Trading position (short-term; our opinion): Long positions with a stop-loss order at $85.96 are justified from the risk/reward perspective. Initial price target: $96.

The price of crude oil has done more or less what we have already described in yesterday’s alert. It had moved to our target area. The “black gold” closed below its previous 2014 low, but still above its 2013 low. Will it finally reverse or was the June – Oct decline just a beginning? Let’s jump right into charts and see the answer (charts courtesy of http://stockcharts.com.)

In short, since yesterday’s decline was not huge, it doesn’t seem that it changed much and what we wrote yesterday, remains up-to-date:

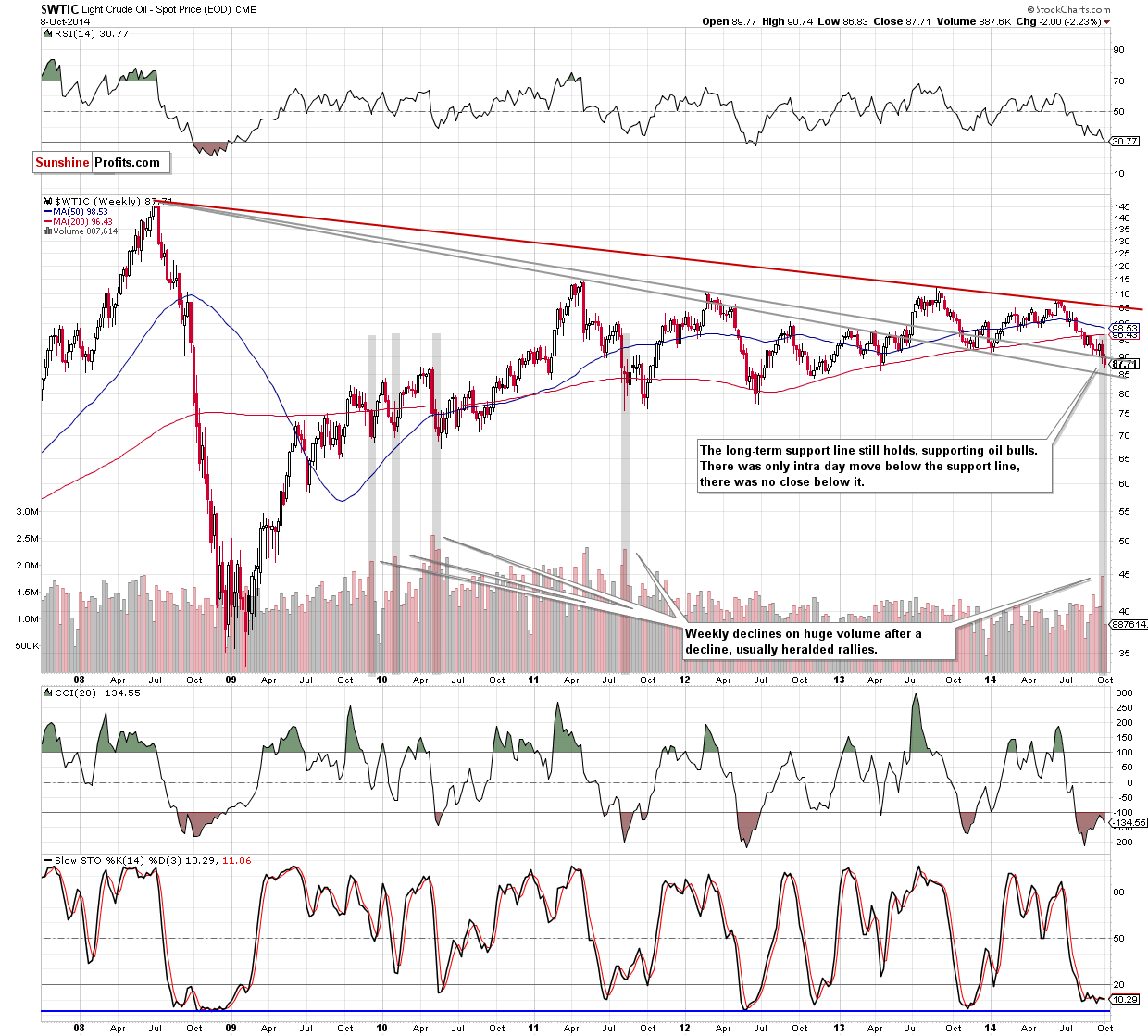

Crude oil moved a bit below the support line, but it the week is not over yet, so this move doesn’t have to be meaningful. In fact, it’s not meaningful just yet. Crude oil has not only closed below it for just one day, but has also just (last week) invalidated a similar intra-week breakdown. Consequently, unless we see a confirmation of the breakdown, it doesn’t seem that one should put much weight to it.

(...)

Before moving on to the short-term picture, we would like to draw your attention to the size of the volume that we saw last week’s decline. It was very significant, and when we saw something similar in the past (huge-volume decline after a visible downswing), it meant that the decline is either over or very close to being over. Consequently, the above-mentioned bullish comments are confirmed also from this angle.

Yesterday, we wrote about crude oil reaching our target level, and the above chart shows this move. What we wrote about the yesterday’s intra-day price action is what can describe the above chart today:

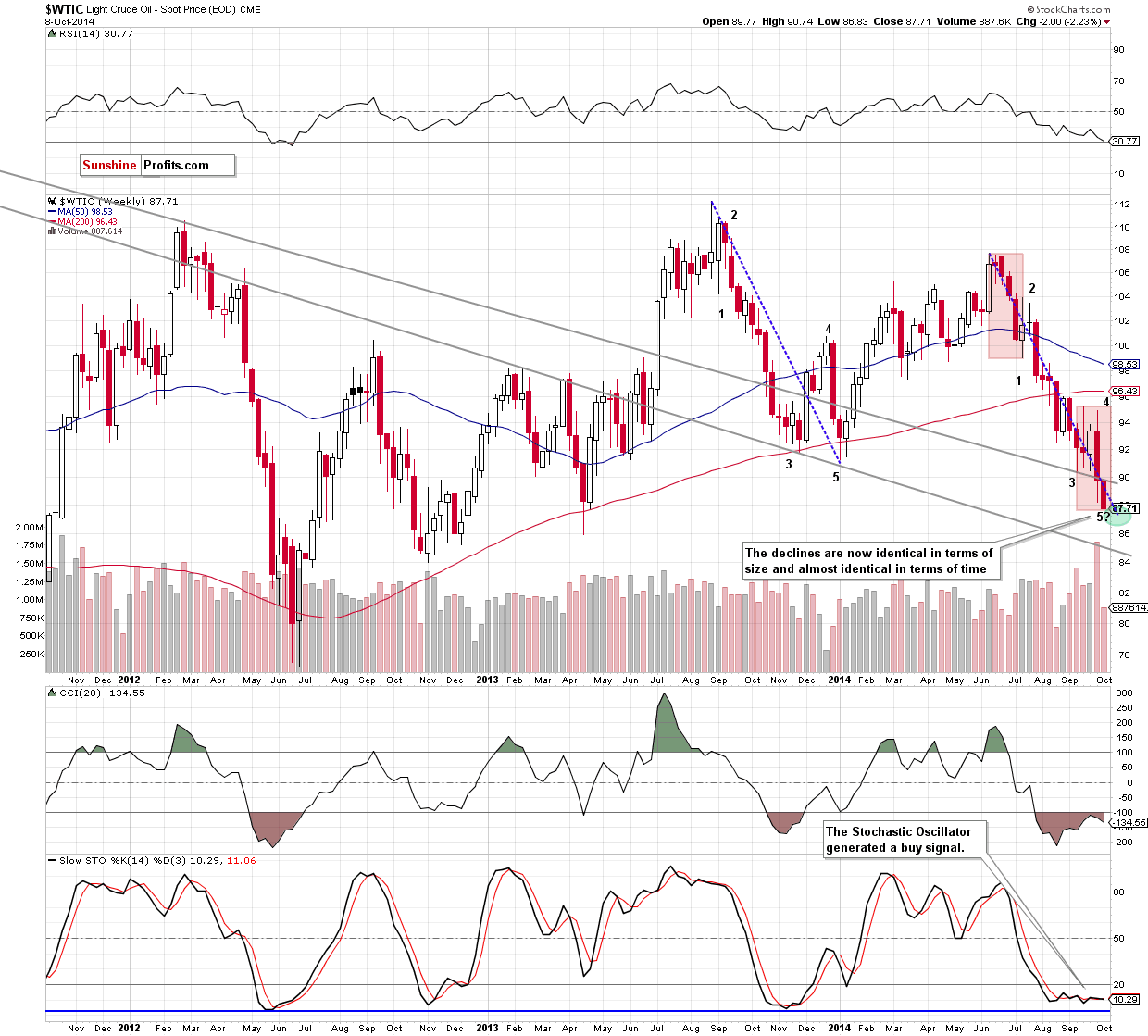

Please note that today crude oil moved right into our price target area and it seems to be completing the 5th wave that we have commented on previously. Moreover, the decline is now almost identical in terms of price and time to the one seen last year.

(...)

Looking at the above chart, we see that although crude oil declined below the long-term support line and the 61.8% Fibonacci retracement, this deterioration was only temporarily and the commodity invalidated the breakdown very quickly. As we have pointed out before, this is a strong bullish signal, which suggests that the next sizable move will be to the upside and the final bottom might be in (especially when we factor in the fact that wave 5 is shorter than wave 1). If this is the case, the initial target for oil bulls will be around $95, where the recent high is.

Summing up, it seems that keeping long positions is still justified from the risk/reward perspective as the breakdown below the recent lows and the key medium-term support zone was invalidated very quickly last week. This week’s “breakdown” is not yet confirmed and we doubt that it will be confirmed, as it moved right into our target area – it seems ready to move back up. It seems that the next sizable move will be to the upside, not to the downside.

Very short-term outlook: bullish

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: bullish

Trading position (short-term): Long with a stop-loss order at $85.96. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts