Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Monday, crude oil lost 3.62% as a combination of a rising greenback and news from the United Arab Emirates pushed the price lower. Thanks to these circumstances, light crude broke below its key support line and hit a fresh 2014 low of $55.02. How much more room to decline does the commodity have?

Yesterday, official data showed that industrial production in U.S. rose 1.3% in the previous month, beating expectations for a 0.7% gain, which pushed the greenback higher, making crude oil less attractive for investors holding other currencies. Additionally, the United Arab Emirates said that OPEC will stand by its recent decision not to trim production to support declining price of crude oil, which watered down the commodity and pushed it to its lowest level since the beginning of May 2009. How much more room to decline does the commodity have? (charts courtesy of http://stockcharts.com).

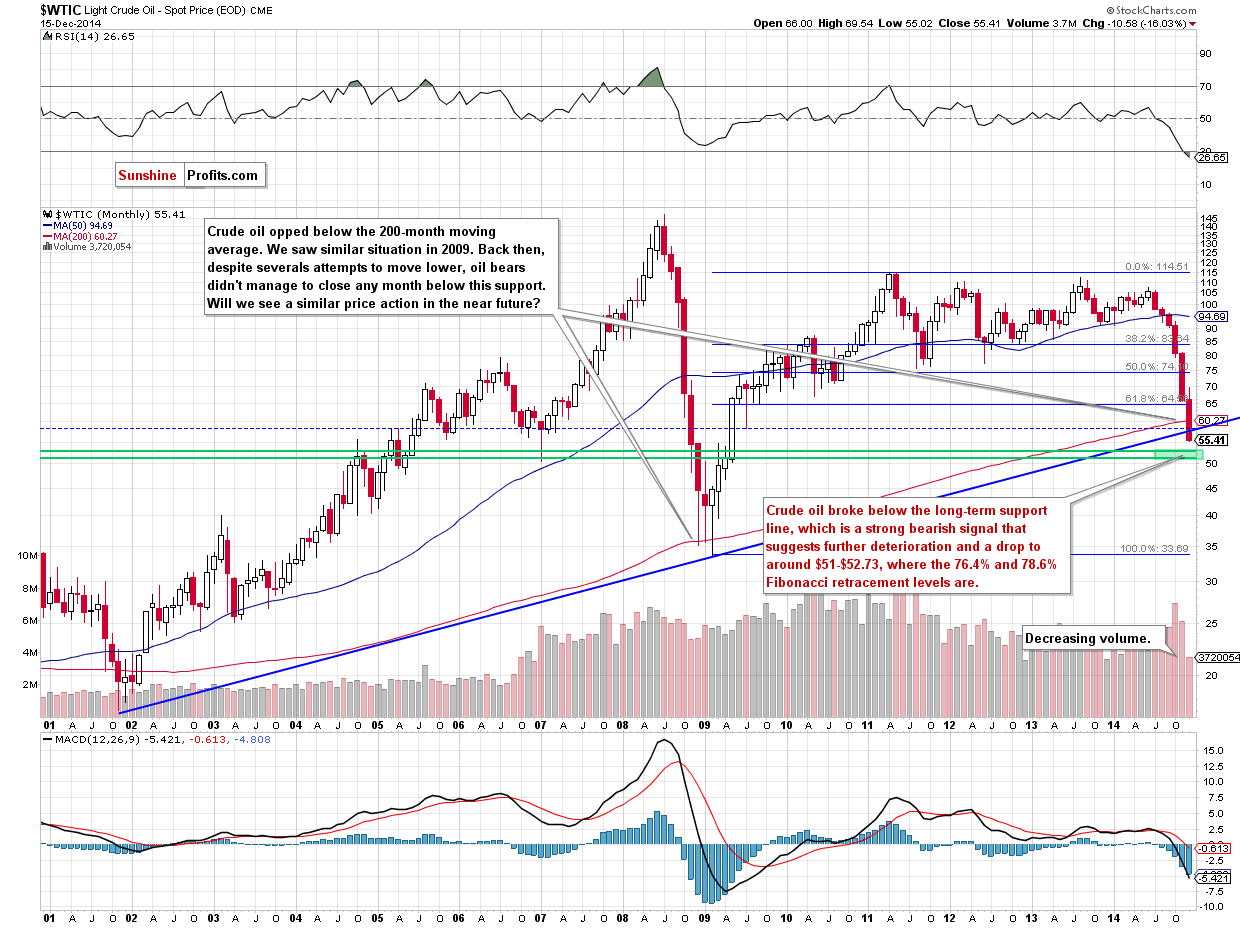

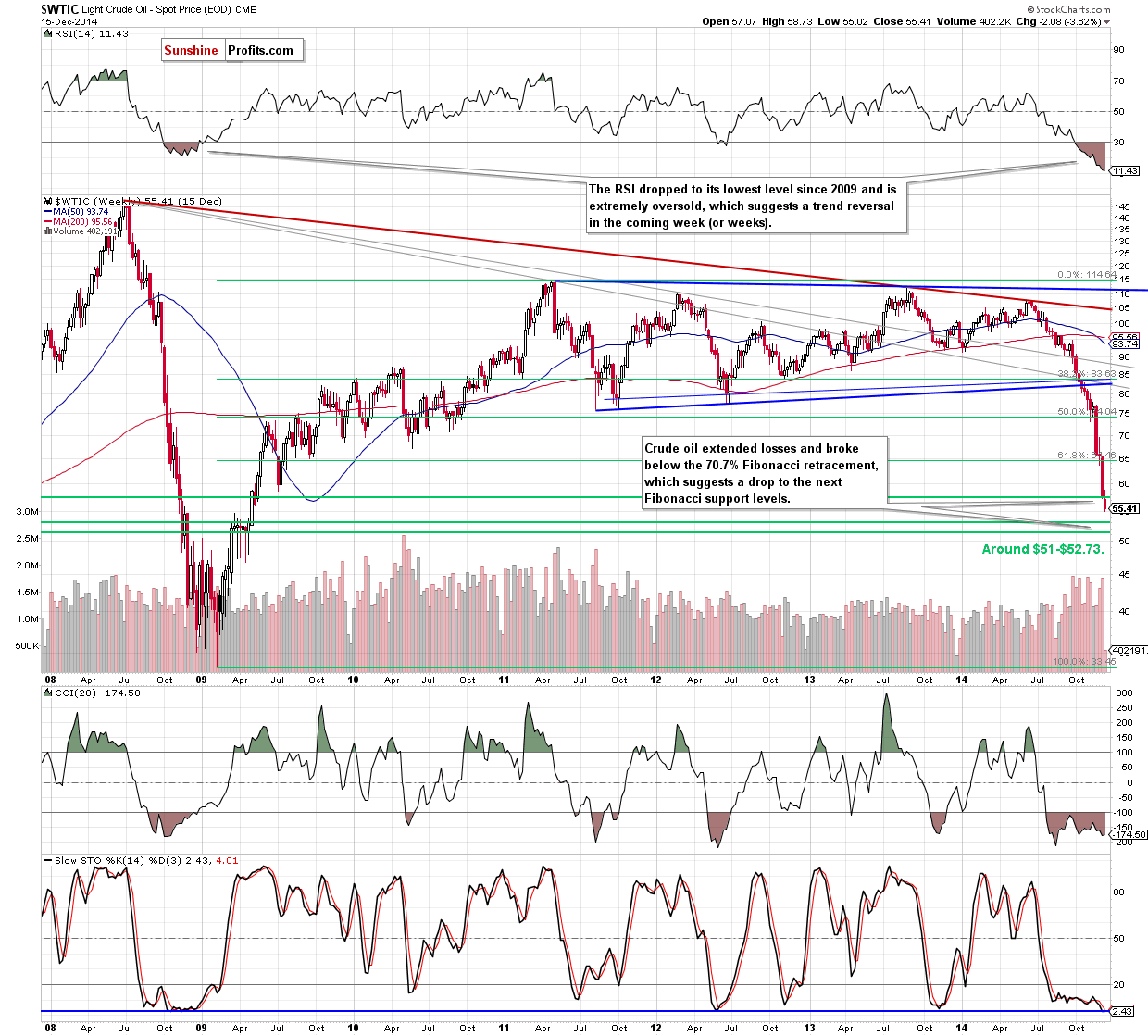

The first thing that catches the eye on the above charts is a breakdown below the long-term blue support line (based on the 2002 and 2009 lows and marked on the monthly chart) and the 70.7% Fibonacci retracement based on the entire 2009-2014 rally (marked with green on the weekly chart), which suggests further deterioration in the coming day (or days). If this is the case, the commodity could drop to around $51-$52.73, where the 76.4% and 78.6% Fibonacci retracement levels are.

Before we summarize today’s alert, please keep in mind what we wrote on Friday:

(…) although we saw several attempts to close the month below the 200-month moving average in 2009, oil bears failed, which resulted in a significant rebound in the following months. Taking this fact into account and combining it with the above-mentioned support zone and decreasing volume (at least in the previous months), we think that (…) a trend reversal is just around the corner.

Summing up, crude oil extended losses once again and broke below its key long-term support line and the 70.7% Fibonacci retracement, which suggests further deterioration. Nevertheless, we think that opening short positions at these levels is not justified from the risk/reward perspective as the space for declines seems limited.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts