Trading position (short-term; our opinion): Speculative short positions in crude oil seem to be justified from the risk/reward perspective.

On Monday, crude oil rose after the market’s open as the combination of a weaker U.S. dollar and ongoing worries over a supply interruptions from Russia and Libya weighted on the price. In this way, light crude climbed above $102, reaching the medium-term resistance line once again. Is it enough to trigger another sizable downswing?

The Libyan government reached an agreement with rebels in recent weeks to reopen some export terminals that had been blockaded in eastern Libya, but the stability of those agreements is in question as gunmen stormed parliament on Sunday. Violence in Libya renewed concerns that the nation's oil output would stay below full capacity, keeping global oil supplies tight and supported the price of light crude yesterday.

Crude oil also gained support from the ongoing unrest in Ukraine. The conflict between pro-Russian separatists and Ukrainian forces continued on over the weekend and also yesterday, resulting in the death of one Ukrainian soldier. U.S. and European officials warned that Russia would have to face additional sanctions if Moscow disrupts the upcoming presidential elections in Ukraine on May 25.

Geopolitical concerns also softened the dollar by fueling worries that the U.S. may become deeper involved in the Ukraine crisis. In reaction to this (and also mixed U.S. economic reports released on Friday), investors avoided the greenback, which softened the U.S. currency. As is well known, crude oil is traded in dollars, therefore, a weaker dollar makes oil more affordable to buyers using foreign currencies and supported the price as well.

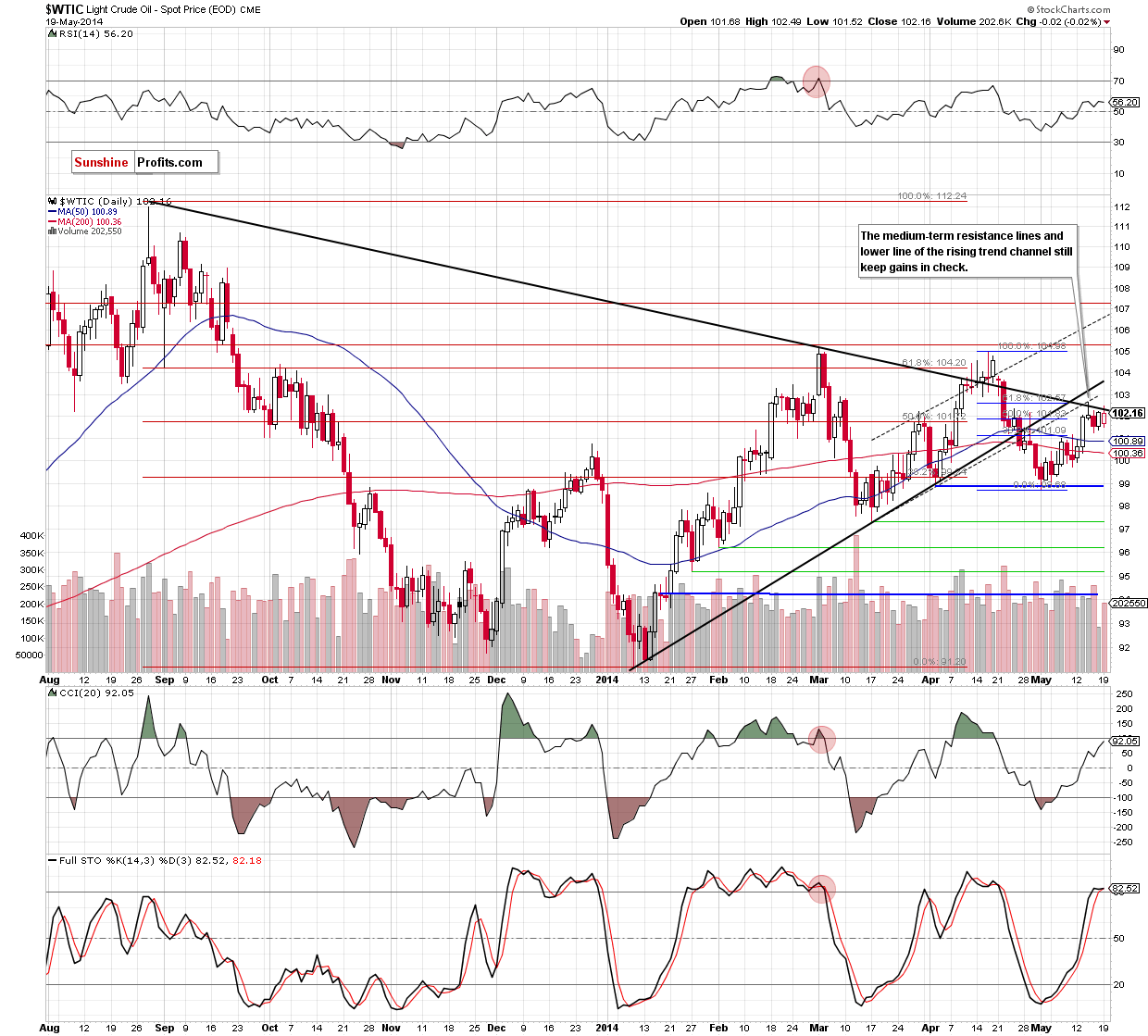

Once we know major fundamental factors that affected the commodity on Monday, let’s find out what impact did they have on the technical picture of crude oil (charts courtesy of http://stockcharts.com).

The overall situation in the medium term hasn’t changed much as the commodity remains below the upper and lower border of the triangle. Today, we’ll focus only on the very short-term changes.

Looking at the daily chart, we see that although crude oil moved higher once again, the very-short term situation hasn’t changed much. Therefore, what we wrote yesterday is up-to-date:

(…) the commodity still remains below the medium-term declining resistance line (the upper line of the triangle). In our opinion, even if cude oil climbs above this line, the combination of the black rising line (the lower border of the tringle), the lower line of the rising trend channel (currently around $103) and the 61.8% Fibonacci retracement will be strong enough to stop further improvement and trigger a downswing – similarly to what we noticed on Wednesday.

Summing up, we remain bearish and think that lower values of crude oil are still ahead us. As we have pointed out before, it seems quite likely that even if crude oil climbs higher, the above-mentioned resistance zone will be strong enough to stop further improvement and trigger a pullback in the near future. If this is the case, the nearest support will be the previously-broken 50-day moving average (currently around $100.89).

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): Short. Stop-loss order: $104. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts