Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

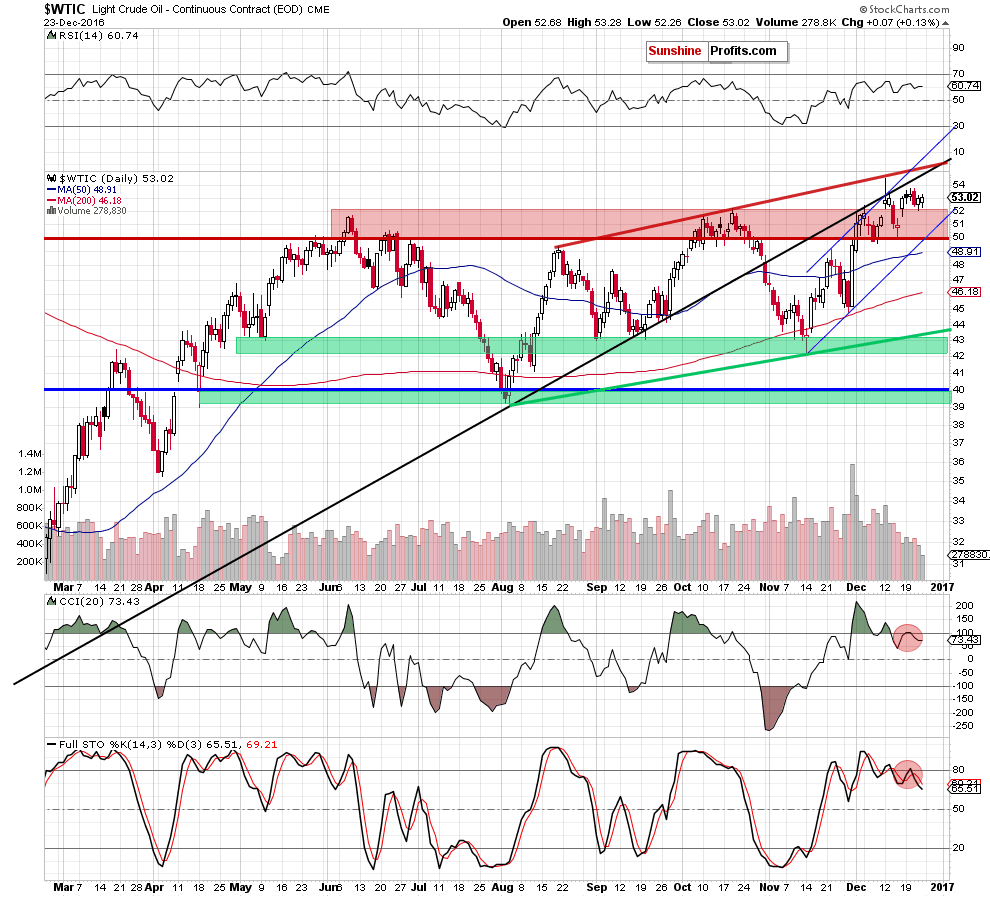

Let’s examine the daily chart and find out what can we infer from it about future moves (charts courtesy of http://stockcharts.com).

Looking at the daily chart, we see that crude oil didn’t do anything that would change the outlook on Friday and the same applies to today’s session so far. As you see, the commodity, is consolidating slightly above, the previously-broken Oct high, which makes the very short-term picture a bit unclear.

On one hand, light crude still remains above the Oct high (there was no invalidation of a breakout), which could trigger a short-term upward move (before a bigger decline) and a test of the medium-term black resistance line or even the red resistance line based on the previous highs. However, on the other hand, sell signals generated by the indicators remain in place, suggesting another attempt to move lower in near future. We could see some more volatility after crude oil inventory reports, but at this time we can’t say whether a rally or a decline will be seen next. As always, we will keep you – our subscribers – updated.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts