Trading position (short-term; our opinion): Speculative short positions in crude oil seem to be justified from the risk/reward perspective.

In yesterday's Oil Trading Alert we wrote that there will be no alert today, but we decided to provide you with this alert anyway, because we think we saw something particularly important on the crude oil market. Namely, we saw a significant move lower and a close below the psychologically important $100 level and we think this provides us with a great trading opportunity.

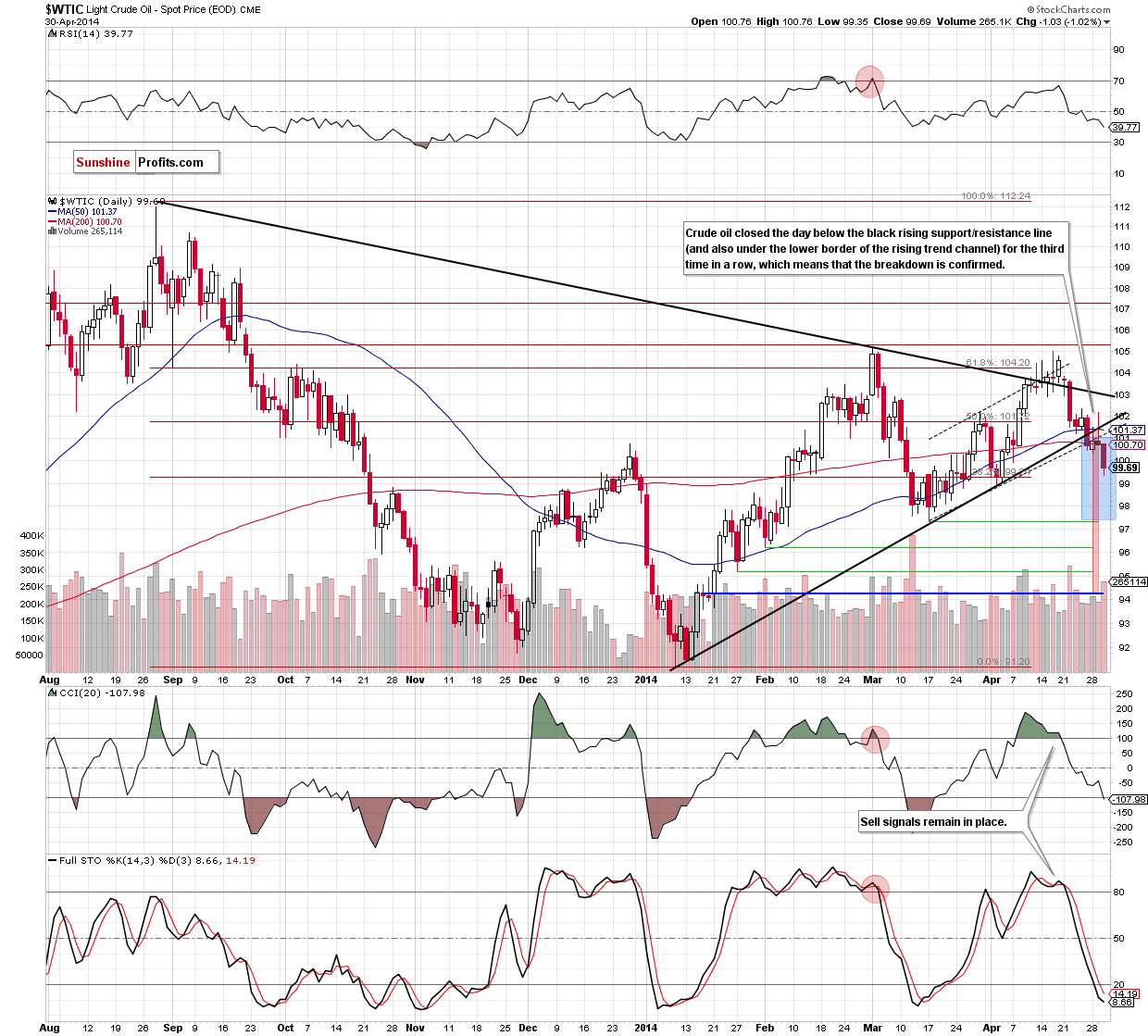

How much did this change? A lot. The volume that accompanied the move lower was significant and we saw a breakdown also in case of the USO ETF (a proxy for crude oil). Since the breakdown below the rising medium-term support line (the lower border of the medium-term triangle pattern) has already been confirmed, the above-mentioned additional confirmation was just what we need to say that short positions seem justified from the risk/reward perspective.

Is it still a good idea to bet on lower oil prices? Most likely yes. Quoting yesterday’s alert:

In the case of the breakdown under the lower border of the trend channel, declines may push the price to around $97, where the size of the downswing will correspond to the height of the formation. Nevertheless, in our opinion, the confirmation of the breakdown below the medium-term line is more important because it suggests an even bigger move. In this case, the correction may be deeper and take light crude to around $94.20. At this point, it’s worth noting that the first downside target is supported by the March low of $97.37 and the latter corresponds to the 78.6% Fibonacci retracement based on the entire Jan.-March rally.

(charts courtesy of http://stockcharts.com.)

Therefore, if the decline is to continue, then we're looking for another $3-$5 (or so) move lower.

Consequently, in our opinion it seems that opening short positions in the crude oil market with $102.5 as a stop-loss order is justified from the risk/reward perspective.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): In our opinion short positions in the crude oil market with $102.5 as a stop-loss order are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts