Trading position (short-term; our opinion): Long positions with a buy limit order at $75.82 and a stop-loss at $73.47 are justified from the risk/reward perspective.

On Monday, crude oil lost 3.11% as Saudi Arabia cut its selling price for oil to the U.S. Addtionally, stronger greenback also weighed on the price. In this enviromnent, light crude hit a fresh multi-month low and closed the day below $80 for the firs time since the end of Jun 2012. How low could oil bears push the price in the coming days?

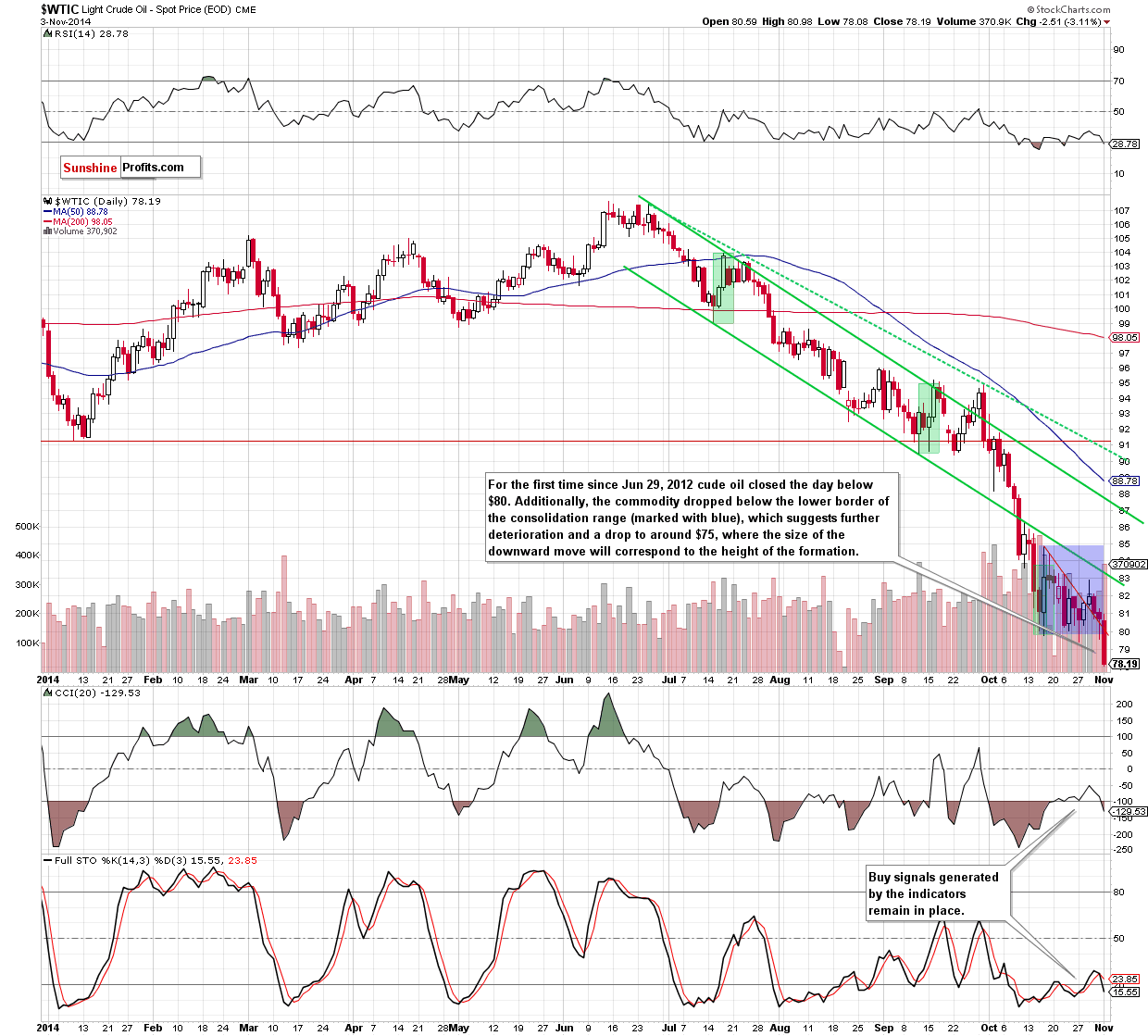

Yesterday, the Institute of Supply Management showed that its manufacturing purchasing managers' index climbed to 59.0 in October from 56.6 in September, beatimg analysts‘ forecasts of a decline to 56.2. These bullish numbers suppported the greenback, fueling hopes that U.S. recovery continues to gain steam. Similarly to what we saw in the previous weeks, sronger U.S. dollar made crude oil less attractive in dollar-denominated exchanges (especially among investors holding other currencies) and pushed the commodity below $80 once again. This time, oil bulls didn’t manage to invalidate this breakdown as news that Saudi Arabia cut its selling price for crude oil to the U.S. watered down the price, taking it to a fresh multi-month low of $78.08. How low could the commodity go? (charts courtesy of http://stockcharts.com).

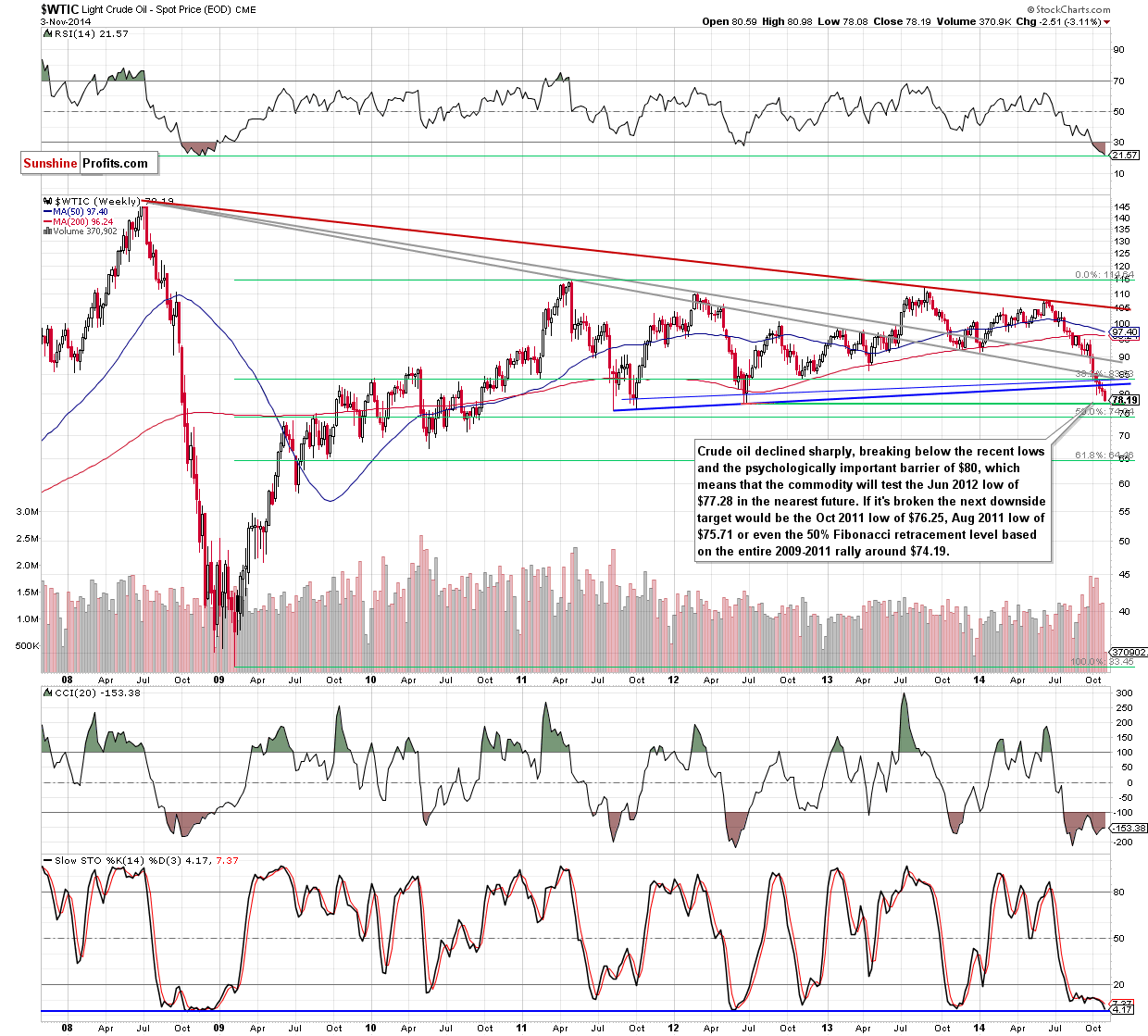

The first thing that catches the eye on the above chart is a successful drop below the lower border of the consolidation range (marked with blue). Additionally, for the first time since Jun 29, 2012 crude oil closed the day below the psychologically important level of $80, hitting a fresh multi-month low of $78.08. All the above provide us with bearish implications and suggest that light crude will move lower in the coming days. How low could the commodity go? Looking at the weekly chart, we see that the initial downside target for oil bears will be the Jun 2012 low of $77.28. If it’s broken, oil bulls may find support around $76.25 (the Oct 2011 low) or $75.71 (the Aug 2011 low). However, taking into account the above-mentioned breakdown below the lower border of the consolidation, it seems that crude could drop even to around $75, where the size of the downward move will correspond to the height of the formation. At this point, it’s worth noting that below this level there is also the 50% Fibonacci retracement based on the entire 2009-2011 rally (at $74.19), which together create a solid support zone.

Summing up, crude oil extended losses, hitting a fresh multi-month low of $78.08 and breaking below the lower border of the consolidation. However, the most important event of yesterday’s session was a daily close below the psychological barrier of $80. In this way, oil bears opened the way even to $75 per barrel. Taking into account the fact that space for declines seems limited, we suggest opening long positions when crude oil drops to $75.82 with a stop-loss order at $73.47.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): In our opinion, long positions with a buy limit order at $75.82 and a stop-loss at $73.47 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts