Trading position (short-term; our opinion): In our opinion no positions are justified from the risk/reward perspective.

The situation in the crude oil market is far from exciting on a day-to-day basis. The commodity moves a little in one direction fueling hopes for a breakout or breakdown and a trading opportunity only to move back the following day. However, there is something about this lack of movement that can get one excited. What’s that? Let’s take a look at the charts (charts courtesy of http://stockcharts.com.)

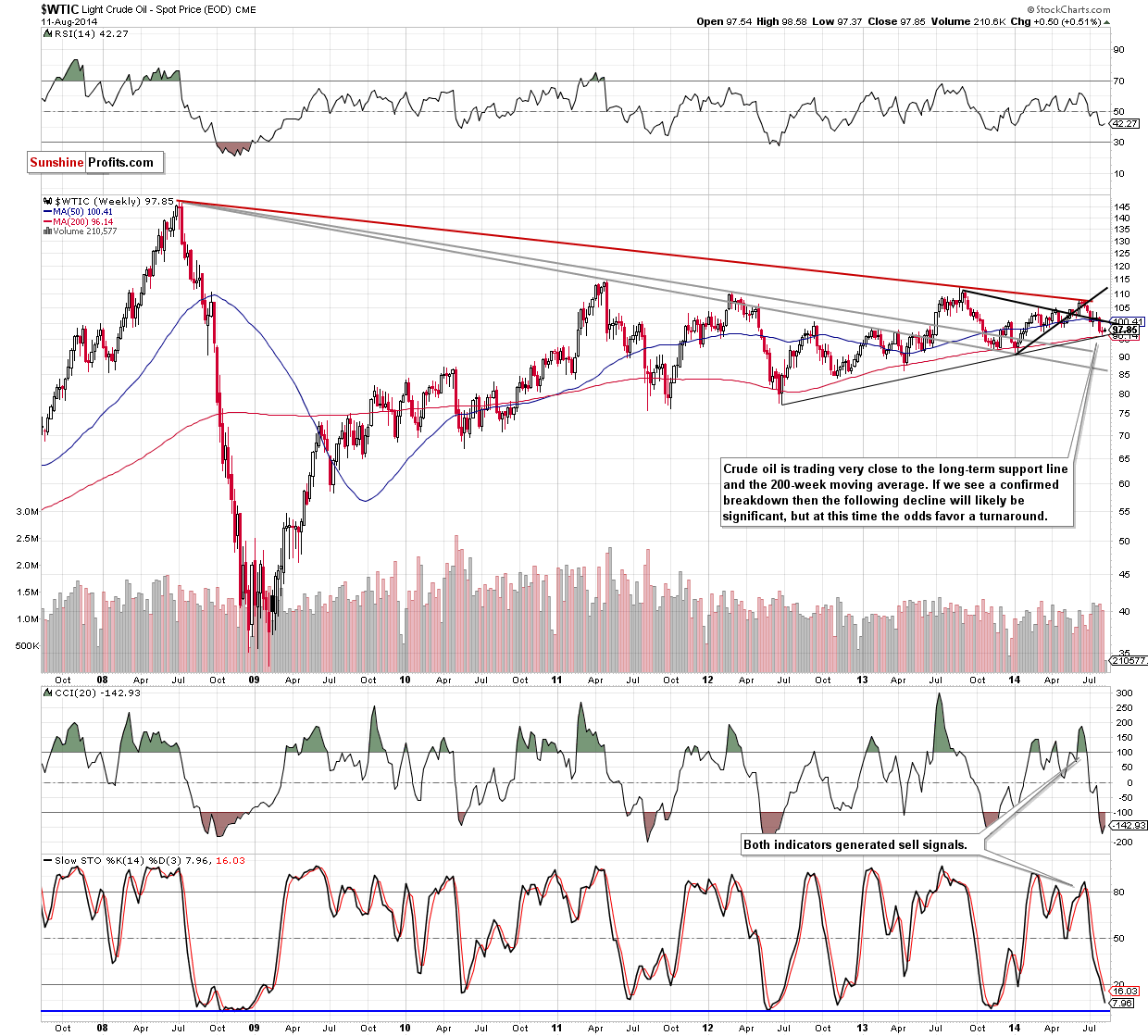

The price currently rests at the long-term support. The combination of the rising support line based on 2 major tops and the 200-week moving average is something that should make you alert – it certainly makes us alert. The combination of these two support levels is strong enough to stop the current decline, but on the other hand, if it is broken, we will likely see a quite significant slide. Consequently, we keep monitoring this area with extra attention.

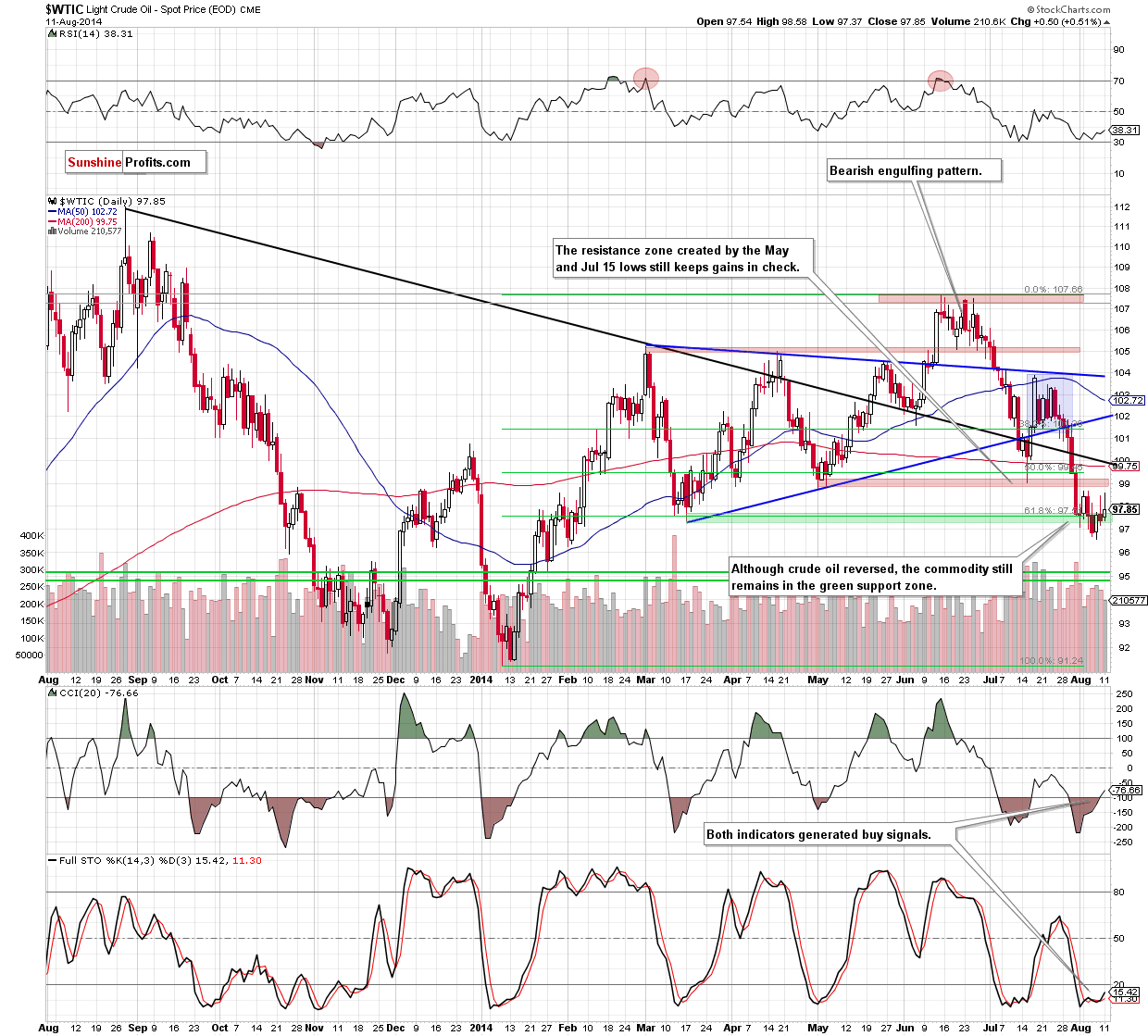

From the short-term point of view, we see that Monday’s session was very similar to what we saw on Friday. There was an intra-day reversal – only this time the price ended the day a bit higher. The difference between closing prices is small – only $0.50 (0.51%). Consequently, what we wrote previously remains up-to-date:

On the above chart, we see that the situation developed in line with the above bearish scenario and crude oil came back to the green support zone. What’s next for the commodity? Taking into account the medium-term situation and combining it with the current position of the indicators (the CCI and Stochastic Oscillator generated buy signals), we think that light crude will rebound from here and oil bulls will try to push the price above the nearest resistance once again. Nevertheless, as long as crude oil remains below it an attempt to test the recent low can’t be ruled out.

Summing up, the overall situation hasn’t changed much as crude oil is still trading in a narrow range between the support and resistance zones, slightly above the rising, long-term support line and the 200-week moving average. We think that as long as there is no breakout or breakdown above/below one of these areas, another sizable is not likely to be seen and it’s worth to stay on the sidelines waiting for another profitable buying or selling opportunity. It seems more likely to us that we will see an upswing here, but we view the risk/reward as not favorable enough to open a position at this time.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts