Trading position (short-term; our opinion): Long positions (with a stop-loss order at $40.40 and the upside target around $50)

On Monday, the black gold gained 0.86% as a weaker U.S. dollar and investors covering short positions supported the price of crude oil. As a result, light crude climbed above $43 and closed the day above it. Will we see further improvement in the coming days?

Crude Oil’s Technical Picture

Let’s take a closer look at the charts and find out (charts courtesy of http://stockcharts.com).

Quoting our yesterday's alert:

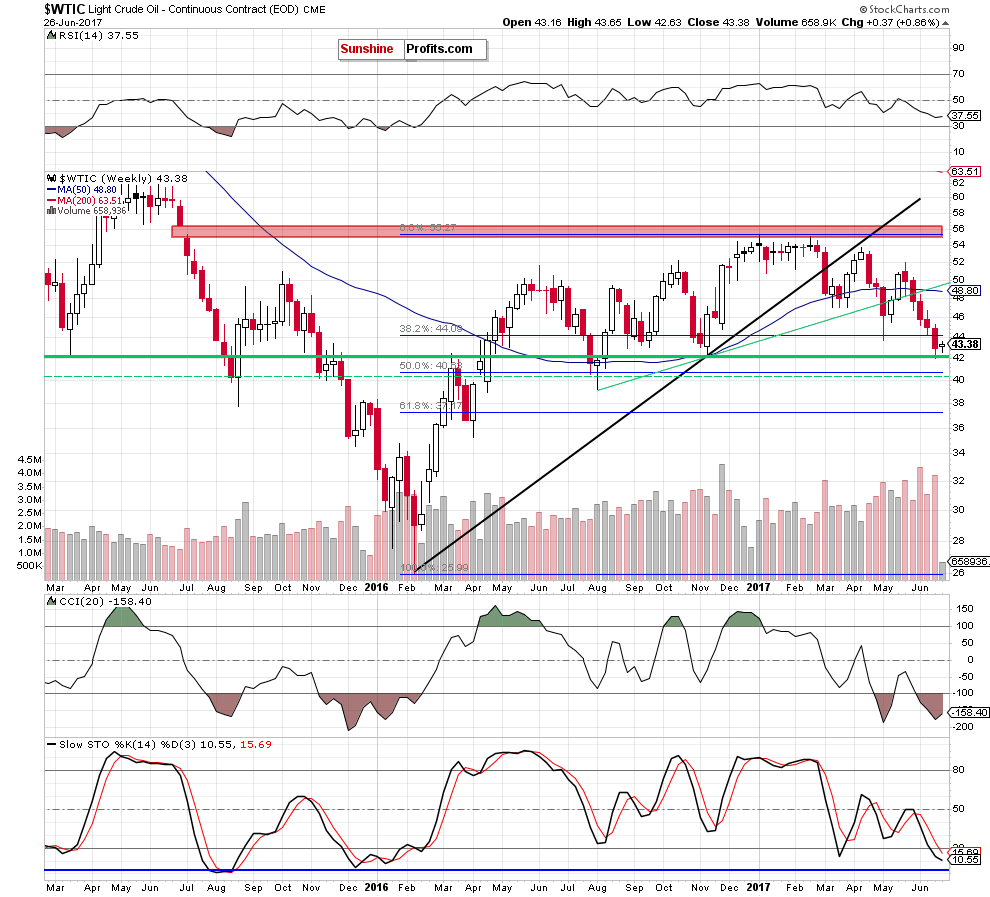

(…) the mid November low and the lower border of the blue declining trend channel, (…) encouraged oil bulls to act, which resulted in a climb above the red dashed line. Additionally, the commodity closed Friday’s session above it, which is a positive development – especially when we factor in buy signals generated by the RSI and the Stochastic Oscillator (while the CCI is very close to doing the same).

Nevertheless, we should keep in mind that the black gold still remains under the green zone created by the September and November lows, which stopped further increases on Thursday. Therefore, in our opinion, higher prices of light crude will be more likely and reliable if we see a breakout above this area (around $43.60).

From today’s point of view, we see that crude oil extended gains and closed yesterday’s session above the green zone created by the September and November lows, which in combination with the buy signals generated by the indicators (the CCI also generated the buy signal) suggests further improvement in the coming days.

How High Could Crude Oil Go?

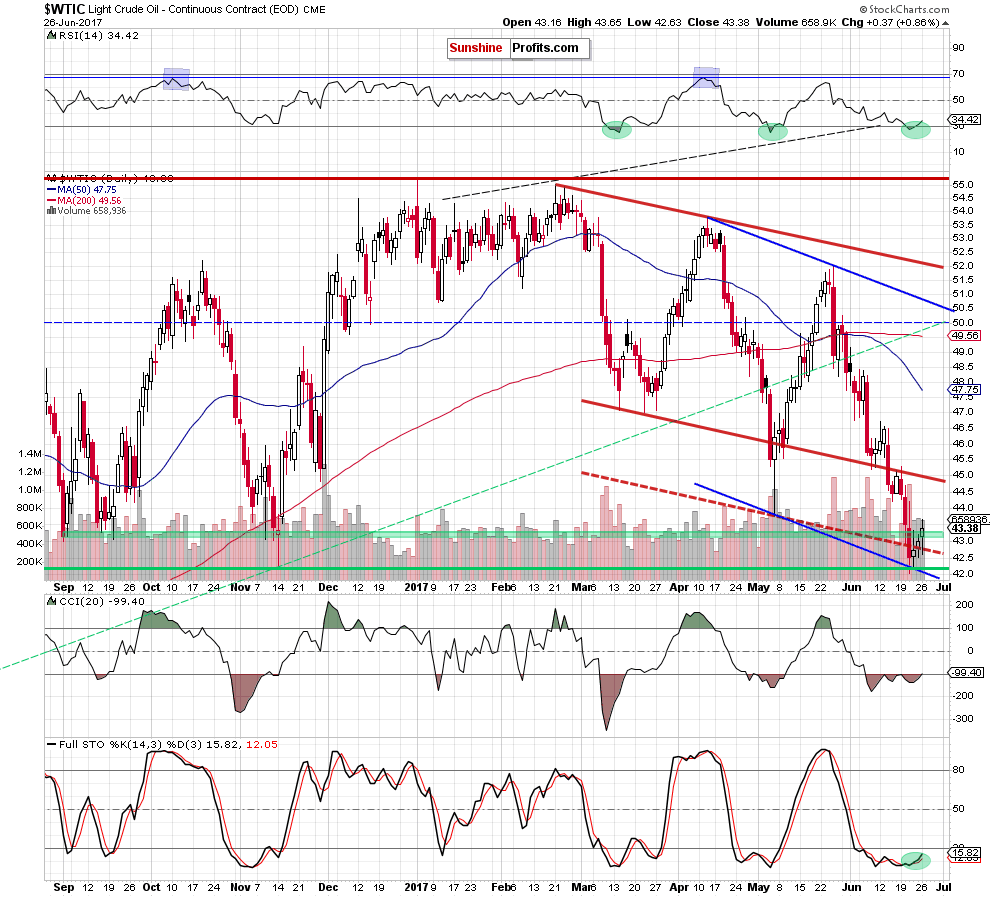

In our opinion, the first upside target will be around $45, where the previously-broken lower border of the red declining trend channel is. If this resistance is broken, we may see an increase even to the upper border of the blue declining trend channel (currently above the barrier of $50). Therefore, we think that opening long positions is justified from the risk/reward perspective.

Summing up, long positions are justified from the risk/reward perspective, because crude oil extended gains and closed the day above the justified from the risk/reward perspective, which together with the buy signals generated by the indicators suggests (at least) a test of the previously-broken lower border of the red declining trend channel in the coming days.

Very short-term outlook: bullish

Short-term outlook: bullish

MT outlook: bullish

LT outlook: mixed

Trading position (short-term; our opinion): Long positions (with a stop-loss order at $40.40 and the upside target around $50) We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts