Trading position (short-term; our opinion): no positions are justified from the risk/reward perspective.

On Monday, crude oil gained 0.22% and hit a fresh five-week high as better-than-expected U.S. economic data and concerns over stability in Ukraine and Libya weighted on the price. Thanks to these circumstances, light crude broke above the medium-term resistance line, but then declined below it for the second day in a row. Third time lucky?

Yesterday, the Commerce Department showed that retail sales rose 1.1% in March (above expectations for a 0.8% rise) and core retail sales (without automobiles) rose 0.7% last month (analysts had expected 0.5% increase). Similarly to what we saw on Friday, these stronger-than- expected data fueled expectations that the U.S. economy will continue to recover and will demand more fuel and energy, which pushed the price higher.

Also yesterday, geopolitical concerns supported the price of crude oil as well.

The U.S. and the European Union informed that they are considering further sanctions against Moscow after pro-Russian separatists ignored an ultimatum to leave occupied government buildings in eastern Ukraine.

Meanwhile, in Libya, newly appointed Prime Minister Abdullah al-Thinni resigned, saying that he and his family were attacked. As a reminder, at the beginning of the month the Libyan government reached an agreement with protestors that had blocked oil ports along the coast. Thanks to this accordance, Libya was on the cusp of re-opening another oil-export terminal. At this point, it’s worth mentioning that although Mr. al-Thinni said he and his cabinet would continue as a caretaker government until a new prime minister is selected, without a stable government in place to negotiate with rebel militias, it remains unclear when a new deal could be reached.

In reaction to these circumstances and solid economic data, light crude extended gains once again and hit a fresh five-week high of $104.55. However, later in the day, crude oil declined as profit taking weighted on the price.

Having discussed the above, let’s move on to the technical changes in the crude oil market (charts courtesy of http://stockcharts.com.)

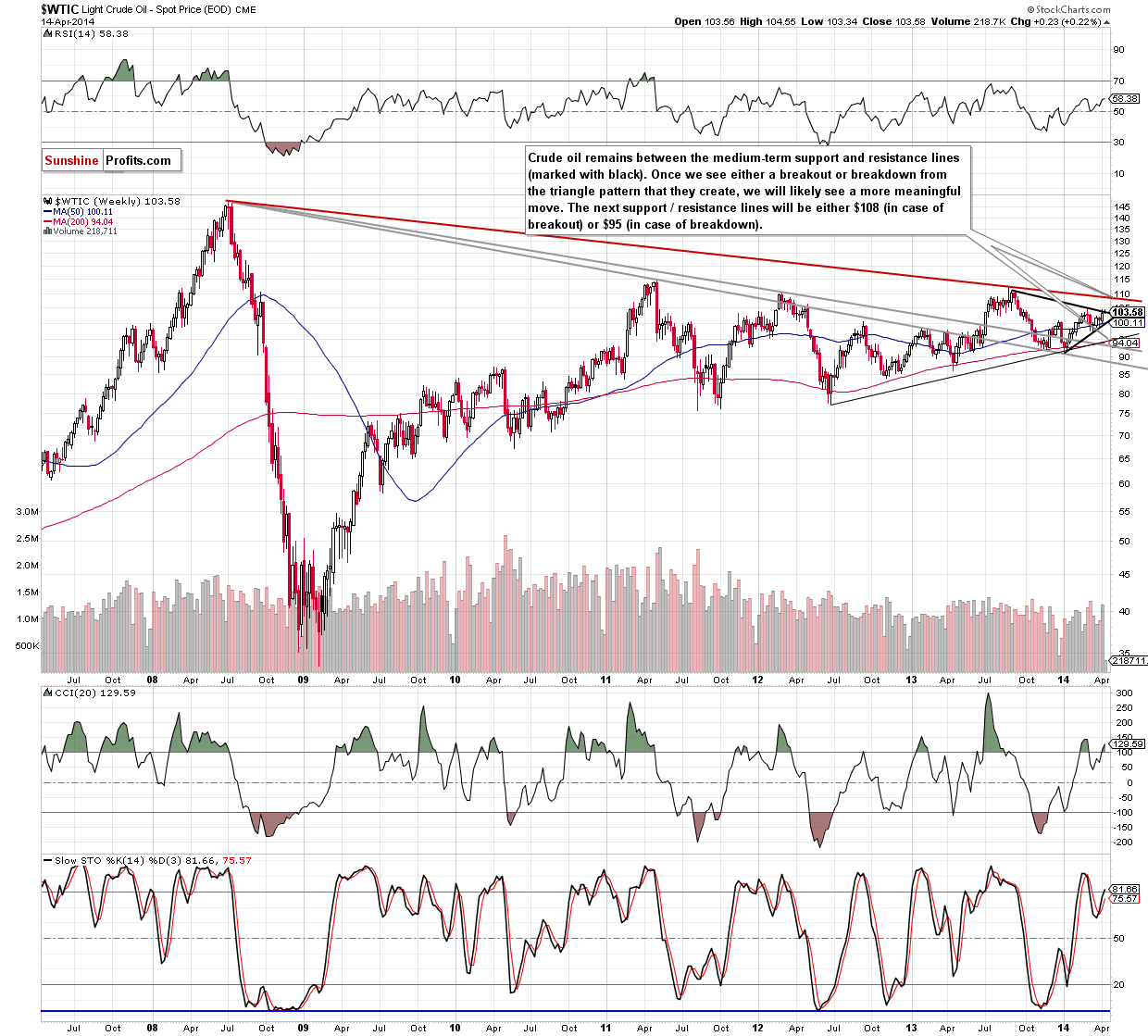

From the wekly perspective, the overall situation hasn’t changed much as crude oil still remains below the medium-term resistance line. Therefore, what we wrote in our last Oil Trading Alertis still up-to-date.

(…) crude oil reached the resistance line based on the September and March highs, which is also the upper line of a triangle. Taking this fact into account, we should consider two scenarios. On one hand, if oil bulls do not give up and succesfully push the price of light crude above this important line, we will likely see an increase to around $108, where the long-term resistance line (marked with red) is. However, if they fail, we may see a pullback to the previously-broken 50-week moving average (currently at $99.95). Please note that this area is supported by the medium-term support line (based on the January and March lows), which is also the lower border of the black triangle. Looking at the current position of the indicators, we see that they still support buyers as buy signals remain in place.

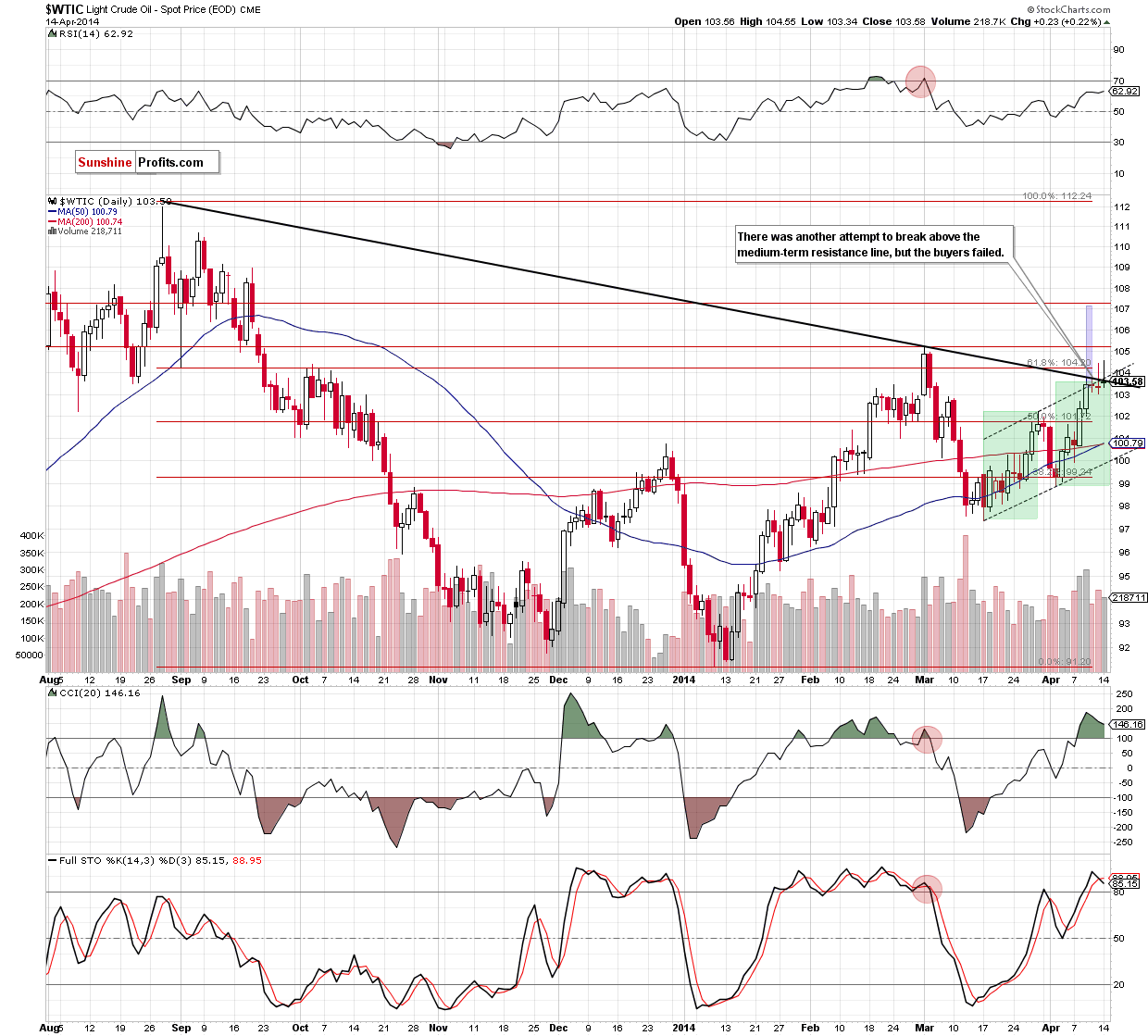

Before we ummarize today’s Oil Trading Alert, let’s zoom in on our picture and move on to the daily chart.

Looking at the above chart, we see that crude oil extended gains and hit a fresh five-week high after the market open. Similarly to what we saw on Friday, this upswing took light crude above the medium-term resistance line (which is also the upper line of a triangle marked on the weekly chart), but the buyers didn’t manage to hold gained levels, which resulted in a decline. Just like during the last trading day, crude oil dropped not only below the black resistance line, but also under the upper line of the rising trend channel (marked with black dashed lines), which is a bearish signal. However, taking into account the fact that we saw similar price action on Friday, another attempt to break above the medium-term resistance line can’t be ruled out.

Summing up, the situation hasn’t changed much as crude oil repeated Friday’s price action. As mentioned earlier, light crude remains below the upper line of the rising trend channel and the medium-term resistance, which suggests that further deterioration should not surprise us (especially if oil bulls fail once again and do not manage hold the price above these lines).

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): In our opinion no positions are justified from the risk/reward perspective. We plan to open the speculative positions once we see either a breakout or breakdown on the long-term chart or a breakout / invalidation thereof on the short-term chart. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts