Trading position (short-term; our opinion): Short positions (with a stop-loss order at $56.45 and an initial downside target at $45.81) are justified from the risk/reward perspective.

Although the Energy Information Administration reported another increase in crude oil and fuel inventories, oil investors shrugged off these bearish numbers and focused on growing signs of coordinated OPEC and non-OPEC producers’ cuts in oil output. In this environment light crude broke above its first resistance line, but can we trust this move?

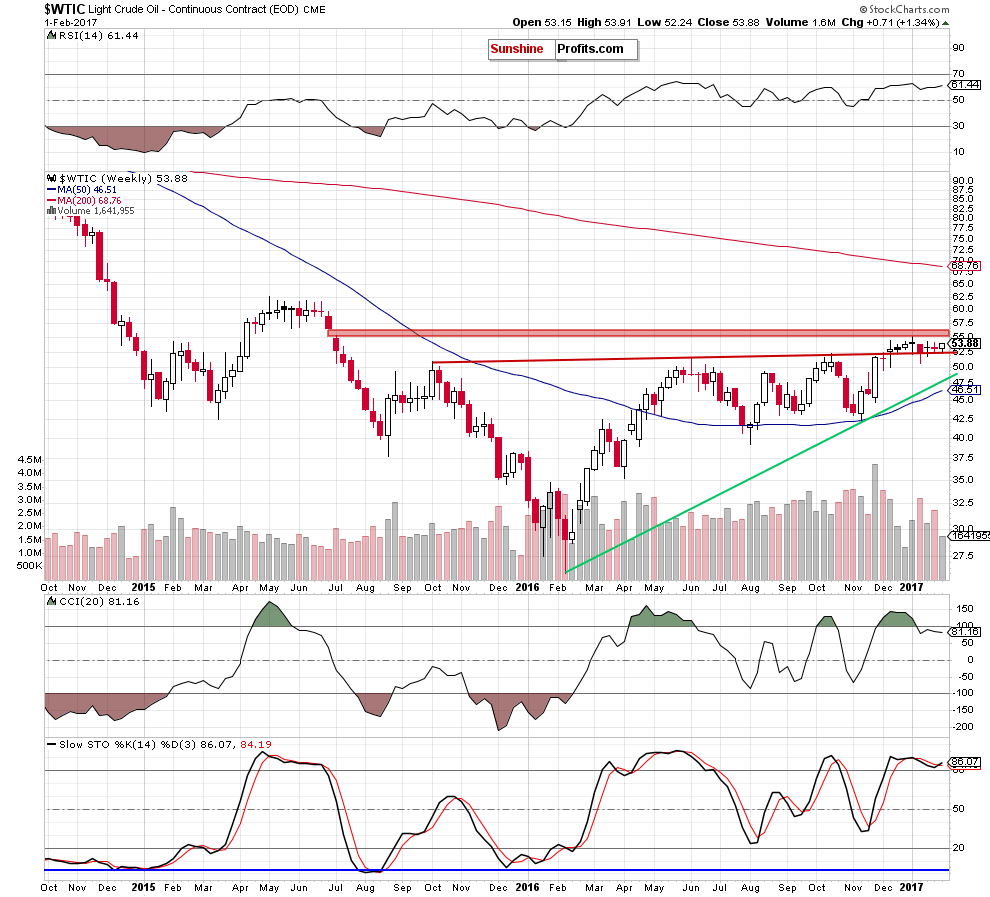

Let’s examine the charts below to find out (charts courtesy of http://stockcharts.com).

Looking at the daily chart, we see that crude oil broke above the orange resistance line based on the previous highs and closed the day above it. Although this is a positive development, we should keep in mind that we saw a similar price action in the previous week. Back then, the proximity to the red resistance zone created by the recent highs was enough to encourage oil bears to act. Taking this fact into account, we think that as long as the breakout is not confirmed another downswing is very likely – especially when we factor in the double top formation (created by the January and January 17 peaks) and the red gap (seen on the weekly chart), which continues to keep gains in check since the beginning of the year.

Summing up, short positions continue to be justified as crude oil remains under the previous highs and the red gap, which together continue to keep gains in check since the beginning of the year.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at $56.45 and an initial downside target at $45.81) are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

We will keep you – our subscribers – informed should anything change.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main market that we provide this level for (crude oil), the stop-loss level and target price for popular ETN and ETF (among other: USO, DWTI, UWTI) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DWTI for instance), but not for the “main instrument” (crude oil in this case), we will view positions in both crude oil and DWTI as still open and the stop-loss for DWTI would have to be moved lower. On the other hand, if crude oil moves to a stop-loss level but DWTI doesn’t, then we will view both positions (in crude oil and DWTI) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the sings pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts