Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Tuesday, crude oil lost 2.59% after the Genscape data showed a large build in crude inventories at the Cushing hub in Oklahoma. Thanks to this news, light crude invalidated the earlier breakout above the 2016 peak and slipped to the first support zone. Will it manage to stop further declines?

Let’s take a closer look at the charts below to find out (charts courtesy of http://stockcharts.com).

Yesterday, we wrote the following:

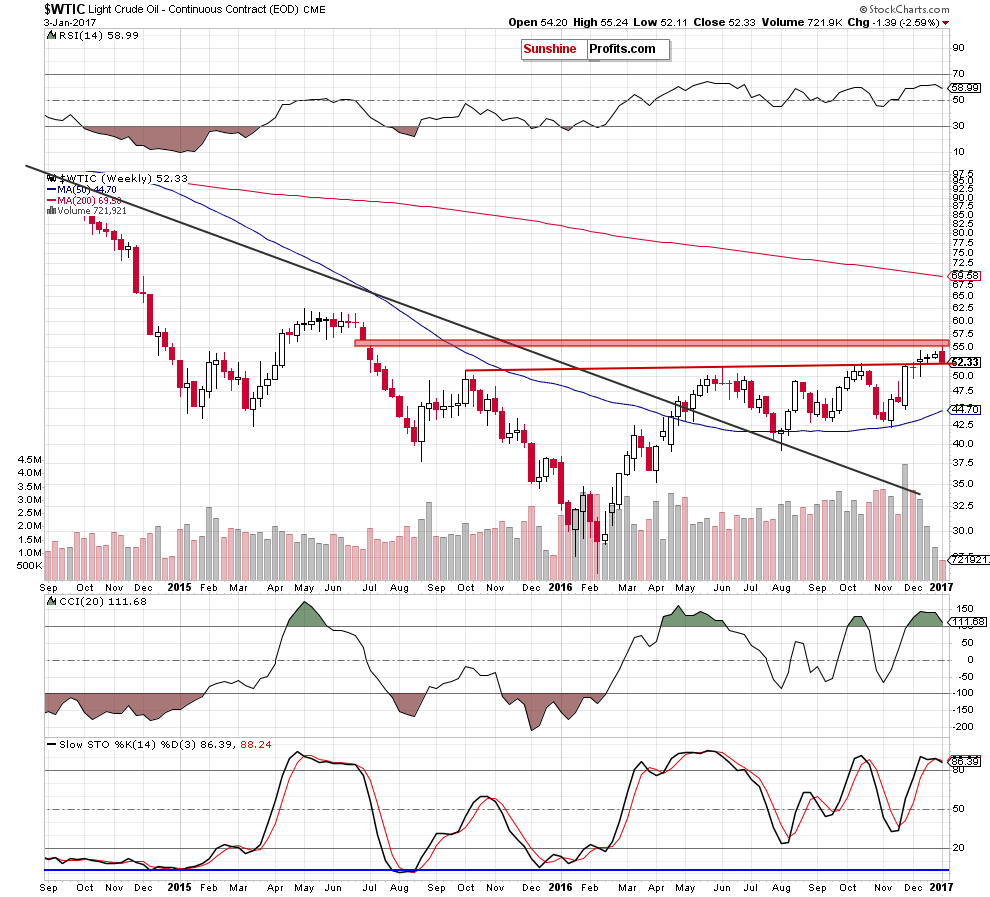

(…) there are several factors which can affect further growth. Firstly – the proximity to the red gap, which serves as the nearest resistance. Secondly – the current position of the indicators. As you see, they climbed to their overbought zones and are close to generating sell signals. Thirdly – volume has fallen from week to week, raising doubts about the strength of oil bulls.

From today’s point of view, we see that a combination of the mentioned factors encouraged oil bears to act, which resulted in a pullback and a comeback to the previously-broken red resistance line based on the October 2015 and June 2016 highs.

How did this drop affect the very short-term picture? Let’s take a look at the daily chart.

Quoting our previous alert:

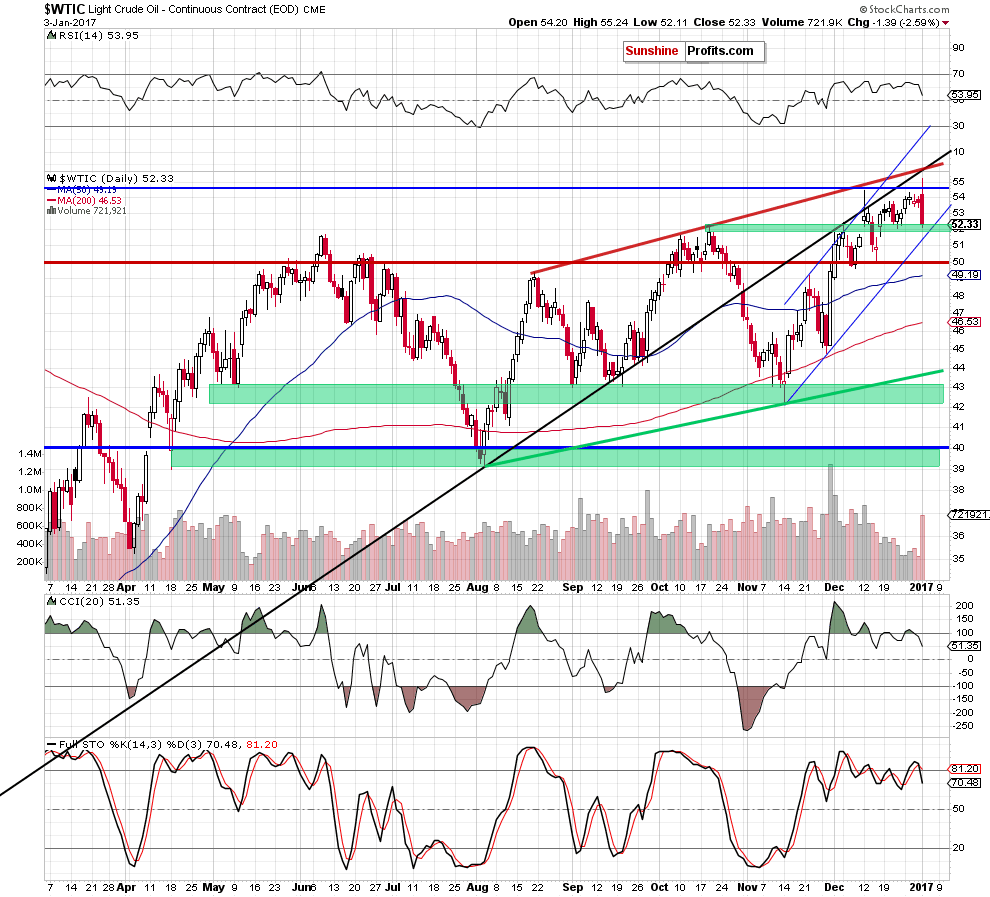

(…) earlier today, crude oil futures moved sharply higher and hit a fresh high of $55.24, which suggests that the black gold would follow them and also increase to a fresh high.

How high could it climb? (…) light crude (…) could (…) test (…) the medium-term black resistance line or even the red resistance line based on the previous highs [currently around $55.60].

Looking at the daily chart, we see that the situation developed in line with the above scenario and crude oil hit a fresh high of $55.24. Despite this improvement, oil bulls didn’t manage to hold this level, which resulted in a sharp pullback and an invalidation of a breakout above the 2016 high. This negative event triggered further deterioration and a decline to the green support zone created by the October 19 high and the December 22 low.

Additionally, the CCI and Stochastic Oscillator generated sell signals, which in combination with yesterday’s sizable increase in the volume suggests further deterioration in the coming days. If we see such action, the initial downside target for oil bears would be the barrier of $50 and the December lows.

Nevertheless, in our opinion, another sizable downward move would be more likely and reliable if crude oil invalidated a breakout above the October peak and dropped below the lower border of the blue rising trend channel. In this case, we’ll consider opening short positions. As always, we will keep you – our subscribers – informed should anything change.

Summing up, the outlook for oil turned to more bearish, however, it still doesn't justify opening short positions as light crude remains above the October peak and the lower border of the blue rising trend channel.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. However, if crude oil invalidates the breakout above the Oct. peak and drops below the lower border of the blue rising trend channel, we’ll consider opening short positions. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts