Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Friday, crude oil moved lower a bit, but closed the previous year above $53. What is the current picture for crude oil?

Let’s take a closer look at the charts below to find out (charts courtesy of http://stockcharts.com).

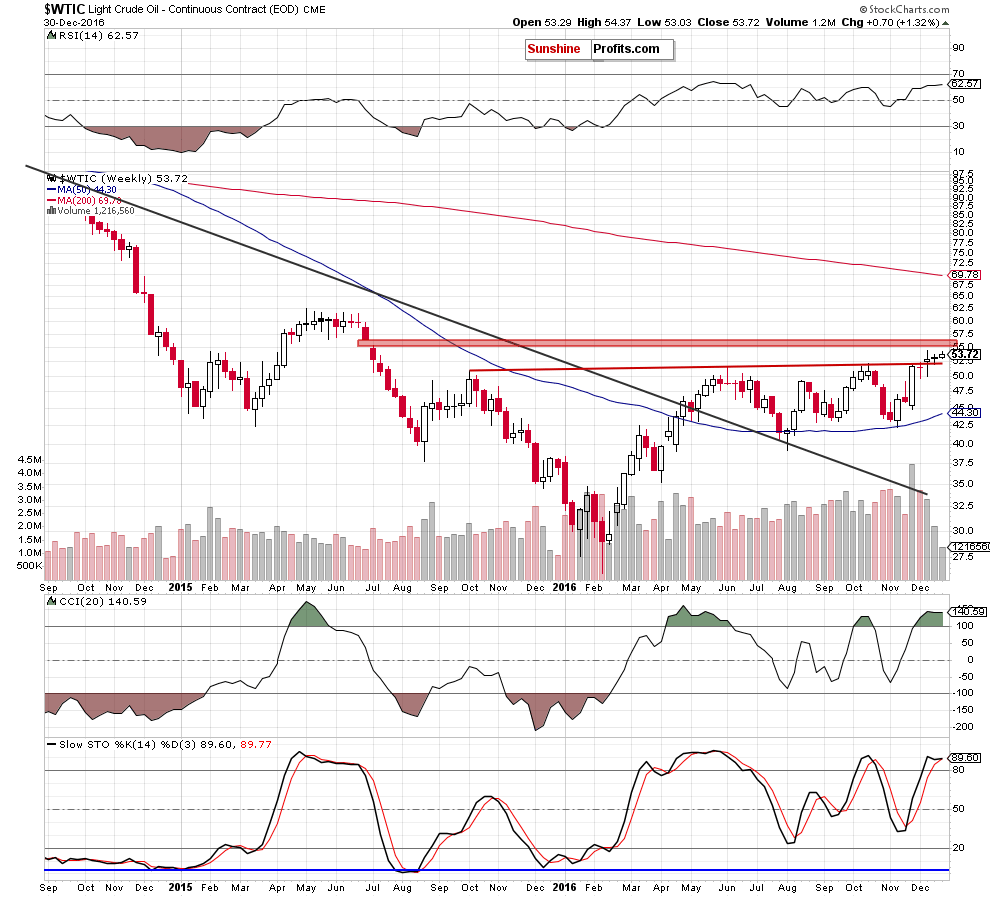

On the medium-term chart, we see that the commodity closed another week above the previously-broken red resistance line based on the October 2015 and June 2016 highs, which means that a breakout is confirmed. As is well known, such price action suggests further improvement, however, there are several factors which can affect further growth. Firstly – the proximity to the red gap, which serves as the nearest resistance. Secondly – the current position of the indicators. As you see, they climbed to their overbought zones and are close to generating sell signals. Thirdly – volume has fallen from week to week, raising doubts about the strength of oil bulls.

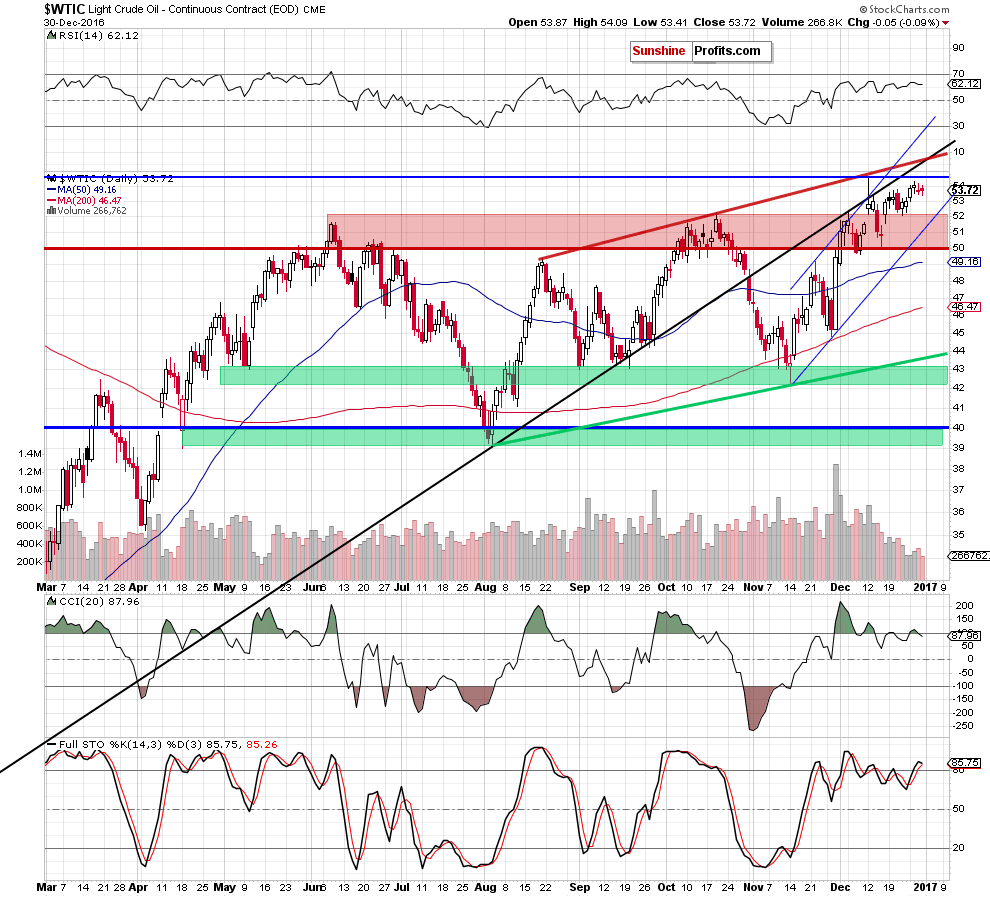

On top of that, the picture that emerges from the very short-term action also doesn’t bode well for a further sizable rally.

Based only on Friday’s session, we see that the overall situation didn’t change much as the commodity is consolidating slightly below the 2016 peak. Nevertheless, earlier today, crude oil futures moved sharply higher and hit a fresh high of $55.24, which suggests that the black gold would follow them and also increase to a fresh high.

How high could it climb? We believe that the best answer to this question would be the quote from our alert posted on Dec. 27:

(…) light crude still remains above the Oct high (there was no invalidation of a breakout), which could trigger a short-term upward move (…) and a test of the medium-term black resistance line or even the red resistance line based on the previous highs [currently around $55.60].

Summing up, the outlook for oil remains mixed as the commodity is trading in a narrow range between the previously-broken October high and two important resistance lines.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts