Trading position (short-term; our opinion): Speculative short positions in crude oil seem to be justified from the risk/reward perspective.

On Monday, crude oil lost 0.65% as worries over potential supply disruptions in the Middle East continued to ease. Because of these circumstances, light crude dropped to a 4-week low, reaching another downside target. Is the space for further declines limited?

Yesterday, crude oil declined below $104 as the possibility of major supply disruptions stemming from violence in Libya and Iraq continued to ease. As a reminder, strikes and armed occupations at fields and ports since the fall of leader Moammar Gadhafi have cut Libyan production to around a fifth of its normal output of about 1.5 million barrels a day, keeping U.S. and global prices higher. Therefore, last week’s agrement between the Libyan government and rebels to open two ports for oil exports, pushed the price of light crude lower as the Es Sider and Ras Lanuf terminals have a capacity to export up to 560,000 barrels of oil a day, nearly half of the country's oil exports.

On top of that, news that Iraqi oil exports from the southern part of the country remained undisturbed also had a negative impact on the price. Consequently, the commodity lost its major ally, which drove the price higher in the previous weeks. Are there any technical factors that could trigger a rebound from here? Let’s check (charts courtesy of http://stockcharts.com).

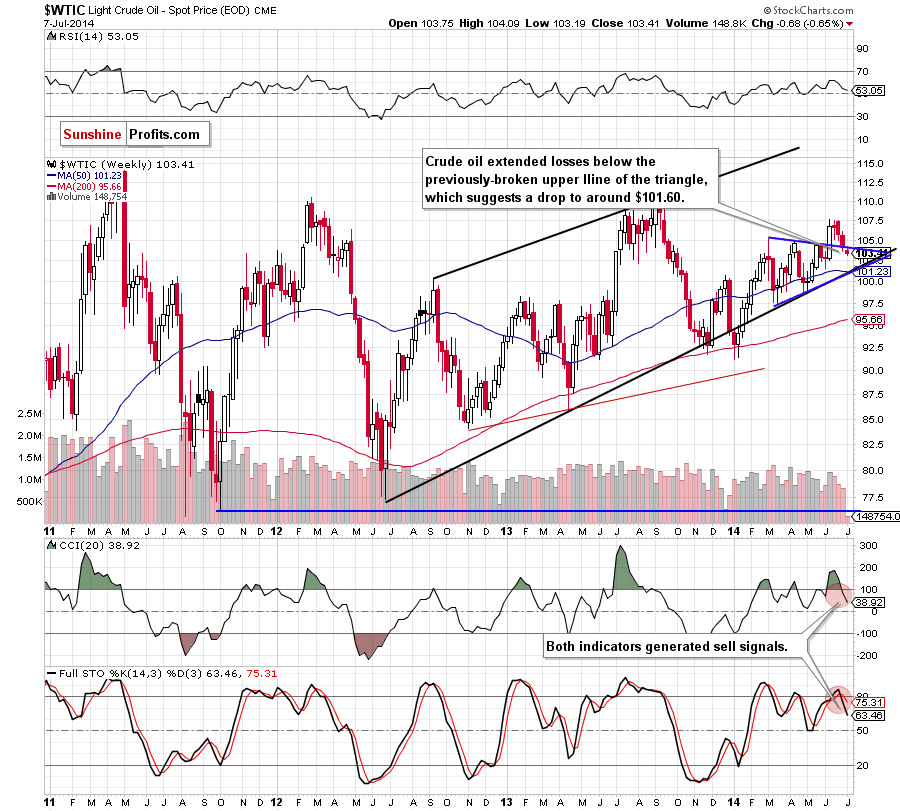

From this perspective, we see that crude oil dropped below last week’s low, extending losses below the previously-broken upper line of the blue triangle. Additionally, sell signals generated by the indicators remain in place, favoring oil bears. Therefore, we are convinced that our last commentary is still valid:

(…)crude oil will extend the current correction and the initial downside target will be around $101.60, where the June low is. At this point it’s worth noting that slightly below this level is a strong support zone created by the 50-week moving average (currently at $101.26) and the lower line of the trend channel (and lower border of the blue triangle), which may pause further deterioraion.

Once we know the medium-term picture, let’s check the very short-term outlook.

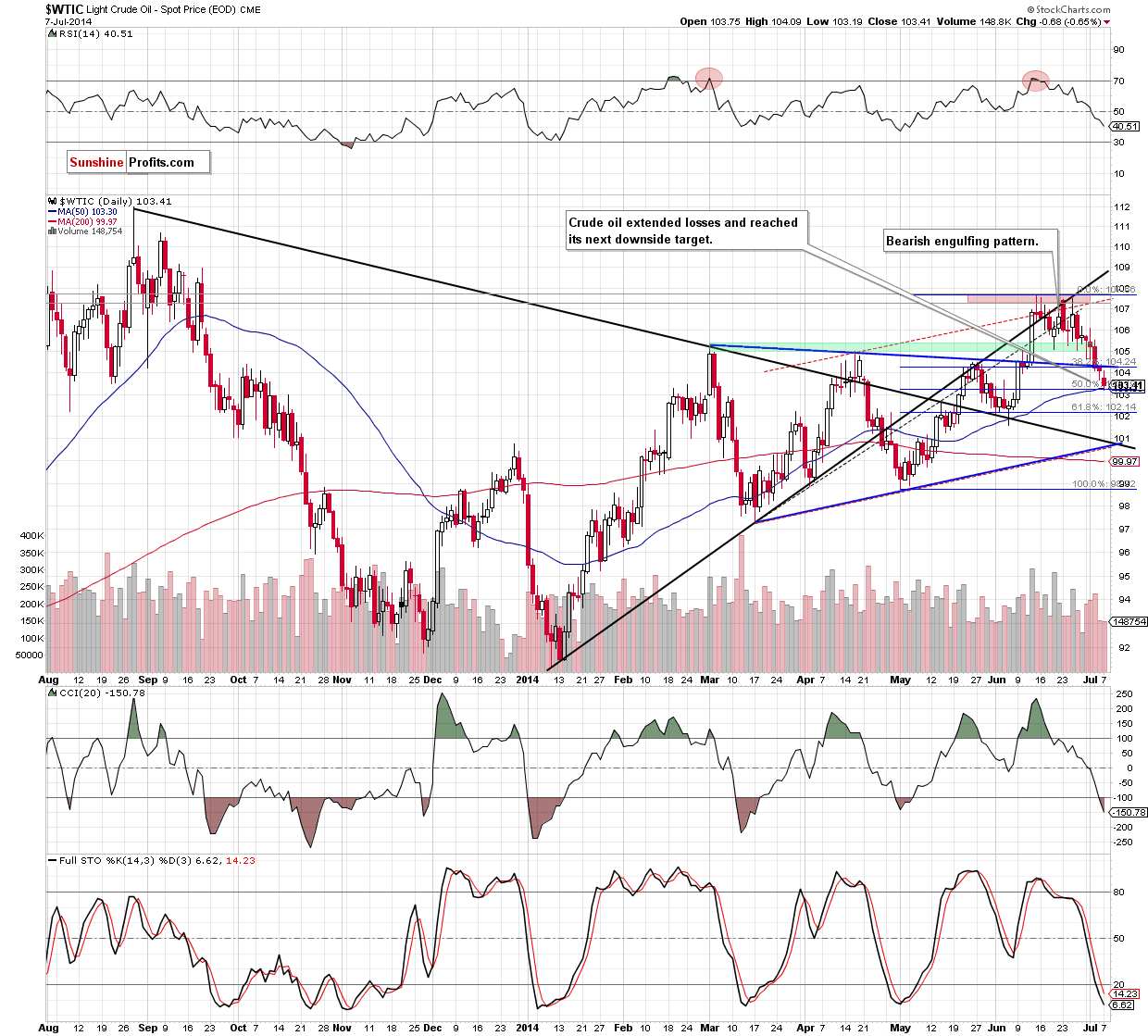

Yesterday, crude oil extended declines below the medium-term blue line (the upper line of the triangle that we saw on the weekly chart) and closed the day under this important resistance line for a third time in a row, which means that the breakdown is confirmed. This is a strong bearish signal that suggests further deterioration in the nearest future. Therefore, what we wrote in our last Oil Trading Alert is up-to-date:

(…) if (…) crude oil moves lower, the initial downside target will be the 50-day moving average (currently at $103.27). (…) this area is supported by the 50% Fibonacci retracement (based on the Apr.-June rally). Therefore, if it holds, we’ll likely see an attempt to move above the blue resistance line. However, if it is broken, the next target for oil bears will be around $102.14, where the 61.8% Fibonacci retracement is. Please keep in mind that sell signals generated by the indicators remain in place, supporting the bearish case at the moment.

Summing up, crude oil closed the day below the medium-term blue line for a third time in a row, confirming earlier breakdown below this important support/resistance. Taking this fact into account and combining it with the current position of the indicators, we remain bearish and think that further correction and lower values of crude oil are still ahead us. Therefore, short positions (which are already profitable) are still justified from the risk/reward perspective.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): Short. Stop-loss order at $109.20. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts