Trading position (short-term; our opinion): Short positions (with a stop-loss order at $35.63 and a price target at $25.63) are justified from the risk/reward perspective.

On Monday, crude oil lost 2.84% as a meeting between oil ministers from Saudi Arabia and Venezuela didn’t bring news about a date for an emergency summit. In this environment, light crude slipped to the barrier of $30, approaching last week’s low. What impact could it have on the price in the coming days?

Although oil ministers from Venezuela and Saudi Arabia met on Sunday, they didn’t reach an agreement about a date for an emergency summit, which in combination with comments from Iran oil minister (he said that the country currently exports 300,000 barrels of crude a day to Europe and the National Iranian Oil Company was close to finalizing a deal with France's Total to sell 160,000 barrels per day) pushed the commodity to an intraday low of $29.57. As a result, light crude approached the last week’s low. What impact could it have on the price in the coming days? Let’s examine charts and find out (charts courtesy of http://stockcharts.com).

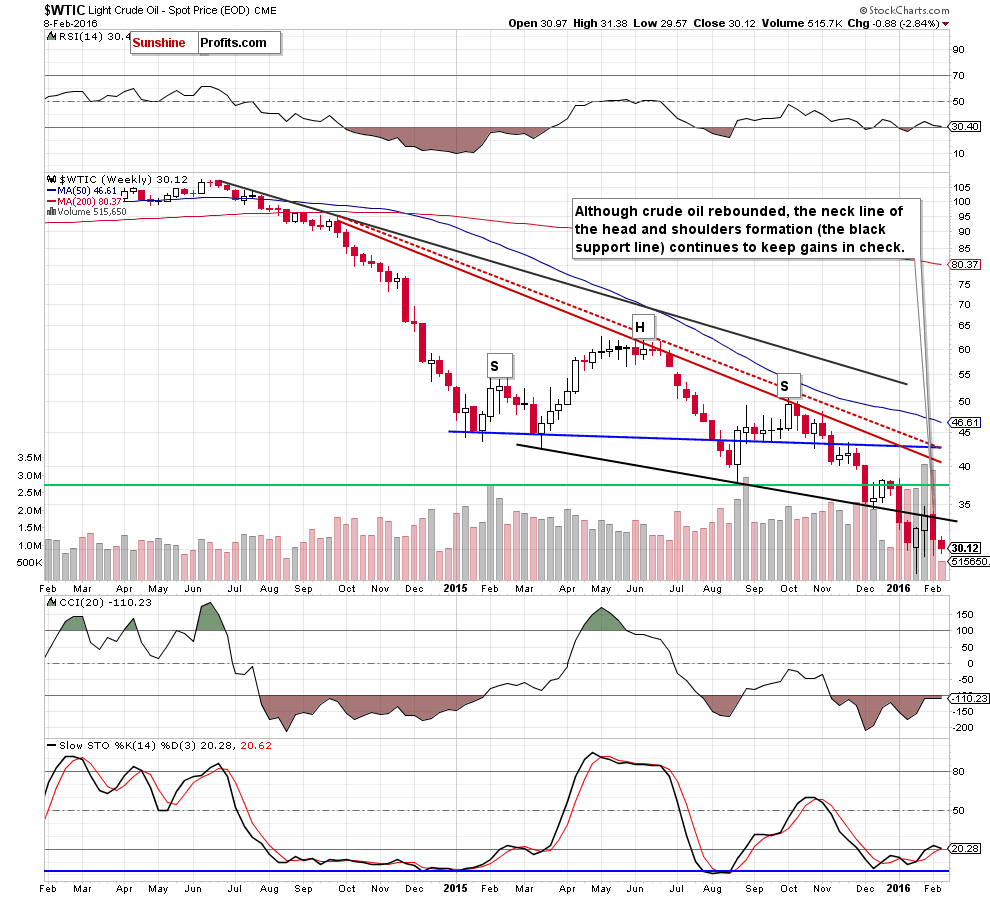

Looking at the weekly chart, we see that crude oil invalidated small increase above the neck line of the head and shoulders formation, which means that the commodity verified earlier breakdown under this important line in the previous week. This negative signal encouraged oil bears to act, which pushed light crude lower on Monday.

What impact did it have on the daily chart? Let’s check.

Last Thursday, we wrote the following:

(…) sell signals generated by the indicators remain in place, supporting oil bears. Additionally, light crude is still trading under the key black resistance line and previous highs.

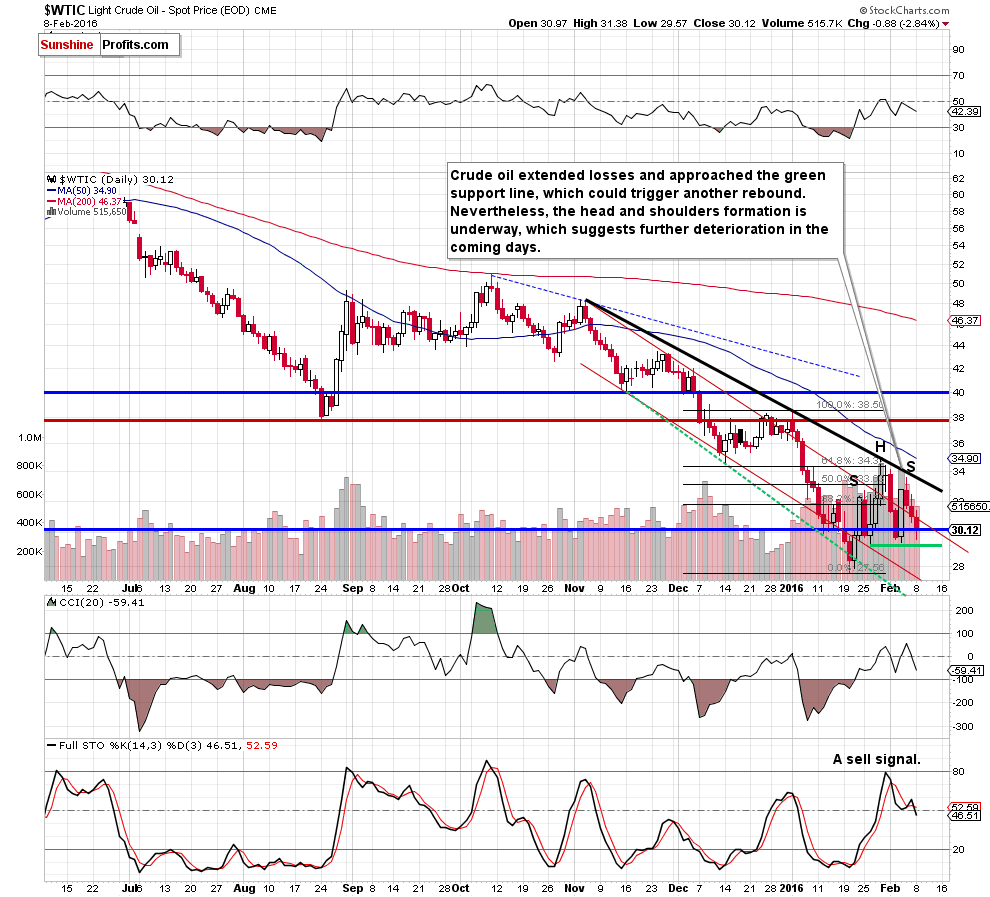

On top of that, when we take a closer look at the chart, we can notice a potential head and shoulders formation (the right shoulder of the pattern is underway). If this is the case, light crude will reverse from here and come back to (at least) the green support line in the coming days.

As you see on the daily chart, the situation developed in line with the above scenario and crude oil approached our first downside target yesterday. With this drop, light crude came back to the red declining trend channel and slipped temporarily under the barrier of $30. Despite this move, the commodity closed the day above it which in combination with the proximity to the green support line suggests that we may see a rebound from here in the coming day.

Nevertheless, even if we see such price action, we believe that as long as crude oil is trading under the key black resistance line and the neck line of the head and shoulders formation (marked on the weekly chart, which serves as the key medium-term resistance), lower values of the commodity are more likely than not. This pro-bearish scenario is also reinforced by the current position of the RSI, CCI and a sell signal generated by the Stochastic Oscillator.

Summing up, crude oil extended losses and approached the green support line, which triggered a sharp rebound in the previous week. Taking this fact into account, a similar price action in the coming day can’t be ruled out. Nevertheless, as long as the key medium- and short-term resistance lines keeps gains in check lower values of the commodity are more likely than not (especially when we factor in the head and shoulders formations). Therefore, we believe that short positions (which are already profitable as we opened then when crude oil was around $34) are justified from the risk/reward perspective.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions (with a stop-loss order at $35.63 and the price target at $25.63) are justified from the risk/reward perspective. The analogous levels for USO ETF and DWTI ETN are:

- USO initial target price: $6.67; USO stop-loss: $10.25

- DWTI initial target price: $513.31; DWTI stop-loss: $165.84

We will keep you – our subscribers – informed should anything change.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main market that we provide this level for (crude oil), the stop-loss level and target price for popular ETN and ETF (among other: USO, DWTI, UWTI) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DWTI for instance), but not for the “main instrument” (crude oil in this case), we will view positions in both crude oil and DWTI as still open and the stop-loss for DWTI would have to be moved lower. On the other hand, if crude oil moves to a stop-loss level but DWTI doesn’t, then we will view both positions (in crude oil and DWTI) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the sings pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts