Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Tuesday, crude oil lost 1.18% after the Energy Information Administration increased its near-term outlook for U.S. oil production. As a result, light crude declined to the previously-broken lower border of the trend channel. Will it withstand the selling pressure in the coming day?

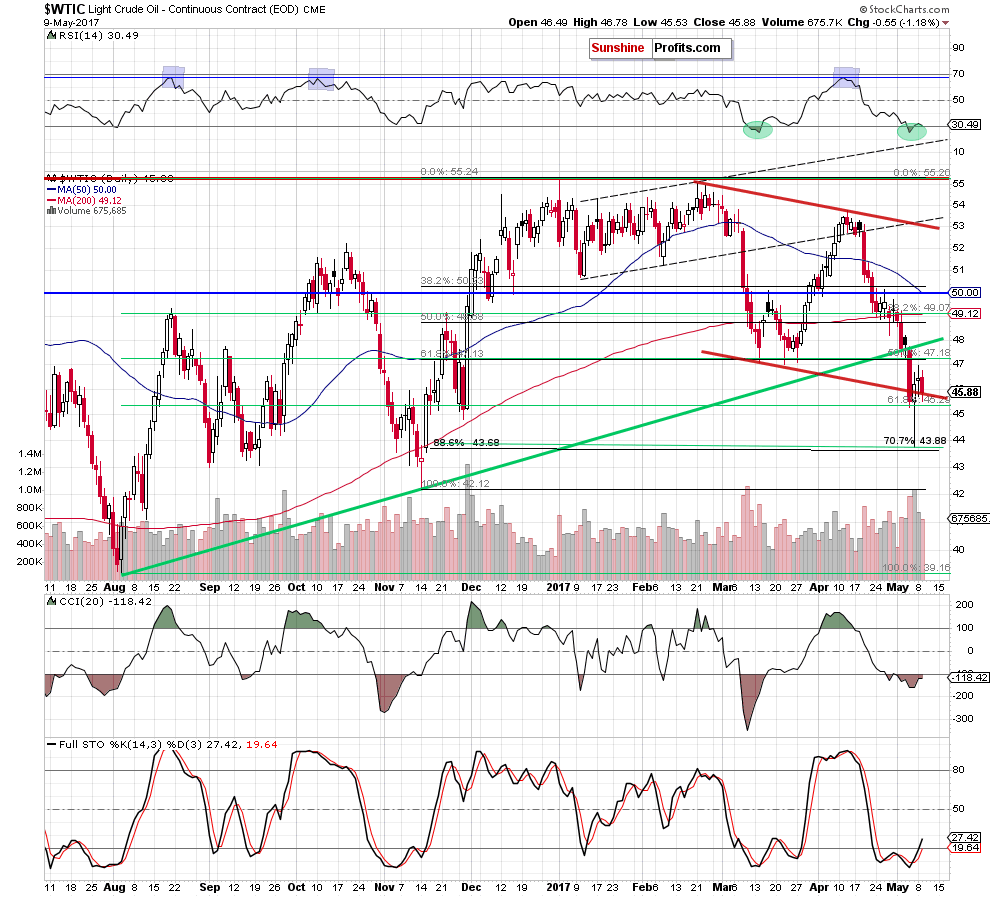

Let’s take a closer look at the daily chart and find out (charts courtesy of http://stockcharts.com).

Yesterday, crude oil moved lower, which resulted in a drop to the previously-broken lower border of the red declining trend channel. Such price action looks like a verification of the earlier breakout and suggests another attempt to move higher.

This scenario is also reinforced by the buy signals generated by the Stochastic Oscillator and the RSI. At this point, it is worth keeping in mind that we saw the RSI at similar levels in mid-March, which translated into a bigger upward move in the following weeks. Therefore, it seems to us that further improvement is just around the corner – especially when we factor in the fact that yesterday’s decline materialized on smaller volume than earlier increases, which suggests that oil bulls are stronger at the moment.

If this is the case, and light crude rebounds from here, the initial upside target will be around $47.87, where the previously-broken long-term green line (based on the August and November lows) currently is.

Finishing today’s alert, please note that after yesterday’s market’s closure the American Petroleum Institute reported that although gasoline stocks rose by 3.17 million barrels (missing expectations of a draw), crude inventories dropped by 5.79 million barrel (more-than-expected) and distillate stocks fell by 1.17 million barrels (also more than forecasts). Additionally, inventories in Cushing, Oklahoma, fell by 130,000 barrels. If today’s government data confirms these encouraging numbers, oil bulls will receive another reason to act later in the day.

Summing up, crude oil moved lower and slipped to the lower border of the red declining trend channel, which looks like a verification of the earlier breakout and suggests another attempt to move higher (especially when we factor in the buy signals and the size of volume) in the coming days.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts