Trading position (short-term; our opinion): Short positions (with the stop-loss order at $56.45 and the initial downside target at $45.81) are justified from the risk/reward perspective.

Although the EIA weekly report showed a larger-than-expected weekly build in U.S. crude and fuel inventories, news that Saudi Arabia cut exports to Asia and a weaker U.S. dollar supported the price of crude oil. In this environment, light crude gained 2.81% and came back above the previously-broken levels. Can we trust this invalidation of the earlier breakdowns?

Yesterday, the U.S. Energy Information Administration reported that crude oil inventories increased by 4.1 million barrels in the week ended January 6, easily missing analysts’ forecasts. Additionally, gasoline inventories rose by 5.0 million barrels and distillate supplies increased by 8.4 million barrels. Despite these bearish numbers, investors focused on a 579,000 barrels drop in supplies at Cushing, Oklahoma, which in combination with a weaker greenback and news that Saudi Arabia cut exports to Asia supported the price and pushed light crude above $52. In these circumstances light crude invalidated the earlier breakdown under the June and October highs, but can we trust this improvement?

Let’s take a closer look at the charts below to find out (charts courtesy of http://stockcharts.com).

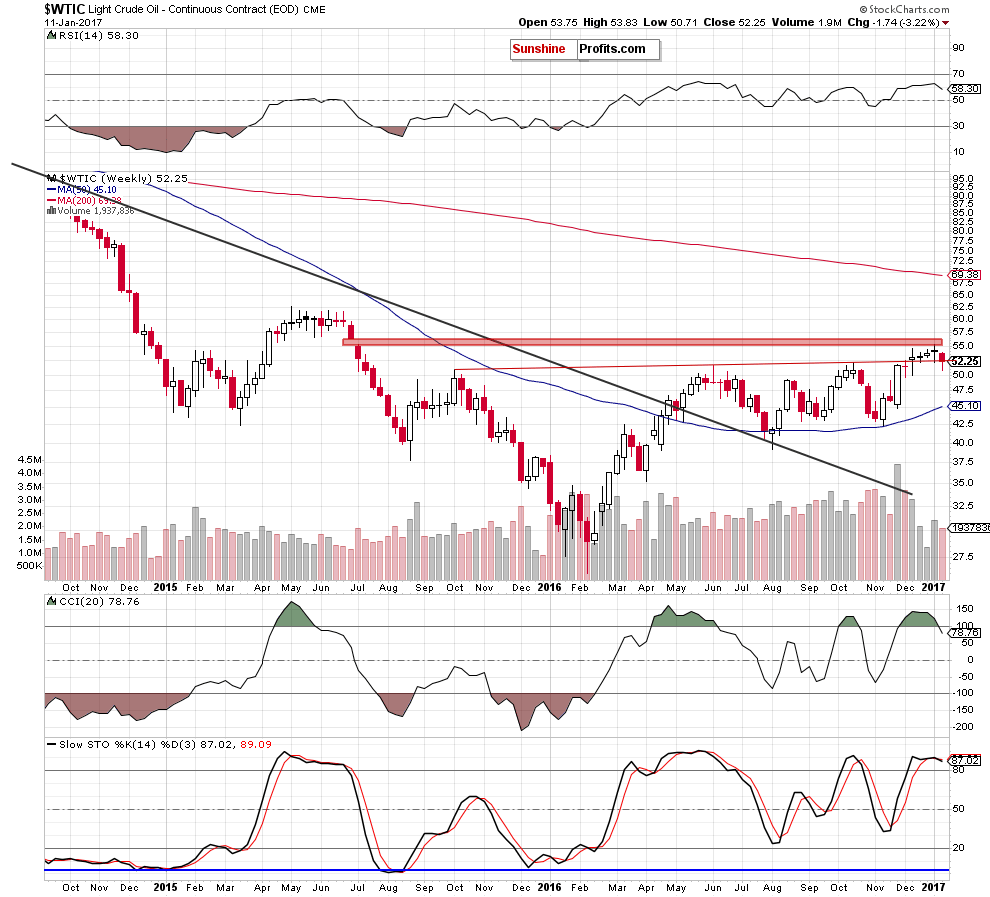

Looking at the weekly chart, we see that crude oil reversed and came back to the previously-broken long-term red support line. Despite this price action, the commodity closed the day below this line and sell signals generated by the indicators remain in place, which suggests that another attempt to move lower may be just around the corner (especially if light crude closes the week under the red line).

Will the daily chart confirm this scenario? Let’s check.

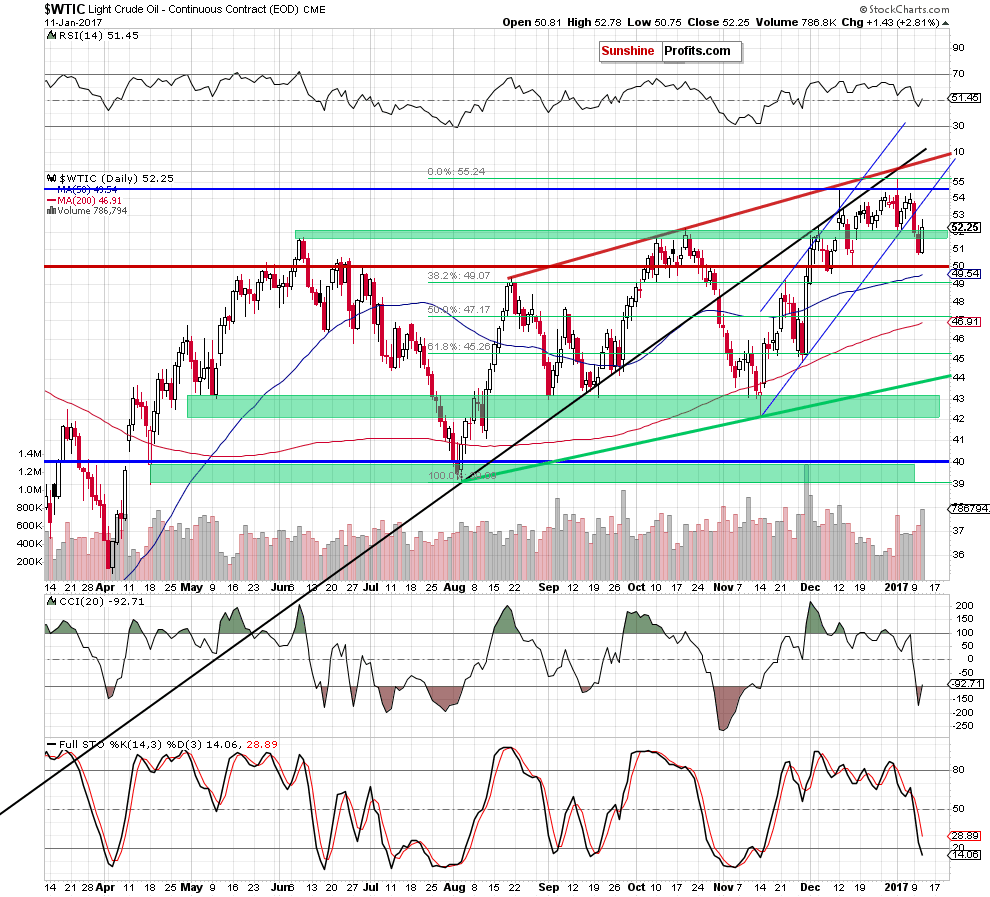

From the daily perspective we see that crude oil reversed and rebounded, invalidating the earlier breakdown under the June and October highs. Additionally, this move materialized on higher volume, which suggests further improvement in the coming day(s). How high could light crude go? In our opinion, if the commodity extends gains from here, we may see an increase to around $53.51, where the 61.8% Fibonacci retracement (based on the January decline) is. If this resistance is broken, the next upside target will be around $54.12, where the previously-broken lower border of the blue rising trend channel currently is.

Nevertheless, in our opinion, as long as there is no invalidation of the breakdown below this line all upswings will be nothing more than a verification of the earlier breakdown. Therefore, short positions continue to be justified from the risk/reward perspective.

Having said the above, let’s take a closer look at the relationship between crude oil and the precious metals to have a more complete picture of the market.

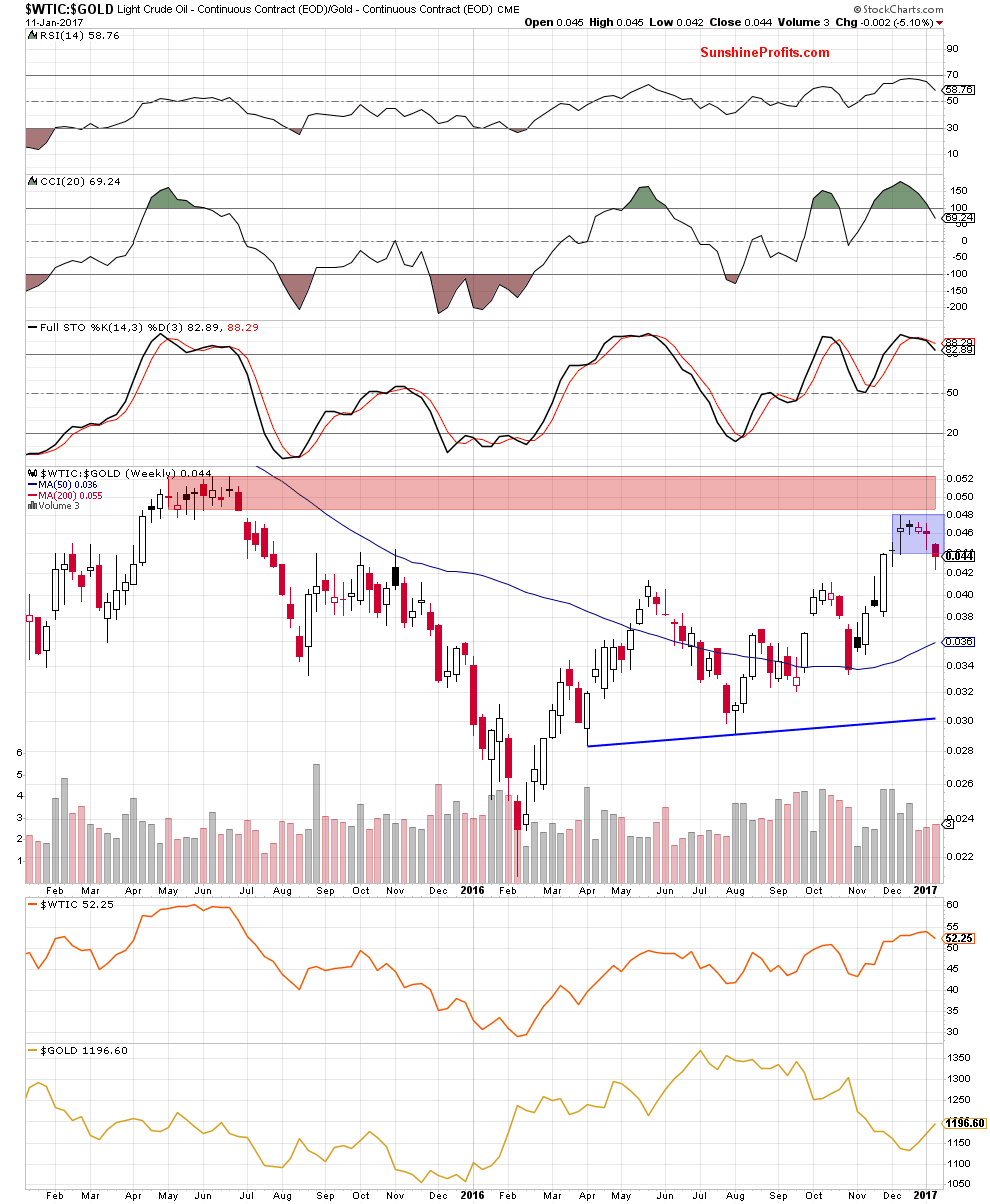

On the medium-term chart, we see that the gap created at the beginning of Jul 2015 and the proximity to the lower border of the red zone (the key resistance at the moment) stopped the rally in the ratio in previous weeks. Additionally, the Stochastic Oscillator and the CCI generated sell signal, which triggered a drop below the lower border of the blue consolidation, suggesting further declines in the coming weeks.

Additionally, the pro bearish scenario is also supported by the very short-term picture.

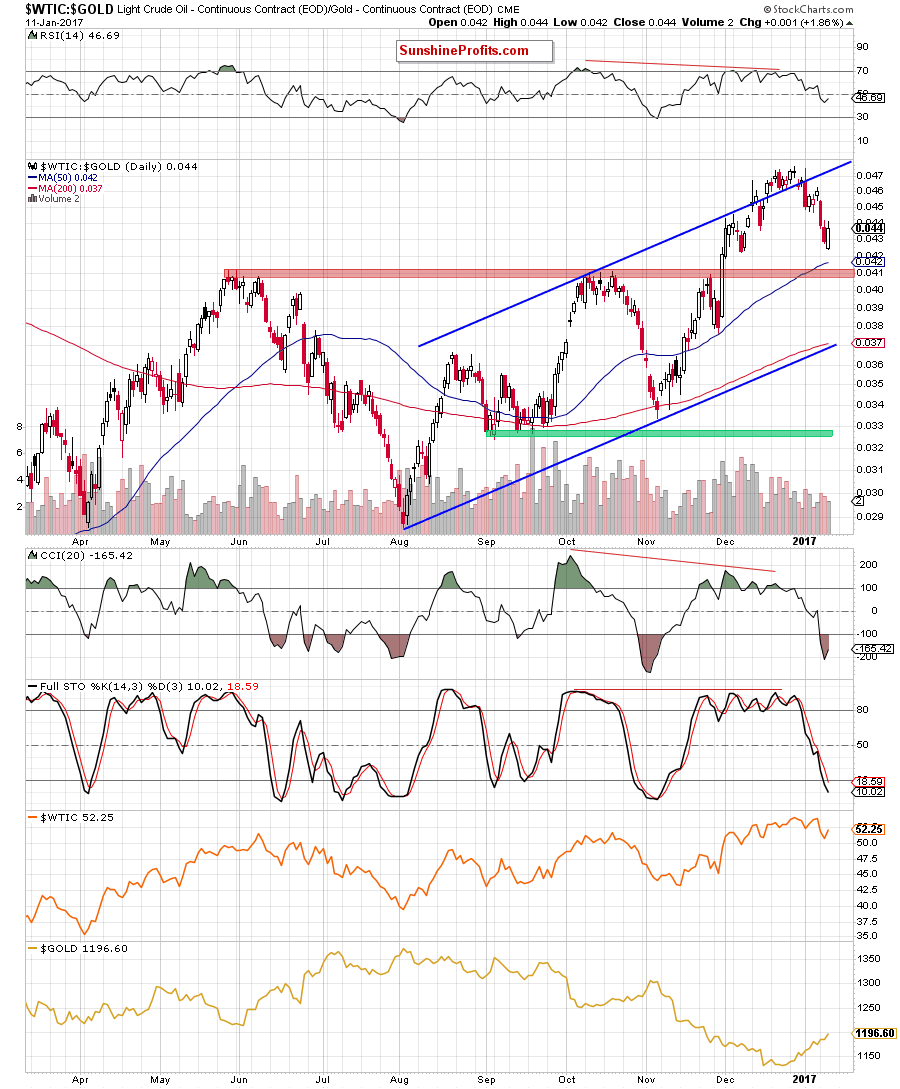

From this perspective, we see that the oil-to-gold ratio invalidated the earlier breakout above the upper border of the blue rising trend channel, which triggered a decline in recent days. Although the ratio reversed and rebounded yesterday, we believe that as long as there is no invalidation of the breakdown under this line, another move to the downside is very likely.

What does it mean for crude oil? Taking into account the positive correlation between the ratio and the black gold, a decline in the ratio will likely translate into lower prices of light crude in the coming week.

Having said that, let’s take a closer look at the oil-to-silver ratio.

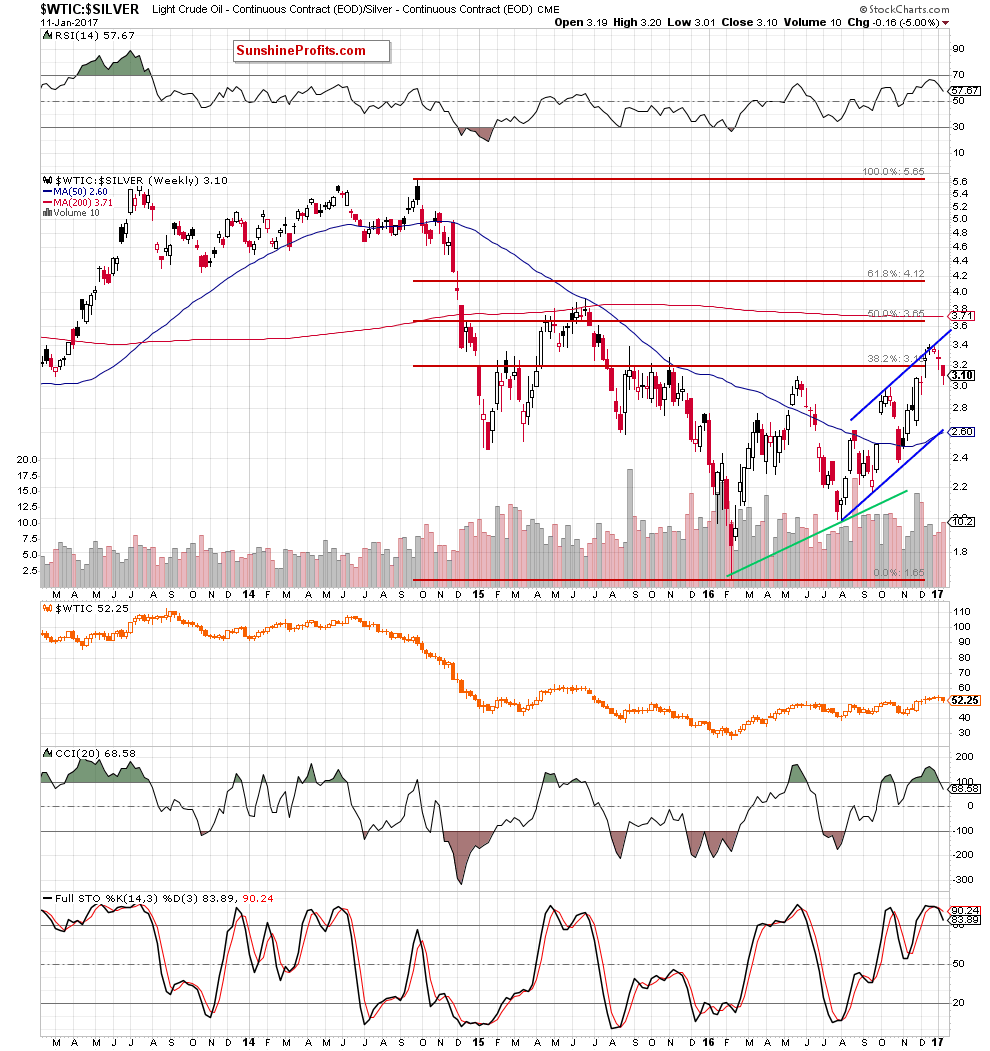

From the weekly perspective, we see that although the ratio extended gains, the upper line of the blue rising trend channel stopped further improvement and triggered pullback. As a result, the ratio declined under the previously-broken 38.2% Fibonacci retracement, invalidatng the earlier breakout. Taking this negative development and the sell signals generated by the CCI and Stochastic Oscillator into account, it seems that the ratio will move lower once again. Therefore, if we see suh price action, we’ll likely also see another move to the downside in the case of crude oil.

Summing up, although crude oil rebounded, short positions continue to be justified, because light crude is still trading under the previously-broken lower border of he blue rising rend channel. Additionally, the current situation in the oil-to-gold and oil-to-silver ratios suggests another attempt to move lower in the coming days.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with the stop-loss order at $56.45 and the initial downside target at $45.81) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts