Trading position (short-term; our opinion): Short positions (with a stop-loss order at $54.15 and the initial downside target at $45.55) are justified from the risk/reward perspective.

On Tuesday, crude oil bounced off the 61.8% Fibonacci retracement and moved little higher in the following hours, but did this increase change anything in the short-term picture of the black gold?

Crude Oil’s Technical Picture

Let’s take a closer look at the charts and find out (charts courtesy of http://stockcharts.com).

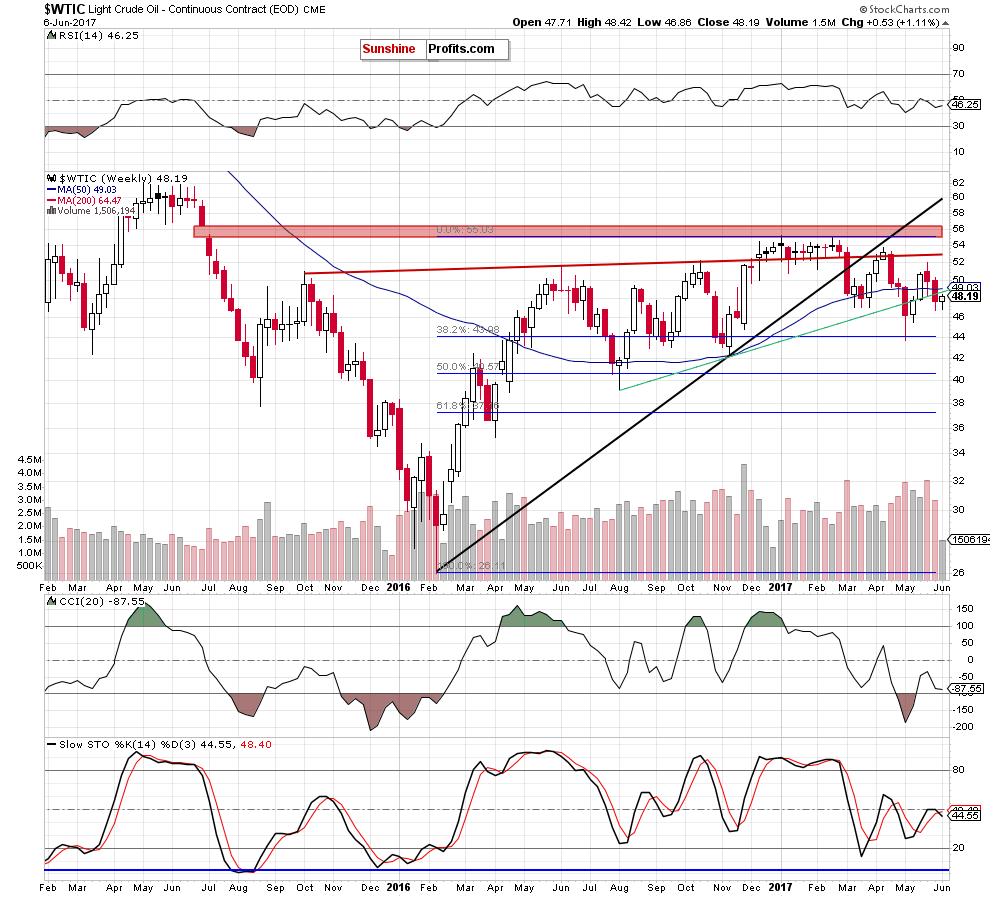

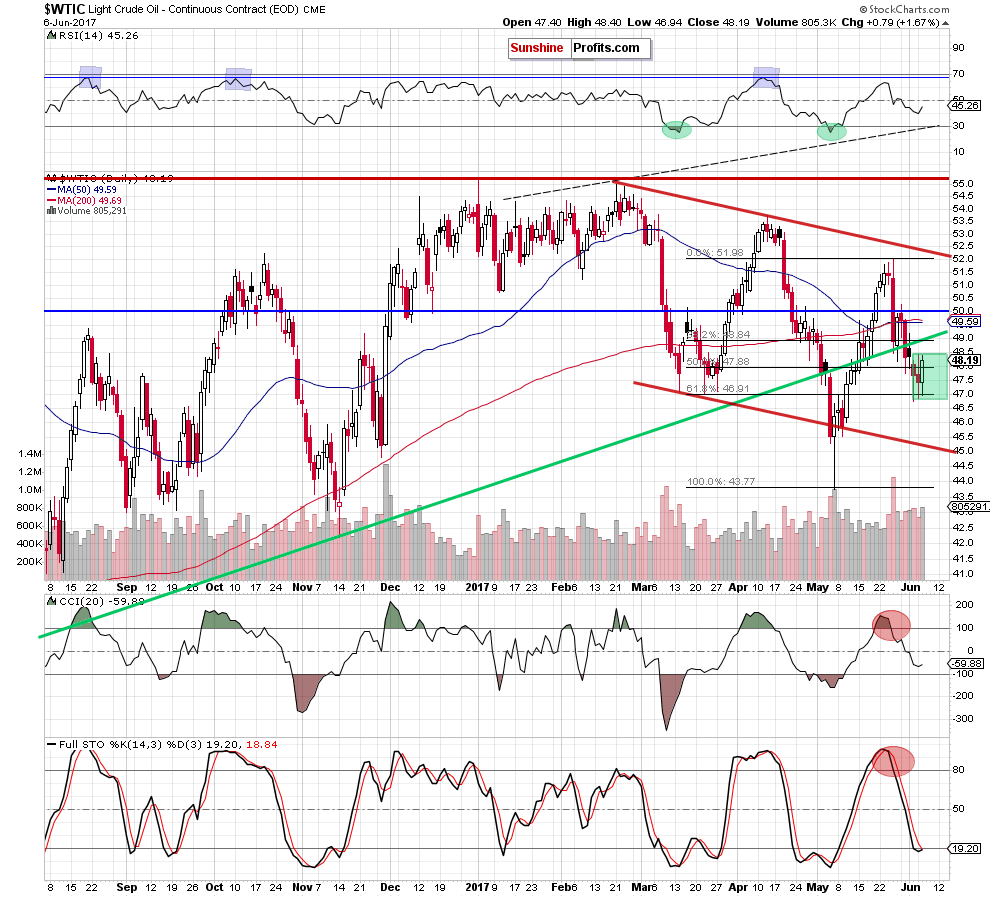

Looking at the above charts, we see that although crude oil moved lower after the market’s open, the 61.8% Fibonacci retracement stopped further declines, triggering a pullback. As a result, light crude extended gains in the following hours and closed the day above the 50% retracement.

But did this increase change anything in the short-term picture of the commodity? In our opinion, it didn’t, because despite yesterday’s move, crude oil is still trading under the previously-broken long-term green line (which serves as the nearest resistance) and well below the 50- and 200-day moving averages. This suggests that as long as there is no invalidation of the breakdown under the green resistance line all upswings could be nothing more than a verifications of the earlier breakdown. Therefore, another attempt to move lower and (at least) a re-test of the recent lows is very likely.

API Report and Its Implications

Finishing today’s alert, we would like to draw your attention to yesterday’s API numbers. After the market’s closure, the American Petroleum Institute showed that crude inventories fell 4.620 million barrels at the end of last week, beating analysts’ expectations. Despite this bullish news, the report also showed that gasoline stocks rose by 4.1 million barrels and distillates inventories gained 1.8 million barrels. Thanks to these disappointing numbers, crude oil futures moved lower earlier today. Therefore, in our opinion, if today’s government data confirms builds in gasoline and distillates inventories oil bears will receive important reasons to act, which will likely translate into another move to the downside later in the day.

Summing up, short (already profitable) positions continue to be justified from the risk/reward perspective as crude oil is still trading under the long-term green support line and moving averages.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at $54.15 and the initial downside target at $45.55) are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts