Trading position (short-term; our opinion): Short positions (with a stop-loss order at $56.45 and an initial downside target at $45.81) are justified from the risk/reward perspective.

On Tuesday, light crude extended gains, but did this increase change anything in the short-term picture of the commodity?

Let’s examine the charts below (charts courtesy of http://stockcharts.com).

Today's alert is going to be even shorter than yesterday's issue, as crude oil remains under the key resistance levels and thus everything that we wrote yesterday is up-to-date also today:

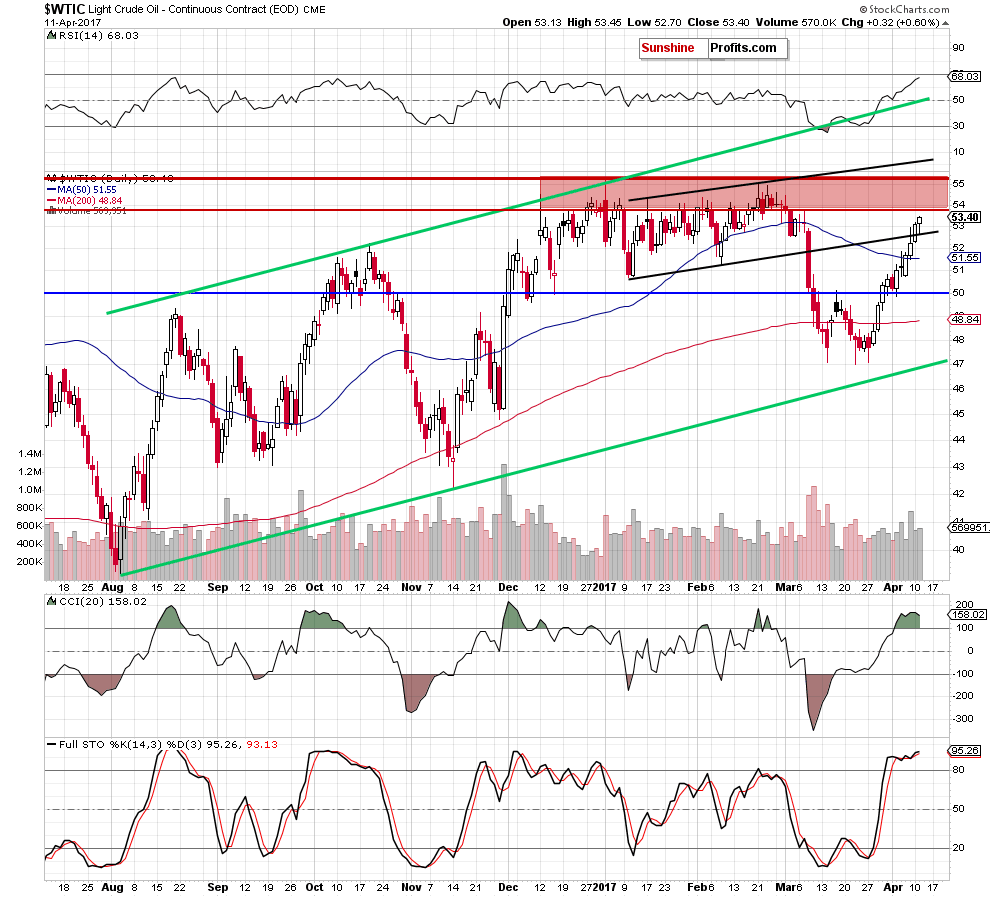

(…) although crude oil increased yesterday, the commodity is still trading under the long-term rising resistance line based on the February and November lows, which means that as long as there is no invalidation of the breakdown reversal and lower prices are more likely than not.

Additionally, the CCI and the Stochastic Oscillator remain in their overbought areas, which suggests that sale signals are just around the corner. On top of that, not far from current levels is also the key resistance zone, which stopped oil bulls many times in the previous months (between the March high of $53.80 and the January high of $55.24), which increases the probability of declines in very near future. Therefore, as long as there is no breakout above this major resistance zone short positions continue to be justified from the risk/reward perspective.

As always, we’ll keep you - our subscribers - informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts