Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 and initial (!) target price at $35.72 are justified from the risk/reward perspective.

On Monday, crude oil lost 2.24% as downbeat Goldman Sachs forecast and ongoing worries over the supply glut weighed on the price. As a result, light crude broke below important support levels and hit a fresh six-week low. Where will the commodity head next?

Yesterday, Goldman Sachs remarked in a note to investors that distillate storage in the U.S. and Europe almost reached historically high levels, while demand growth (especially relative to gasoline) is only modest, refinery utilization is very high and imports from the East increased. In this way, the bank warned investors of comparable downturns in 1998 and 2009 (when distillate storage reached overall capacity, pushing crude prices considerably lower), which pushed the commodity to an intraday low of $43.64. What impact did this drop have on the short-term picture of crude oil? Let’s examine charts and find out (charts courtesy of http://stockcharts.com).

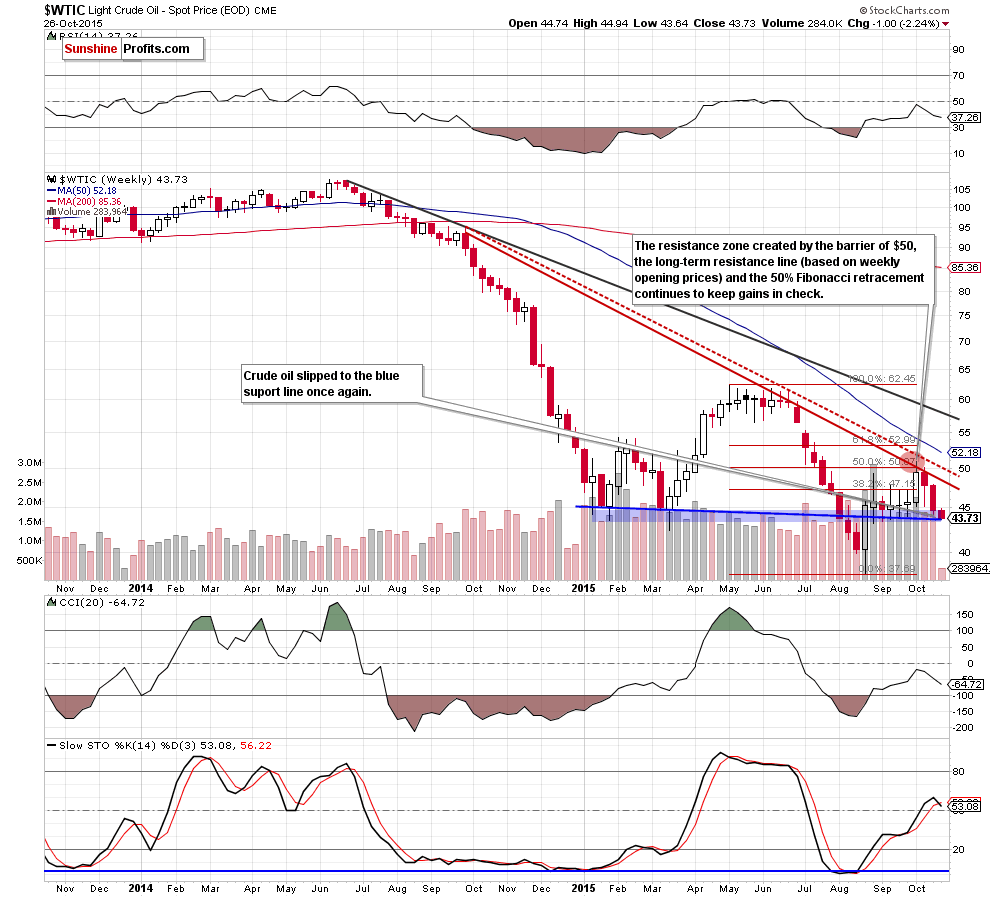

Looking at the above chart we see that the commodity dropped to the blue line. As you see, several times in the past this key support encouraged to act oil bulls. Although we could see similar price action in the coming day(s), the Stochastic Oscillator generated a sell signal, which suggests that further deterioration is more likely than not.

Having said that let’s focus on the very short-term changes.

Quoting our previous alert:

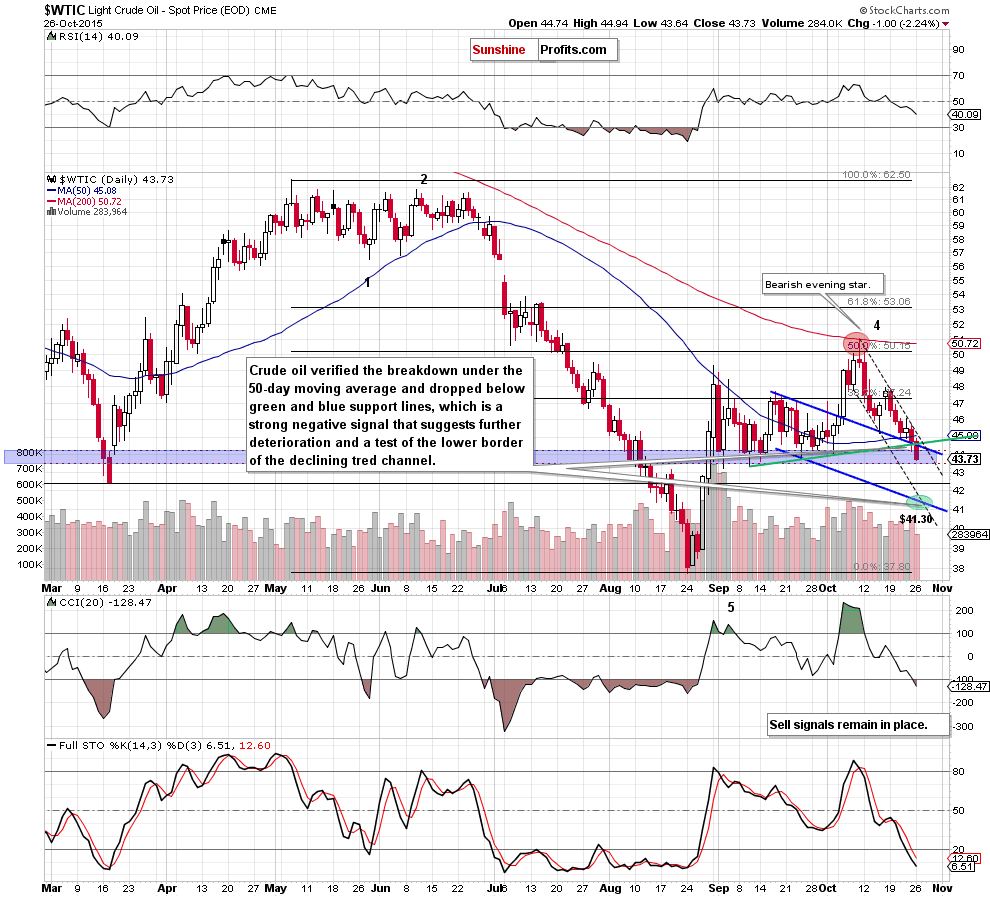

(…) light crude declined below the previously-broken 50-day moving average and reached the key support zone (created by the green support line based on the Sept and Oct lows, the upper border of the blue declining trend channel and the blue support zone).

What’s next? Although the commodity could rebound from here (similarly to what we saw in Sept), the current position of the indicators (sell signals still support oil bears) and the size of volume that accompanied Friday’s increase (much bigger compared to what we saw on Thursday) suggest that lower values of the commodity are just a matter of time.

On the daily chart, we see that the situation developed in line with the above scenario and crude oil moved lower as we had expected. Yesterday, light crude verified the breakdown under the 50-day moving average, which triggered further deterioration. With this downswing, the commodity dropped under the green and blue support lines, which is a strong negative signal that suggests lower values of crude oil.

How low could the commodity go in the coming days? We think that the best answer to this question will be the quote from our Friday’s Oil Trading Alert:

When we could see another sizable downward move? We think that acceleration of declines will appear when crude oil breaks under the upper border of the blue declining trend channel. In this case, the initial target for oil bears would be around $41.72, where the lower line of the formation currently is.

Summing up, crude oil broke below two important support lines, which in combination with sell signals generated by the indicators suggests lower prices of the commodity. Therefore, we believe that further deterioration is more likely than not and short positions (which are already profitable) continue to be justified from the risk/reward point of view.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 and initial (!) target price at $35.72 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts