Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Wednesday, crude oil rebounded and gained 1.78% on expectations that the U.S. crude inventories reports would show a drop in oil supplies. In this environment, light crude bounced off the first support zone and came back above $53. Where will the black gold head next?

Let’s take a closer look at the charts below to find out (charts courtesy of http://stockcharts.com).

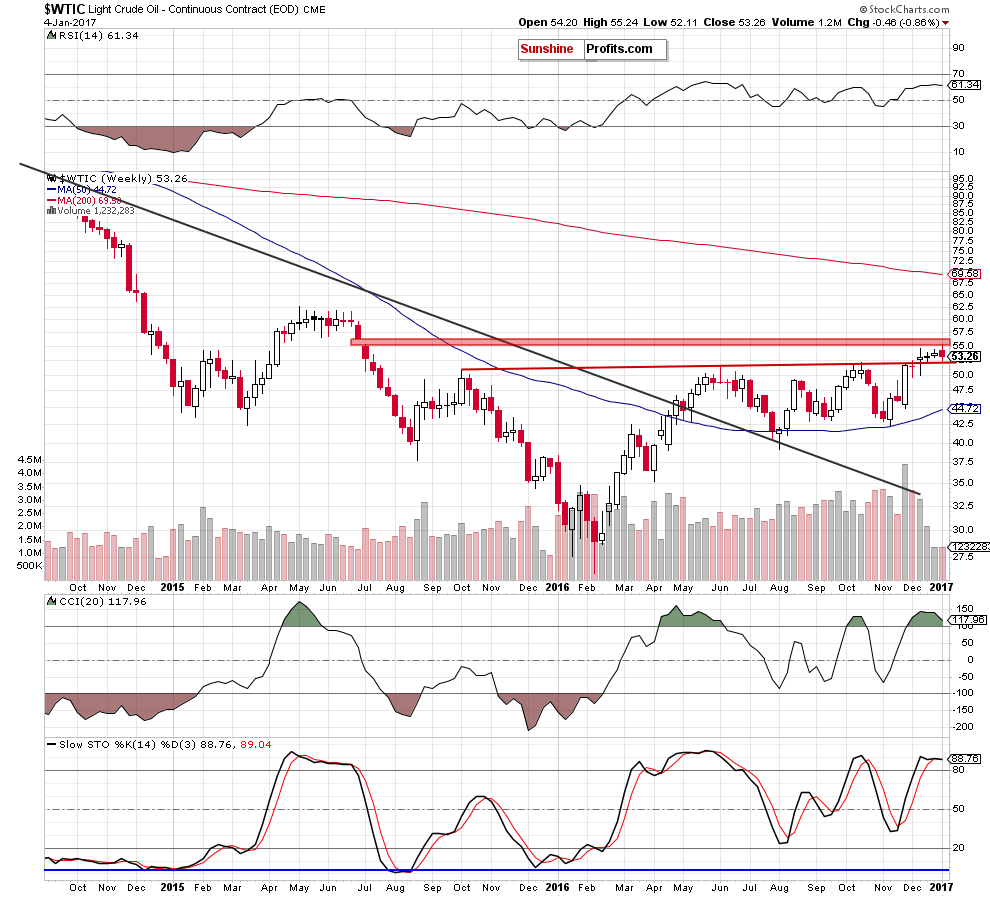

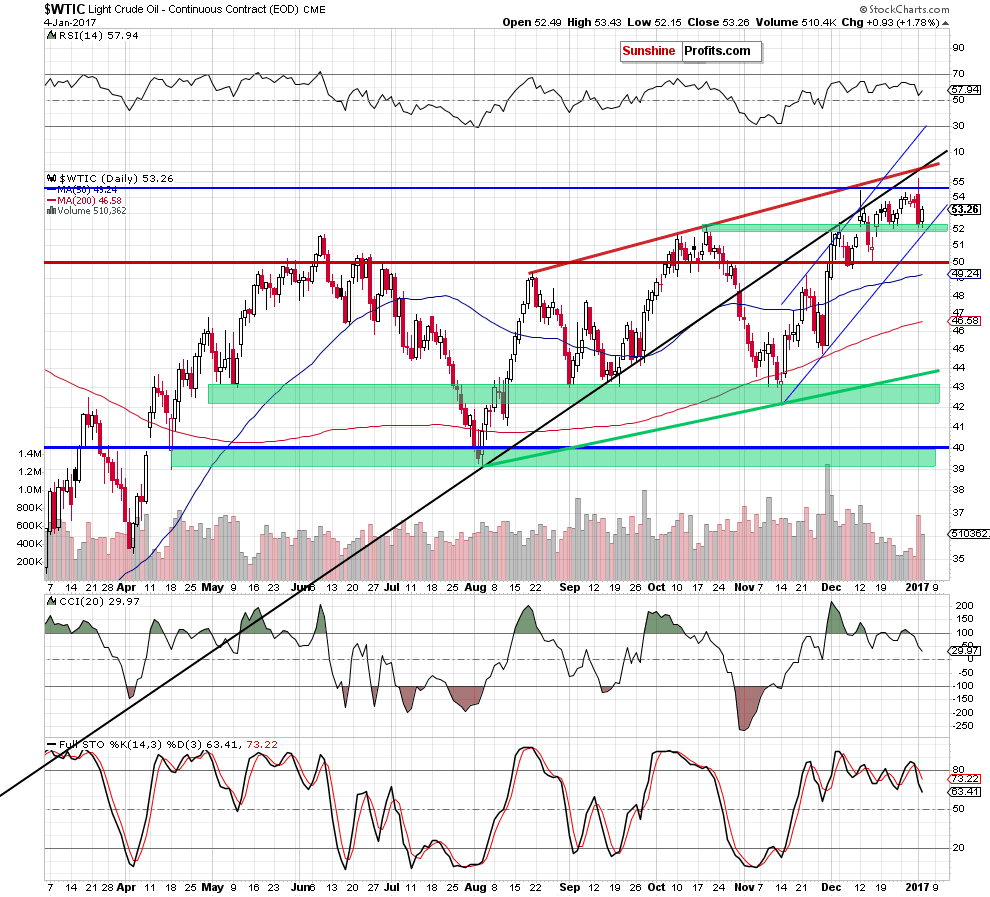

Looking at the charts, we see that the previously-broken red resistance line based on the October 2015 and June 2016 highs (marked on the weekly chart), together with the green support zone created by the October 19 high and the December 22 low (seen on the daily chart) encouraged oil bulls to act yesterday. As a result, light crude reversed and went up above $53.

Will we see further improvement? In our opinion, it is likely, because the American Petroleum Institute reported late yesterday a larger-than-expected decline in oil inventories (a drop of 7.4 million barrels), which supported crude oil futures earlier today. This suggests that the commodity would follow them at least after the market’s open. Nevertheless, from a technical point of view, the space for gains seems limited.

As a reminder, on the weekly chart, there are several factors which can affect further growth. Firstly – the proximity to the red gap which serves as the nearest resistance. Secondly – the current position of the indicators. As you see, they climbed to their overbought zones and are close to generating sell signals. Thirdly – volume has fallen from week to week, raising doubts about the strength of oil bulls.

On the daily chart we also see that light crude remains well below the medium-term black resistance line and the red resistance line based on the previous highs (seen on the daily chart). Additionally, the invalidation of a breakout above the 2016 peak and its negative impact on the price is still in effect, supporting oil bears. On top of that, sell signals generated by the CCI and Stochastic Oscillator remain in play, suggesting lower prices in the near future.

Before we summarize today’s alert, we would also like to quote what we wrote yesterday:

(…) Nevertheless, in our opinion, another sizable downward move would be more likely and reliable if crude oil invalidated a breakout above the October peak and dropped below the lower border of the blue rising trend channel. In this case, we’ll consider opening short positions. As always, we will keep you – our subscribers – informed should anything change.

Summing up, the outlook for oil remains more bearish than bullish, however, it still doesn't justify opening short positions as light crude remains above the October peak and the lower border of the blue rising trend channel.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. However, if crude oil invalidates the breakout above the October peak and drops below the lower border of the blue rising trend channel, we’ll consider opening short positions. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts