Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Earlier today, OPEC decided to extend cuts in oil output until March 2018, but is is enough to push the black gold higher?

Let’s take a closer look at the charts and find out what are they telling about future moves (charts courtesy of http://stockcharts.com).

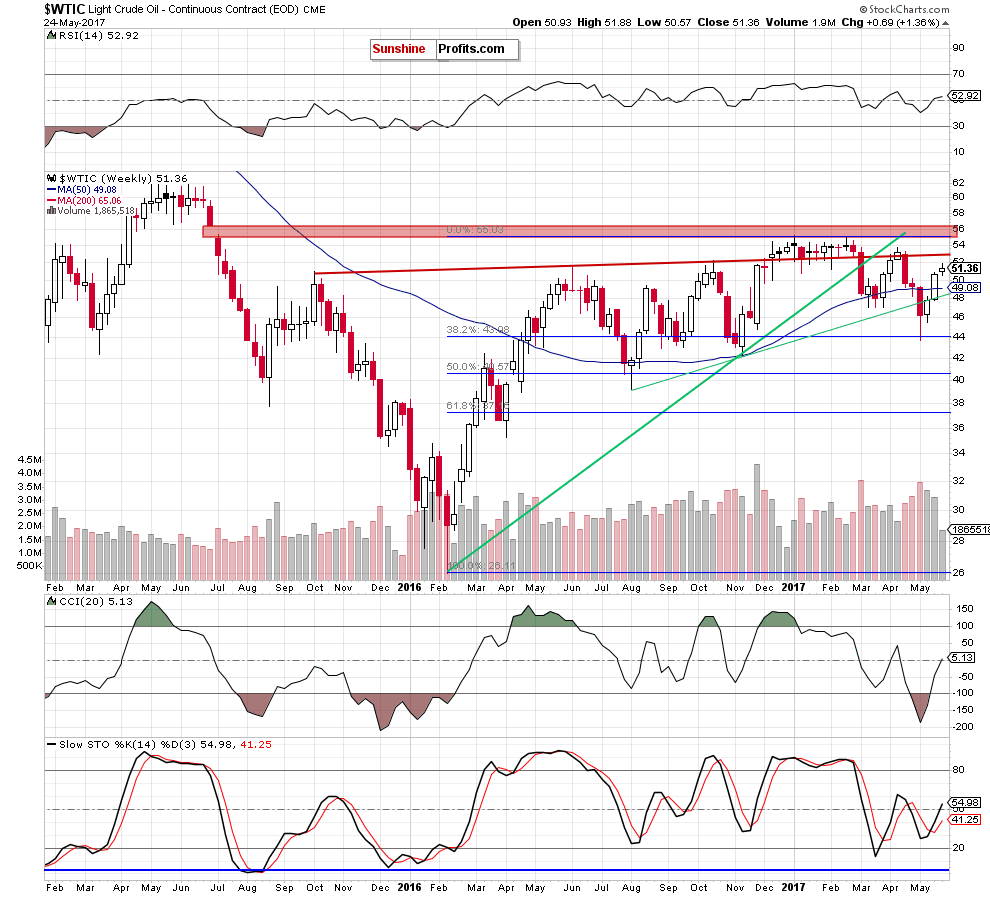

Looking at the weekly chart, we see that although the CCI and the Stochastic Oscillator generated the buy signals and light crude invalidated the earlier breakdown under the 50-week moving average, this week’s size of volume is tiny, which doesn’t confirm oil bulls’ strength, suggesting that reversal may be just around the corner.

Will the very short-term chart give us more negative signals? Let’s check.

On Tuesday, we wrote the following:

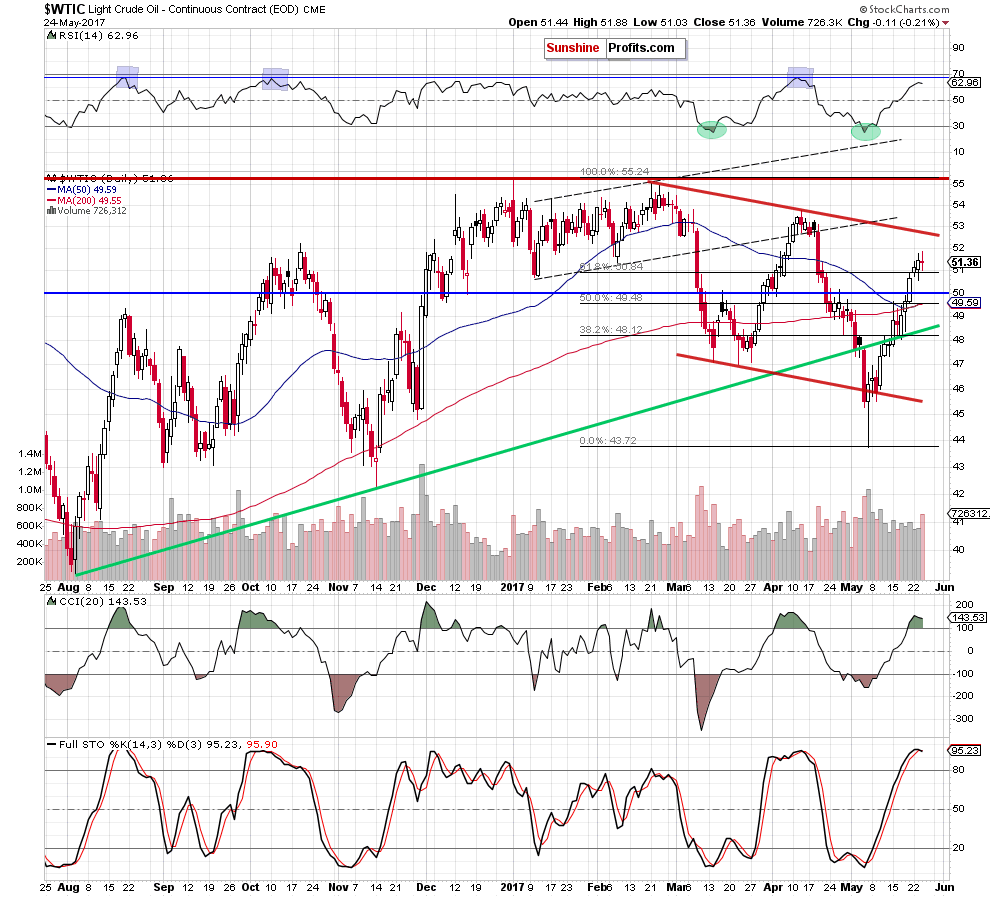

(…) crude oil broke above the 61.8% Fibonacci retracement (…) Such price action suggests that we may see an increase to around $51.73 (the 70.7$ retracement) or even to the resistance zone created by the 76.4% and 78.6% Fibonacci retracements around $52.37-$52.61 in the coming day(s).

From today’s point of view, we see that oil bulls pushed the commodity higher (as we had expected), which resulted in a climb to $51.88 (yesterday’s intraday high). Thanks to this upswing, light crude moved above the 70.7$ retracement, but despite this improvement, oil bears managed to trigger a pullback, which invalidated the earlier breakout above the retracement and Tuesday’s high.

Additionally, yesterday’s decline materialized on bigger volume than earlier increases, which suggests that oil bears are getting stronger. On top of that, the Stochastic Oscillator generated the sell signal, while the CCI is overbought, which increases the probability of reversal and declines in the coming days.

If this is the case and we see more bearish factors (like another daily closure below $52 or higher volume during decline), we’ll consider re-opening short positions. As always, we will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts