Trading position (short-term; our opinion): In our opinion no positions are justified from the risk/reward perspective.

On Monday, crude oil gained 1.11% as fresh worries over geopolitical tensions in Ukraine and in Gaza supported the price. In this way, light crude erased the Friday’s decline, but did this upswing change anything in the short-term picture?

Yesterday, the price of crude oil moved higher after reports that Ukrainian troops were moving into the rebel-held city of Donetsk, which weighed on market sentiment and fueled concerns over an escalation in the region. Concerns that tensions in Ukraine will threaten Russian oil exports pushed light crude to slightly below $103 and as we mentioned earlier, this increase erased Friday’s losses. An additional supportive factor was Israel's offensive in Gaza, which raised worries that the conflict may affect the broader Middle East.

Before we move to the technical part of today’s Oil Trading Alert, please note that European Union foreign ministers are expected to approve sanctions against a range of Russian oligarchs in response to the suspected downing of a Malaysia Airlines jetliner by Moscow-backed rebels in eastern Ukraine. Nevertheless, the extent of the sanctions and its impact on the energy sector are unclear. Will the technical picture of crude oil give us more clues about future moves? Let’s check charts below and find out (charts courtesy of http://stockcharts.com).

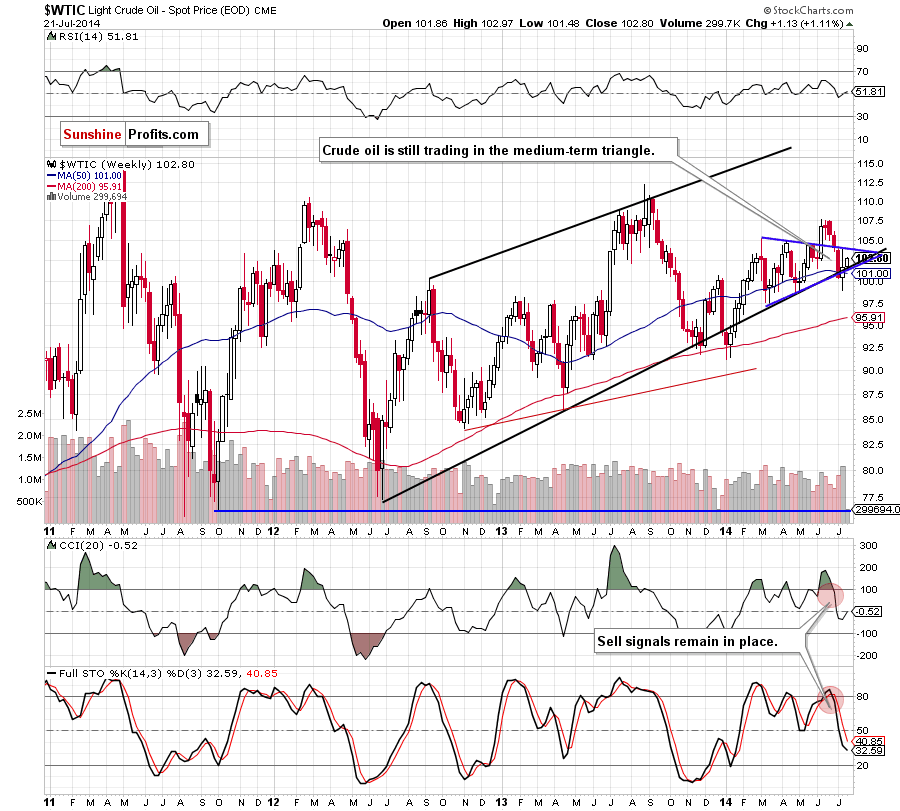

From this perspective, we see that although crude oil moved little higher, the overall situation hasn’t changed much as the commodity still remains between the lower and upper line of the blue triangle. Therefore, we are convinced that our last commentary is up-to-date:

(…) the support zone created by the 50-week moving average and the lower border of the formation (…) If (...) holds, we’ll see a rebound in the coming week and another attempt to break above the upper line of the triangle. However, if it is broken, crude oil will test the strength of the psychological barrier of $100.

Can we infer something more from the daily chart ? Let’s check.

Quoting our last Oil Trading Alert:

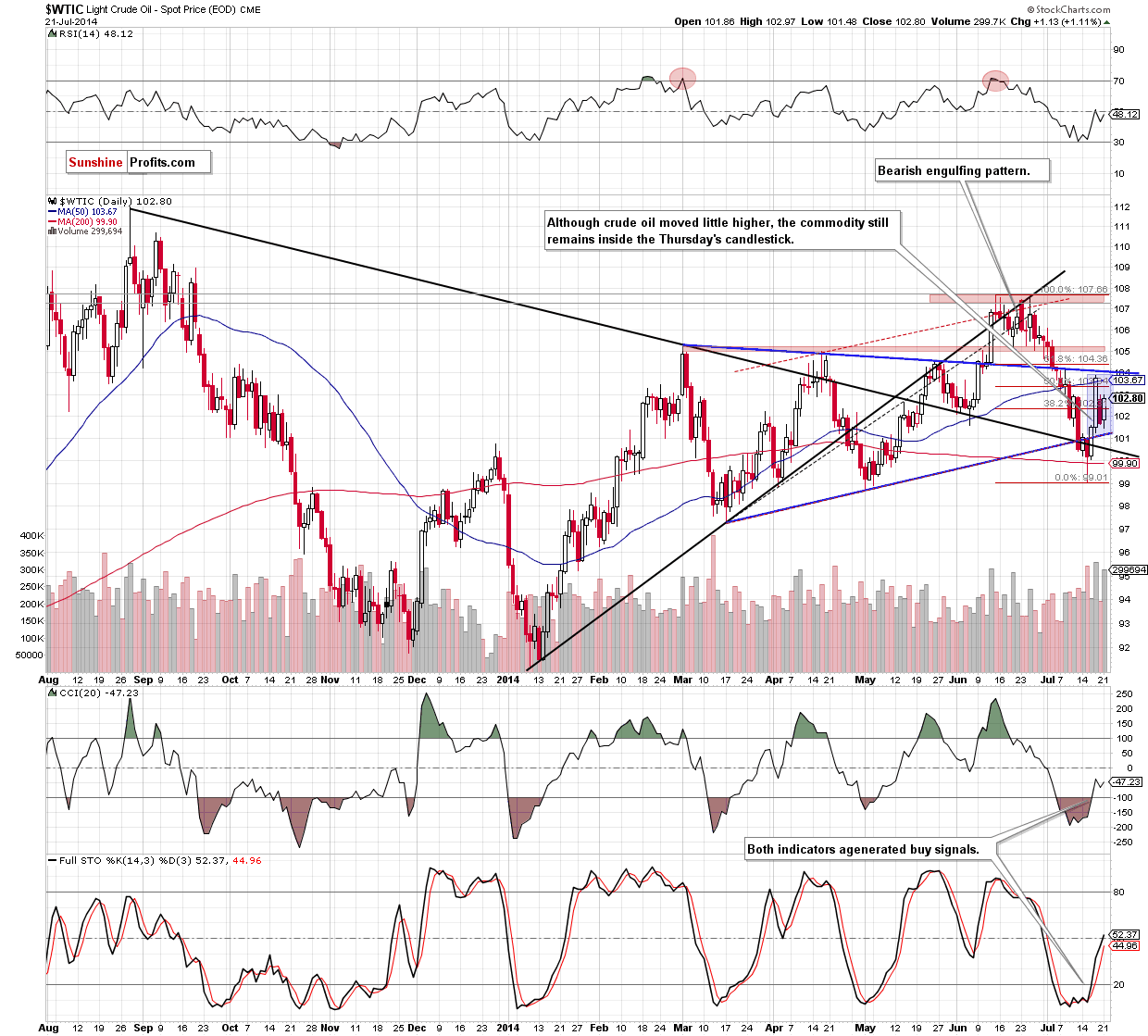

(...) a pulback under the 38.2% Fibonacci retracement suggests a drop to the next one (around $101.46), but we should keep in mind that even if we see such price action, the commodity will be still above Thursday’s low and the blue support line.

On the above chart, we can see that although crude oil hit an intraday low of $101.48, oil bears didn’t magnage to push the price lower. As a result, light crude rebounded and erased all Friday’s decline. Is this event as bullish as it seems at the first sight? Looking at the size of volume that accompanied yesterday’s increase and taking into account buy signals generated by the indicators we can say „yes“. Based only on these two factors, we think that crude oil will likely extend gains in the coming day (or days). Nevertheless, in our opinion, the moment of truth for the commodity will occur when light crude approach the Thursday’s high and the strong resistance zone (created by the 50-day moving average, the upper line of the medium-term triangle and the 61.8% Fibonaci retracement). If it is broken, we’ll see a comeback to around $106, where the next resistance zone is. However, if this area holds, we’ll see another test of the strength of the Thursday’s low, which is currently reinforced by the lower line of the medium-term triangle. Please keep in mind that slightly below this level is also the strong support area based on the blue and black support lines and reinforced by the 200-day moving average.

Summing up, although crude oil erased Friday’s decline, what happened yesterday didn’t change the very short-term picture and the situation remains unclear as the commodity is still trading inside the Thursday’s candclestick. So, what’s next? Just like we wrote yesterday, we believe that as long as there is no breakout above the resistance zone or a breakdown below the support zone another sizable move is not likely to be seen. In our opinion, it’s too early to say that anything has really changed and opening any position at the moment is not justified from the risk/reward perspective.

Very short-term outlook: mixed

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts