Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 and initial (!) target price at $35.72 are justified from the risk/reward perspective.

On Monday, crude oil lost 2.43% as disappointing Chinese data weighed on investors’ sentiment. As a result, light crude slipped under the previously-broken Fibonacci retracement and closed the day under $47. Will we see further declines in the coming days?

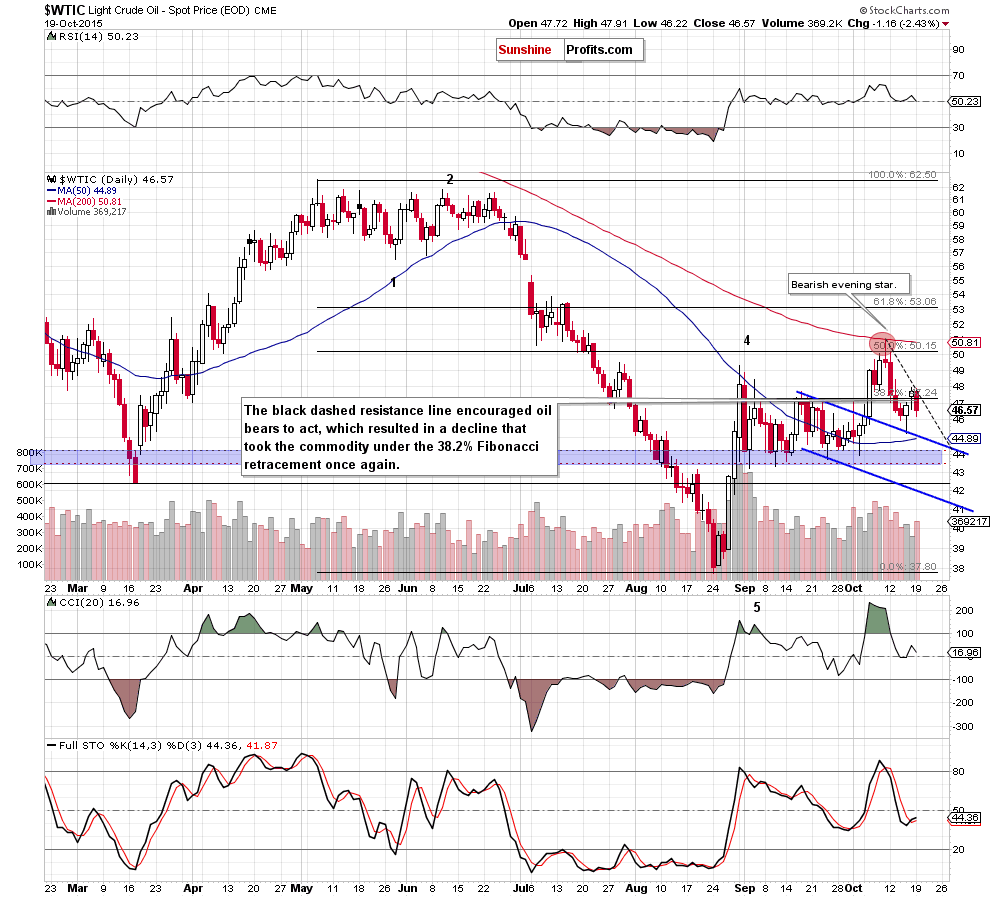

Yesterday’s official data showed that China’s economy grew in the previous three months (6.9%) less than in the second quarter (7%), which was the country's slowest growth rate since the 2009 global financial crisis. On top of that, industrial production rose below expectations, which fuelled worries over smaller demand for the commodity in the world's second largest oil consumer. Thanks to these circumstances, light crude reversed and declined to an intraday low of $46.22. Will we see a drop to $45 in the coming days? Let’s take a closer look at the charts and find out (charts courtesy of http://stockcharts.com).

Quoting our previous Oil Trading Alert:

(…) with Friday’s upswing the commodity reached the black dashed resistance line, which paused further improvement. Additionally, the size of volume was smaller than day before, which suggests oil bulls’ weakness. If this is the case, we’ll see a reversal and lower values of crude oil in the coming week.

(…) Additionally, light crude posted its biggest weekly decline (-3.56%) in 10 weeks, which doesn’t bode well for the commodity.

Looking at the daily char, we see that the situation developed in line with the above scenario and crude oil reversed and declined under the 38.2% Fibonacci retracement. In this way, light crude invalidated the breakout above this support/resistance level, which is a negative signal.

On top of that, yesterday’s decline materialized on bigger volume than earlier increases, which suggests that oil bears are getting stronger and further declines are more likely than not. This means that our downside target from yesterday’s commentary will be in play in the coming days:

(…) How low could the pair go? In our opinion, the initial downside target would be around $45, where the blue support line (the upper border of the declining trend channel) currently is.

Summing up, crude oil reversed and invalidated earlier breakout above the 38.2% Fibonacci retracement. Additionally, the size of yesterday’s decline suggests that further deterioration is more likely than not and short positions continue to be justified from the risk/reward point of view.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 and initial (!) target price at $35.72 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts