Trading position (short-term; our opinion): Short positions (with a stop-loss order at $56.45 and an initial downside target at $45.81) are justified from the risk/reward perspective.

On Tuesday, crude oil moved a bit higher, but the short-term resistance line hold. Will it stop oil bulls in the coming days?

Let’s examine the charts below to find out (charts courtesy of http://stockcharts.com).

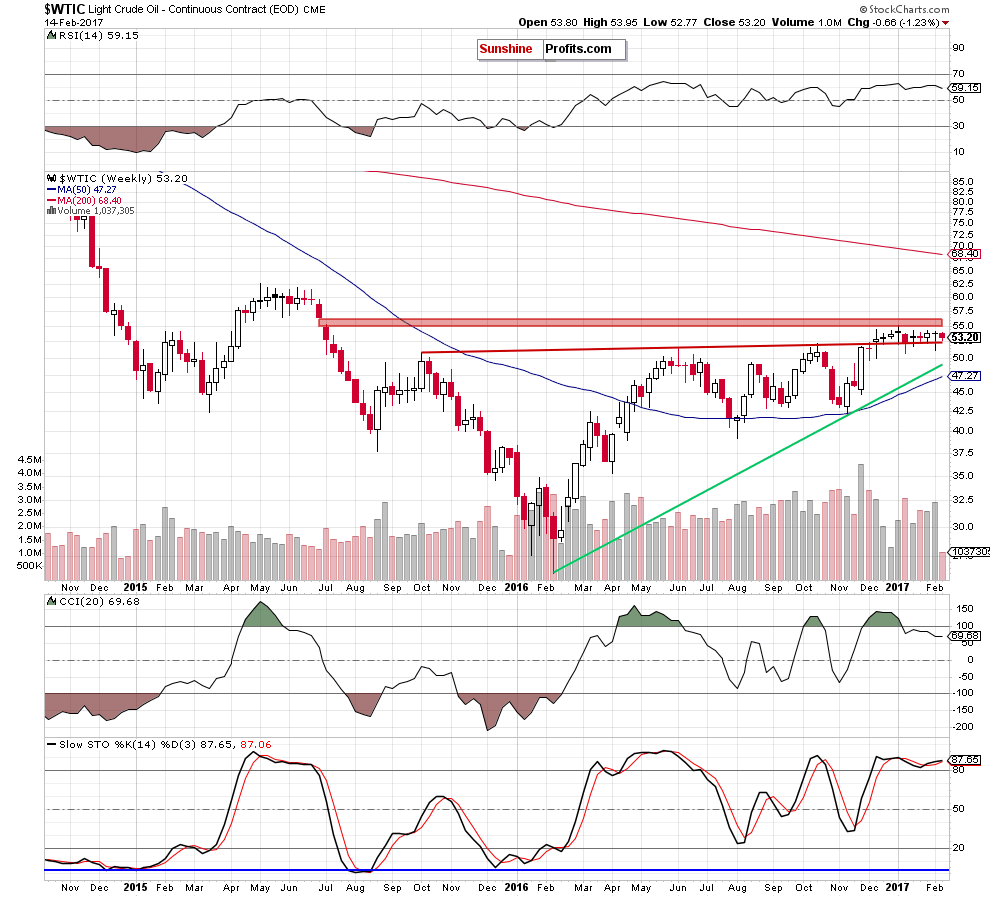

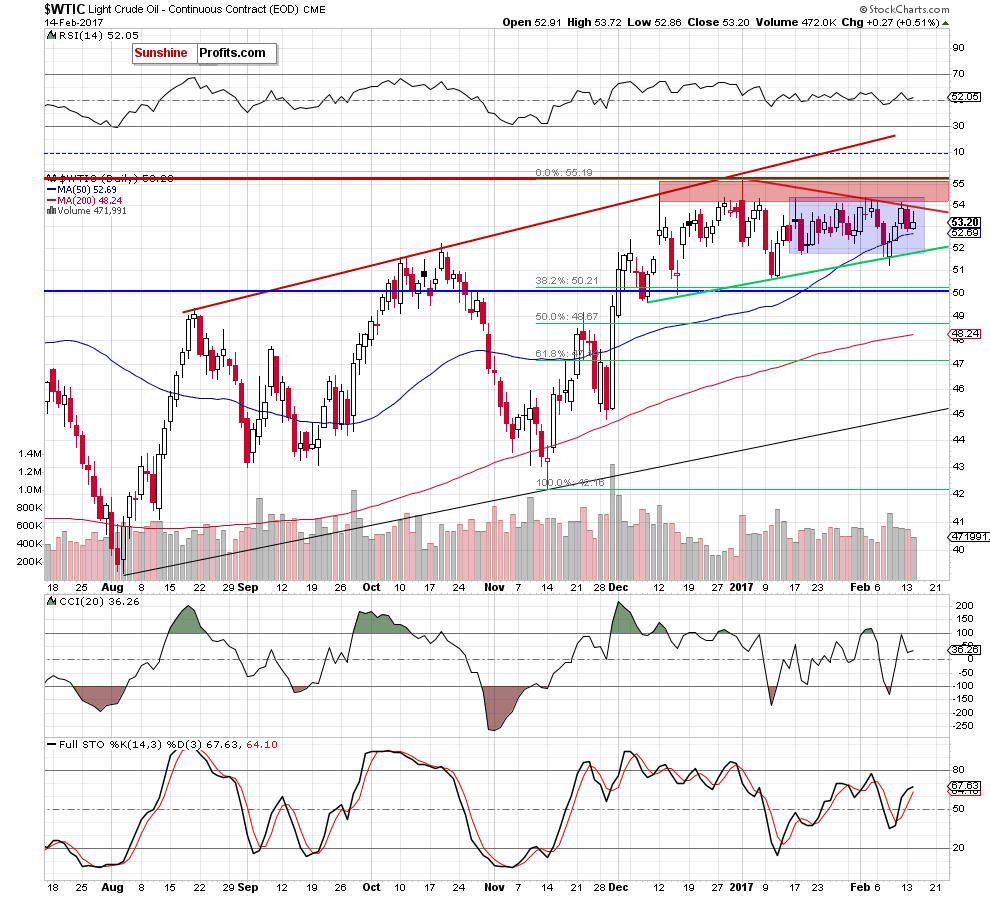

Looking at the charts, we see that the overall situation remains almost unchanged as crude oil is still trading in the blue consolidation between the short-term red resistance line based on the previous highs and the green support line based on the December and January lows. Additionally, this area is reinforced by the red gap at the north and the previously-broken long-term red line at the south (both levels seen on the weekly chart).

Taking these facts into account, we believe that as long as there is no breakout above this key resistance area further rally is not likely to be seen and another reversal is more likely than not. This scenario is also supported by the current situation in the oil-to-oil stocks ratio.

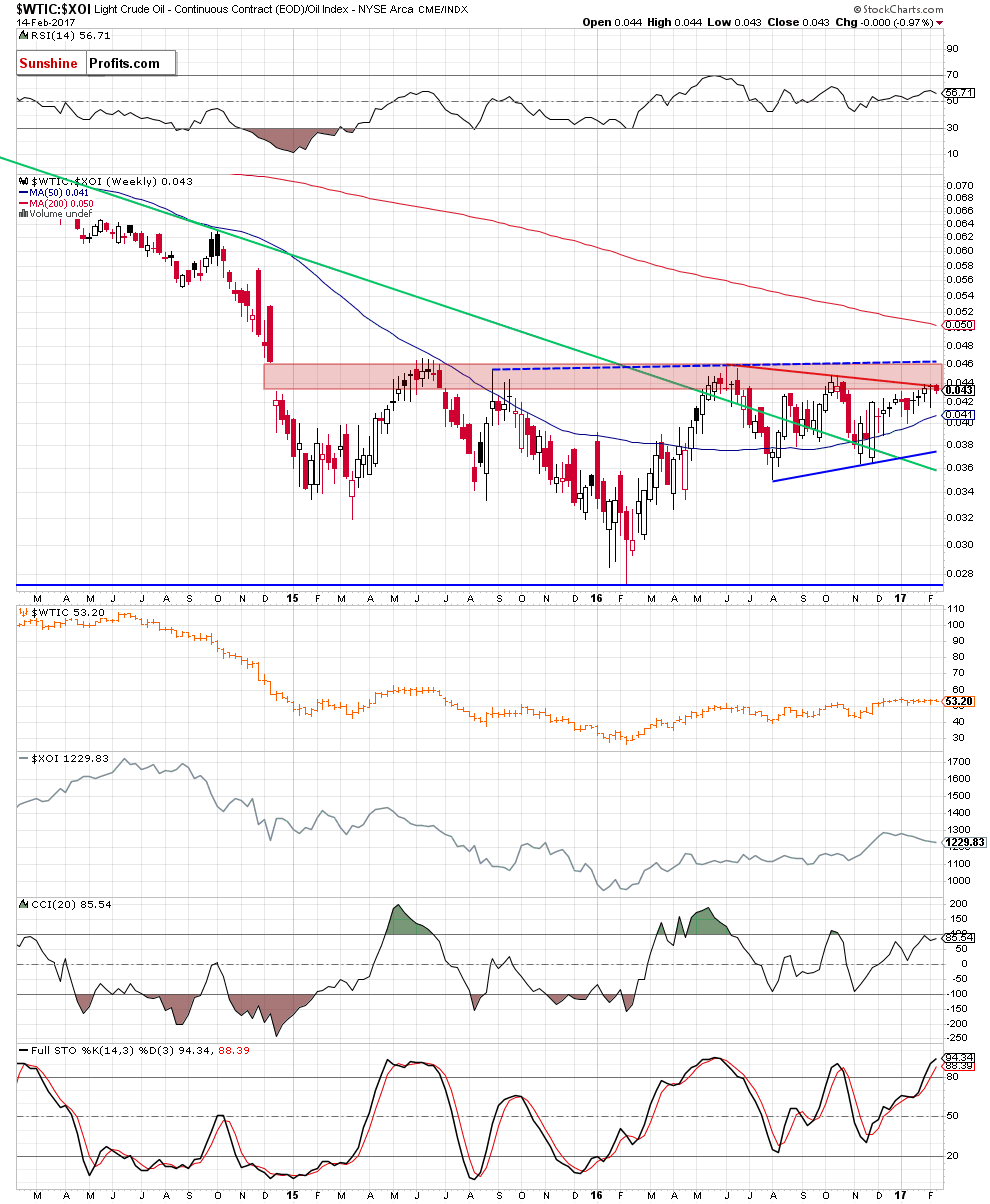

On the weekly chart, we see that although the ratio extended gains once again, the long-term red declining resistance line (based on the June and October highs) together with the red resistance zone stopped oil bulls once again. Therefore, we continue to believe that as long as there are no breakout and a weekly closure above the upper border of the zone (which is currently reinforced by the blue resistance line based on the previous highs) further rally is not likely to be seen and another reversal is more likely than not (not only in the case of ratio, but also in the case of crude oil as strong positive relationship remains in play).

Summing up, short positions continue to be justified as crude oil remains under the red resistance zone created by the recent highs and the red gap marked on the weekly chart, which together continue to keep gains in check since the beginning of the year. Additionally, the pro bearish scenario is also reinforced by the current situation in the oil-to-oil stocks as the key resistance zone supports oil bears and another attempt to move lower.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions (with a stop-loss order at $56.45 and an initial downside target at $45.81) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts