Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 and initial (!) target price at $35.72 are justified from the risk/reward perspective.

On Friday, crude oil moved higher once again as Baker Hughes report showed another decline in oil rigs. In this environment, light crude gained 1.86% and climbed above the Fibonacci retracement. What does it mean for the commodity?

On Friday, Baker Hughes reported that U.S. oil rigs dropped by 10 to 595 for the week ending on Oct. 9, which was its lowest level since July, 2010. These bullish numbers eased some concerns over the crude oil glut in global market and pushed the commodity to an intraday high of $47.97. What impact did this increase have on the short-term picture of the commodity? Let’s take a look at the charts and find out (charts courtesy of http://stockcharts.com).

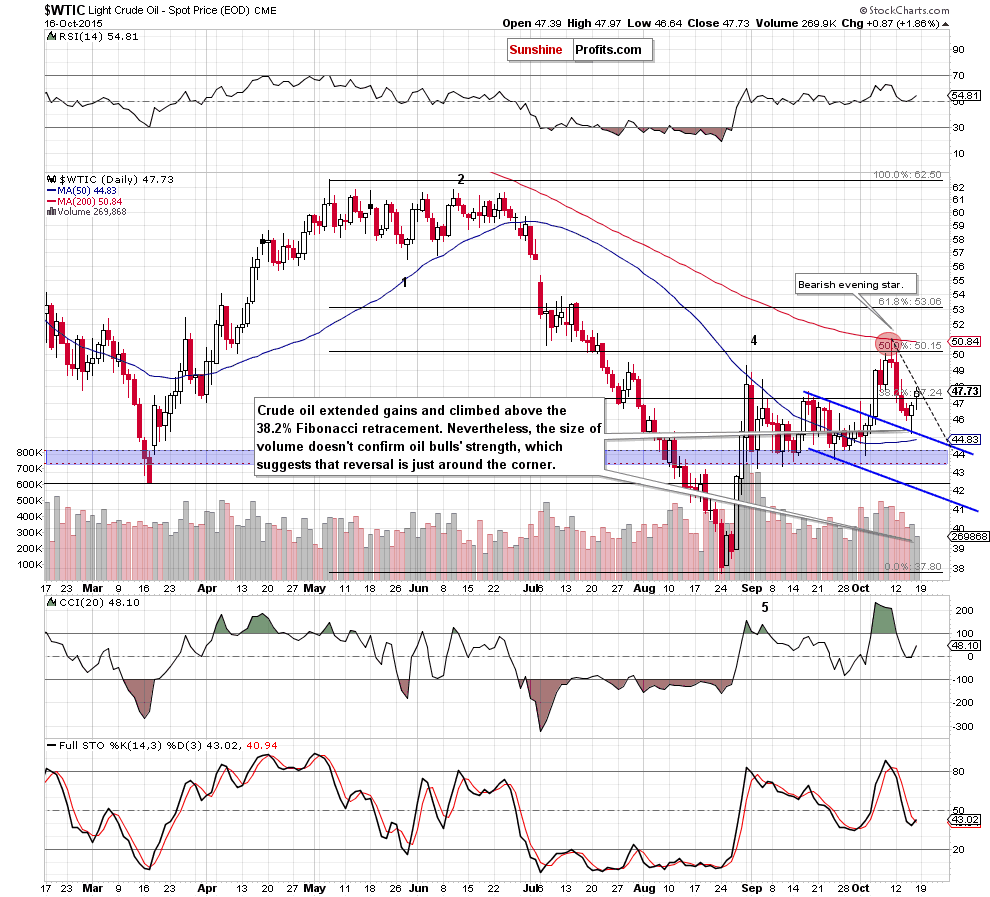

On Friday, crude oil extended gains and climbed above the 38.2% Fibonacci retracement. Although this is a positive signal, we should keep in mind that with Friday’s upswing the commodity reached the black dashed resistance line, which paused further improvement. Additionally, the size of volume was smaller than day before, which suggests oil bulls’ weakness. If this is the case, we’ll see a reversal and lower values of crude oil in the coming week.

How low could the pair go? In our opinion, the initial downside target would be around $45, where the blue support line (the upper border of the declining trend channel) currently is.

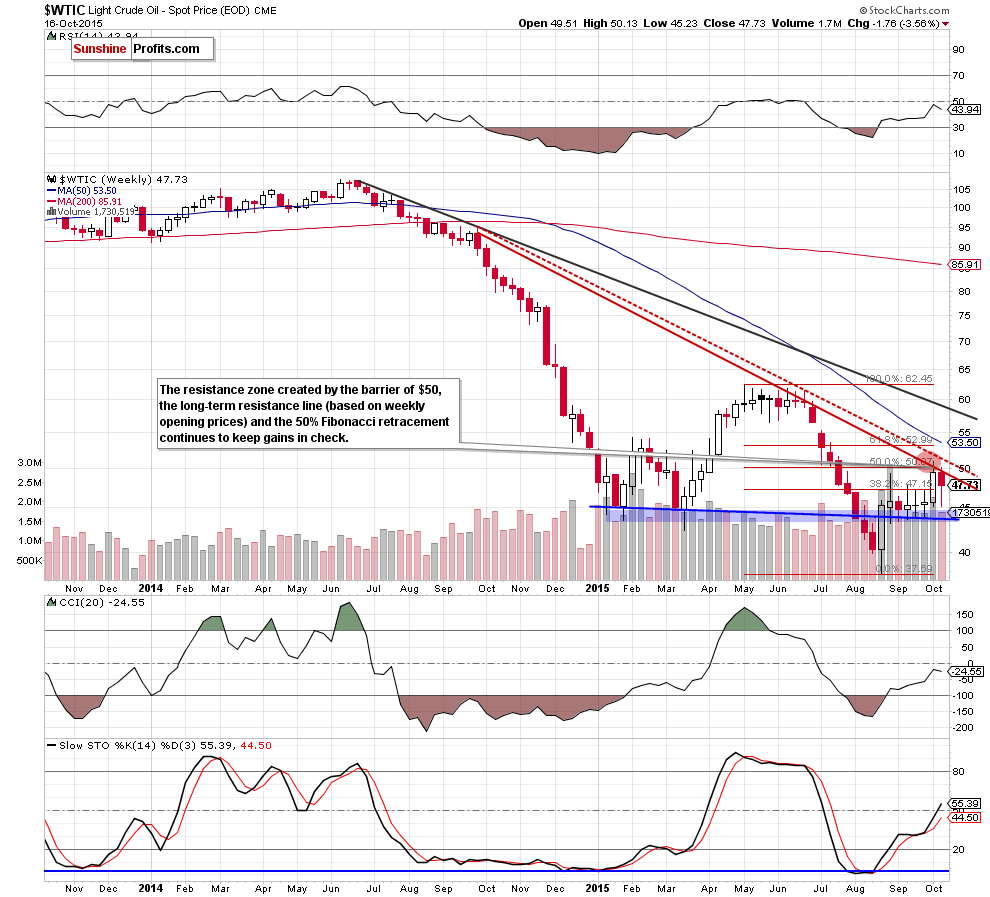

Did this move have any impact on the weekly picture of the commodity?

Not really, because as you see on the weekly chart, the commodity is still trading well below the red resistance zone created by the barrier of $50, the long-term resistance line (based on weekly opening prices) and the 50% Fibonacci retracement, which continues to keep gains in check. Additionally, light crude posted its biggest weekly decline (-3.56%) in 10 weeks, which doesn’t bode well for the commodity.

Summing up, crude oil extended gains and climbed above the 38.2% Fibonacci retracement. Despite this move, the commodity is trading well below the red resistance zone (marked on the weekly chart). Therefore, we believe that further deterioration is more likely than not and short positions continue to be justified from the risk/reward point of view.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 and initial (!) target price at $35.72 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts