Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 are justified from the risk/reward perspective.

Although stronger U.S. currency pushed the commodity to an intraday low of $60.21, light crude rebounded after the IEA improved its forecasts for global demand in 2015. As a result, crude oil lost 0.52% and closed another day under the resistance zone. Time for further declines?

Yesterday, the U.S. Commerce Department showed that retail sales increased by 1.2% in May (beating expectations for a gain of 1.1%), while core retail sales (without automobile sales) rose by 1.0% in the previous month (also beating forecasts for a 0.7% increase). Thanks to these solid numbers, the USD Index moved sharply higher, making crude oil less attractive for buyers holding other currencies. As a result, light crude slipped to an intraday low of $60.21. Despite this deterioration, the commodity reversed and erased some losses after the IEA said in its monthly report that global oil demand is forecast to increase by 1.4 million barrels a day this year, raising its projection from last month by 300,000 a day. Will it encourage oil bulls to act? (charts courtesy of http://stockcharts.com).

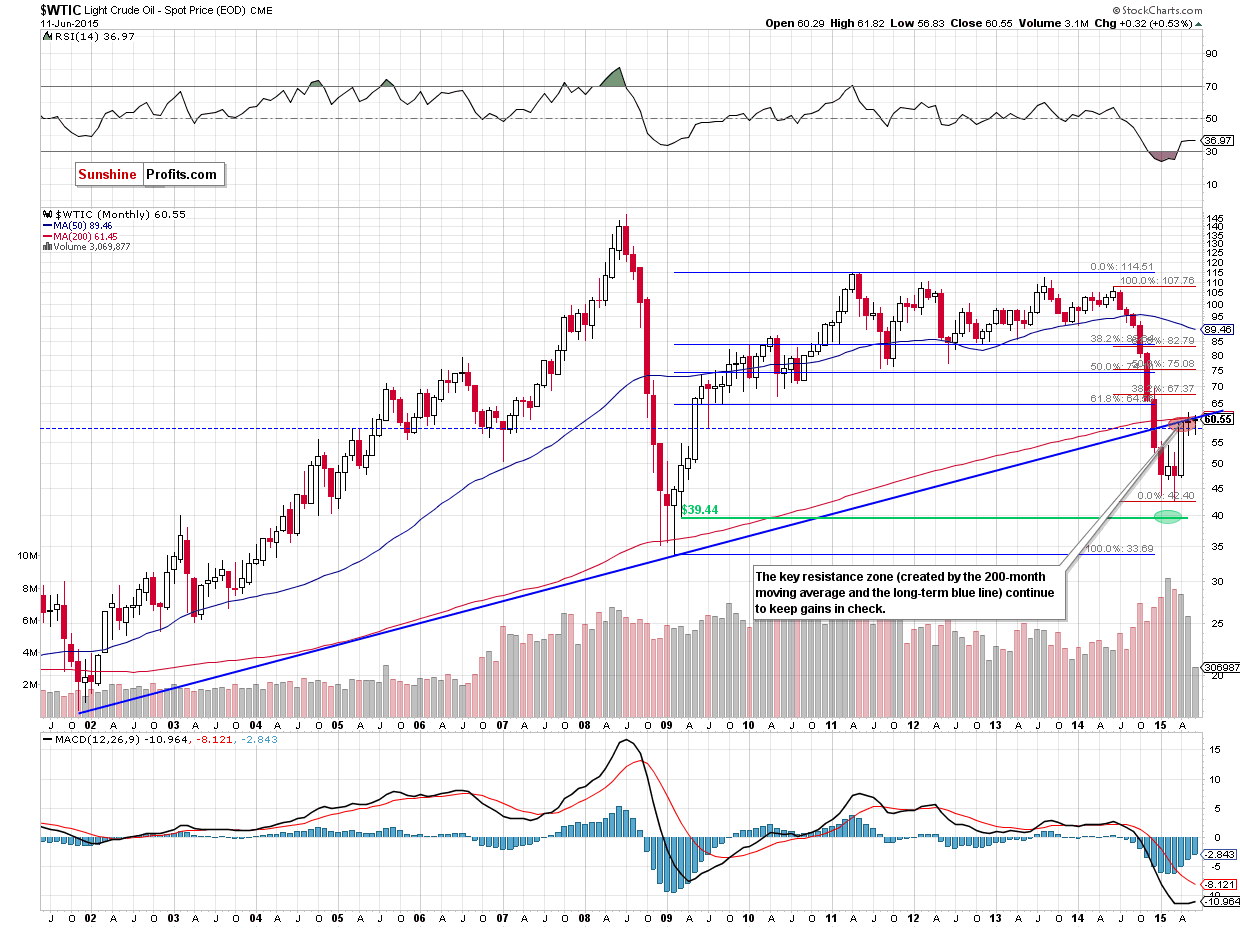

As you see on the monthly chart, crude oil reversed and moved lower once again as the key resistance zone (created by the long-term blue resistance line and the 200-month moving average) continues to keep gains in check. Therefore, we believe that as long as there is no successful breakout above this area further rally is not likely to be seen and another downswing is more likely than not.

How yesterday’s downswing affect the very short-term picture? Let’s check.

Quoting our last Oil Trading Alert:

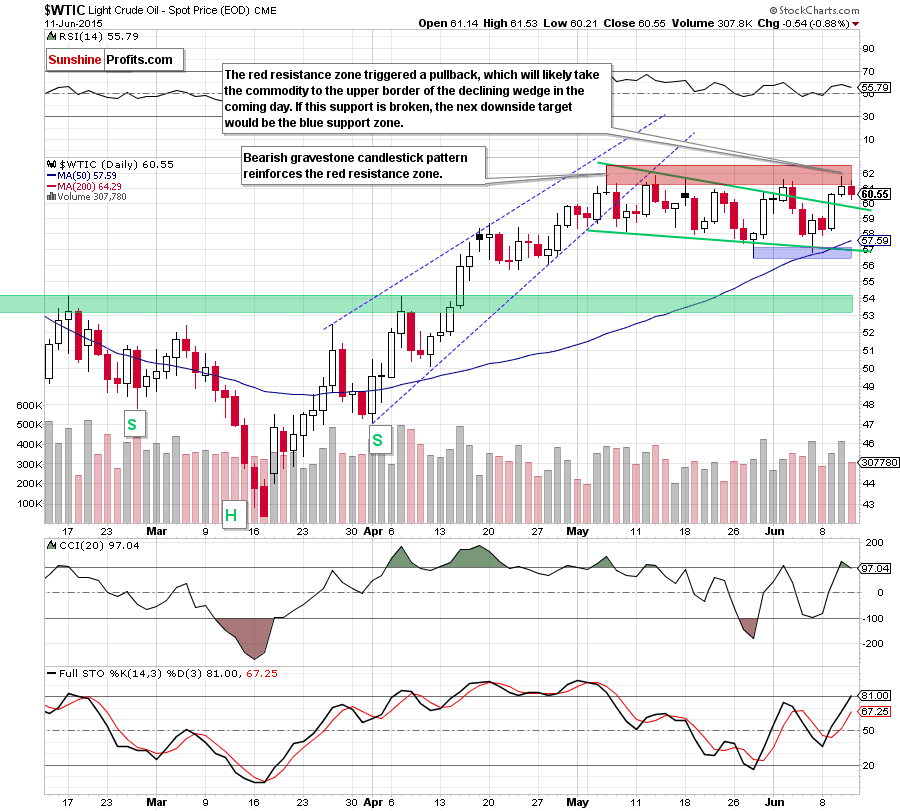

(…) crude oil re-tested the red resistance zone. Despite this upswing, the commodity reversed and closed the day under the resistance area (…) we saw similar price action in the previous week. Back then, the above-mentioned resistance area was strong enough to stop further rally, which suggests that we might see another pullback from there in the coming day(s).

From today’s point of view we see that although crude oil moved little higher after the market’s open, the red resistance zone encouraged oil bears to act, which resulted in a pullback in the following hours. Taking into account another unsuccessful attempt to break above this area, we believe that lower values of the commodity are just around the corner.

If this is the case, and light crude extends declines, we’ll see a drop to the previously-broken upper border of the declining wedge in the coming day. Please note that if this area is broken, the next downside target for oil bears would be the 50-day moving average (currently at $57.60) or even the blue support zone ($56.50-$57.60).

Finishing today’s alert, we would like to notice that the CCI generated a sell signal. In previous cases (May 13, Jun 2) such price action supported oil bears, which translated to a test of the lower line of the declining wedge. Therefore, similar action in the coming days is more likely than not.

Summing up, crude oil moved lower once again and closed another day under the red resistance area (while the key resistance zone created by the 200-month moving average and the long-term blue line continues to keep gains in check), which will likely encourage oil bears to act in the coming day(s) – similarly to what we saw in the previous weeks.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts