Trading position (short-term; our opinion): Short positions (with a stop-loss order at $56.45 and an initial downside target at $45.81) are justified from the risk/reward perspective.

Let’s examine the chart below (charts courtesy of http://stockcharts.com).

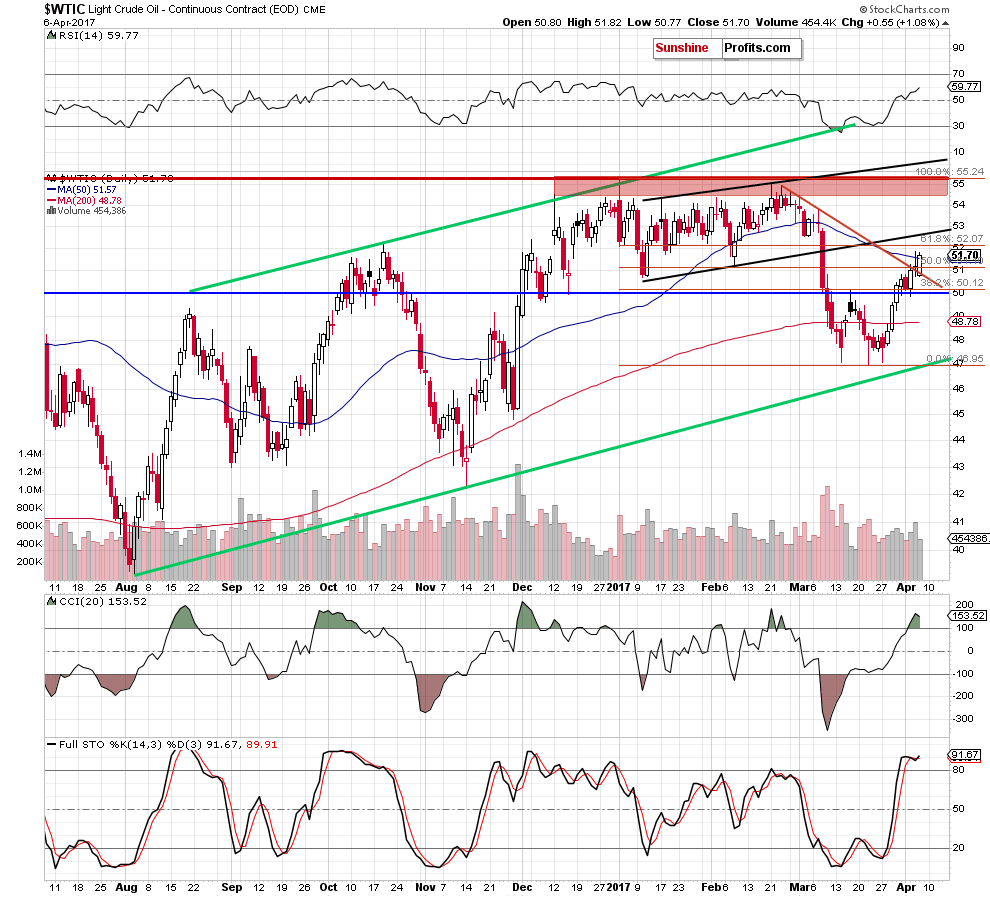

On the daily chart, we see that crude oil moved higher and broke above the red declining resistance line, which resulted in further improvement. As a result, light crude invalidated the earlier breakdown below the 50-day moving average and the 50% Fibonacci retracement.

Earlier today, the commodity extended gains and climbed to the 61.8% Fibonacci retracement. What’s next? Taking into account the current position of the indicators and the long-term picture (we wrote more about this issue yesterday), we think that even if light crude moves a bit higher and we’ll see a verification of the breakdown under the lower border of the black rising trend channel (currently around $52.60), the next bigger move will be to the downside. Therefore, short positions continue to be justified from the risk/reward perspective.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at $56.45 and an initial downside target at $45.81) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts