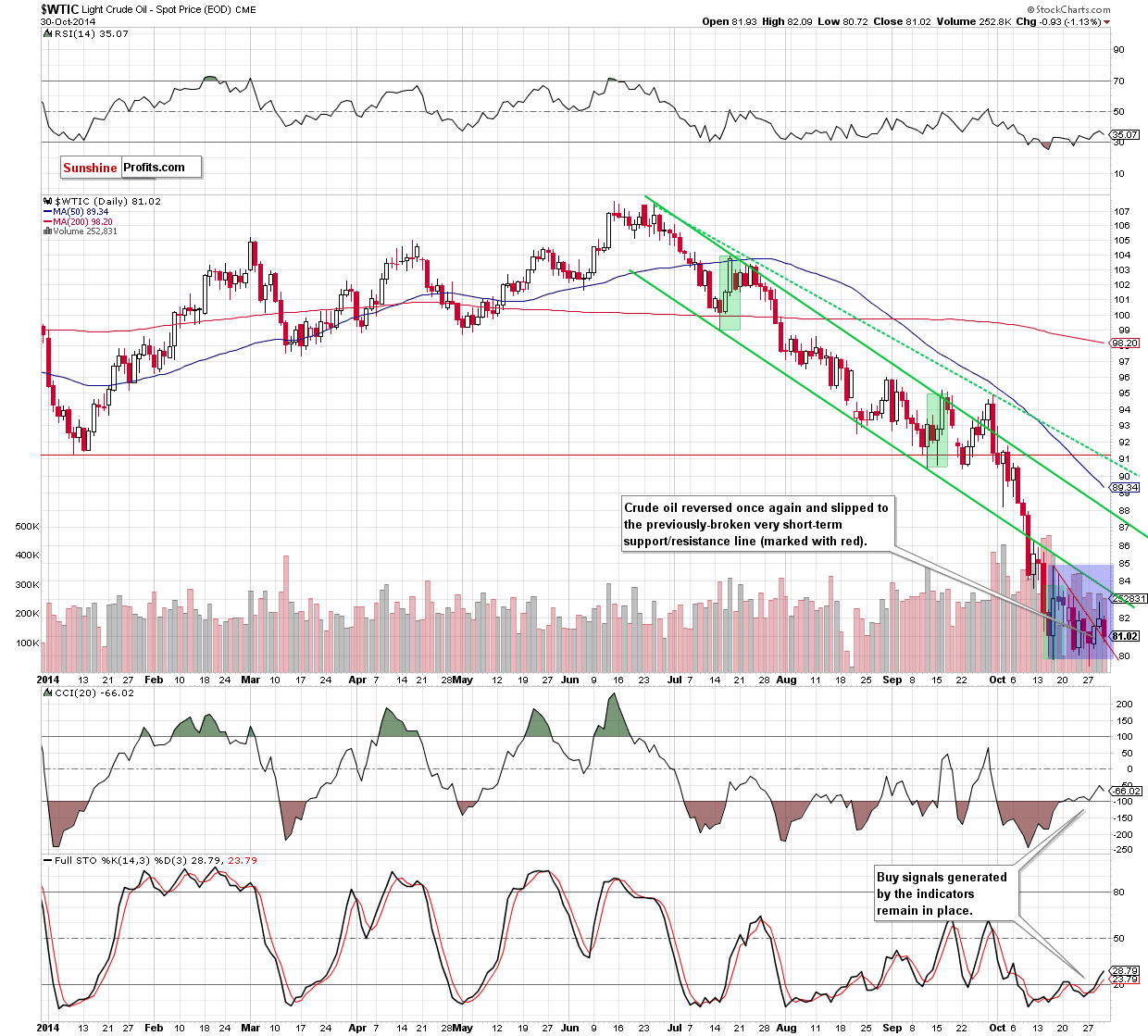

On Thursday, crude oil lost 1.13% as stronger greenback weighed on the price. As a result, light crude reversed and declined to the very short-term support. Will it encourage oil bulls to act?

Yesterday, the Commerce Department reported on Thursday that U.S. gross domestic product grew at an annual rate of 3.5% in the three months to September, beating forecast for 3%. Additionally, initial jobless claims were reported at 287,000, at historically low levels. Thanks to these bullish numbers, the USD Index, which tracks the performance of the U.S. dollar against a basket of six major currencies climbed above 86.50, approaching the recent highs and making crude oil less attractive in dollar-denominated exchanges, especially among investors holding other currencies. As a result, the commodity slipped to the very short-term support. Where the pair head next? (charts courtesy of http://stockcharts.com).

Quoting our Oil Trading Alert:

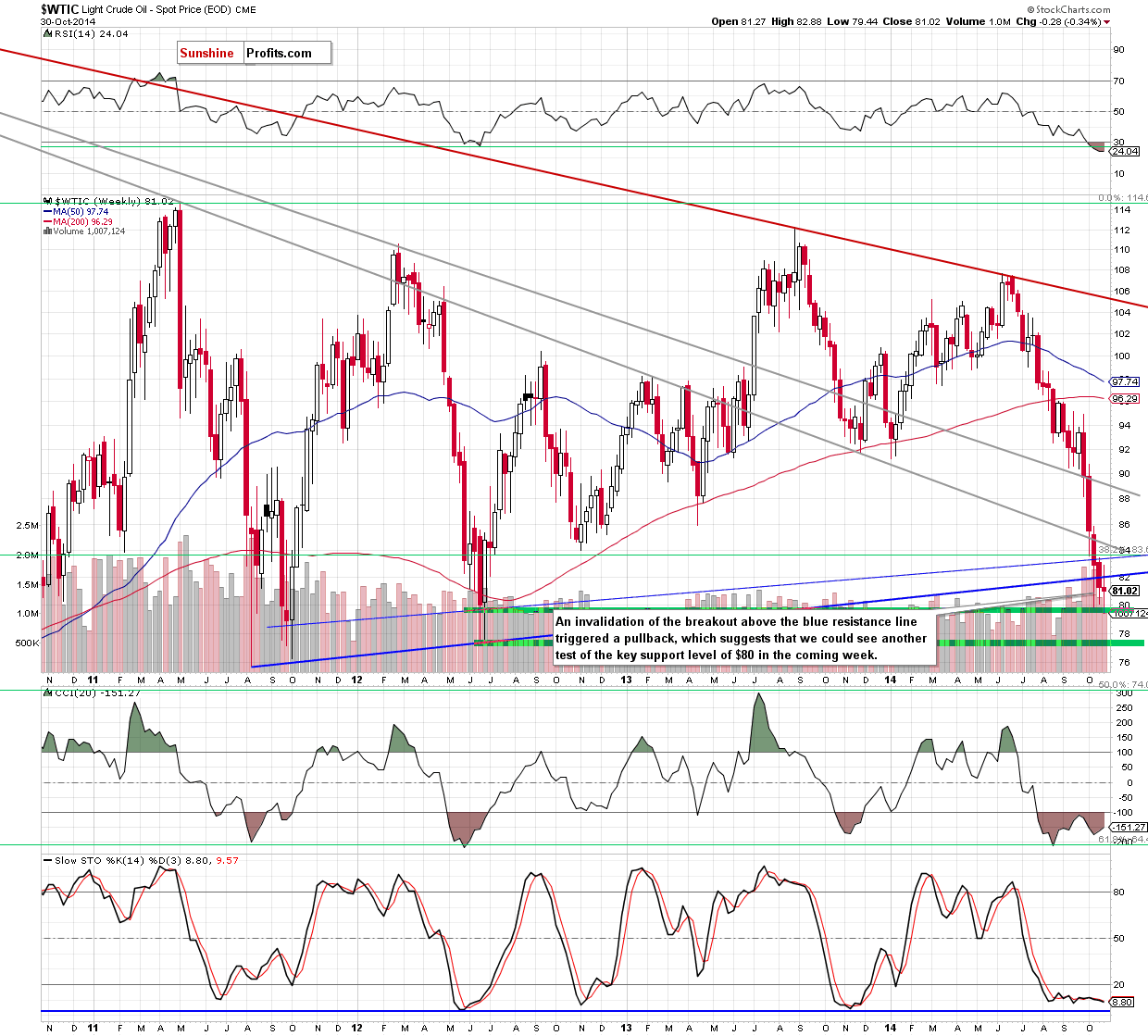

(…) crude oil invalidated earlier breakout above the blue long-term resistance line (seen on the weekly chart) and closed the day slightly below it. This is a negative signal, which suggests that we could see another attempt to move lower. If this is the case, the nearest support would be the very short-term declining red line (marked on the daily chart) around $81.

Looking at the above charts, we see that the currency bears realized the above-mentioned scenario as we expected and crude oil reached our downside target. Although this support line could encourage oil bulls to act, it seems to us that that the medium-term picture in combination with stronger greenback (please note that earlier today, the USD Index extended gains and climbed above 87, hitting a fresh multi-month high) will push the commodity lower later in the day. If this is the case, and light crude invalidates the breakout above the very short-term declining red line, it would be a bearish signal, which will trigger further deterioration and a drop to the key support level of $80 or even to the recent low of $79.44.

Please keep in mind that if the commodity breaks below this level, the next downside target will be around $77.28, where the Jun 2012 low is.

Summing up, although crude oil reached the very short-term support red line, it seems to us that an invalidation of the breakout above the long-term blue resistance line in combination with the stronger greenback will result in a test of the strength of the key support level of $80 or even the recent low of $79.44. Taking into account the fact that the space for further declines seems limited, we do not recommend opening short positions at the moment.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts