Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Thursday, the black gold moved lower as disappointing data on crude oil inventories continued to weigh on the price. As a result, light crude reached the short-term support zone. Will it manage to stop oil bears in the coming week?

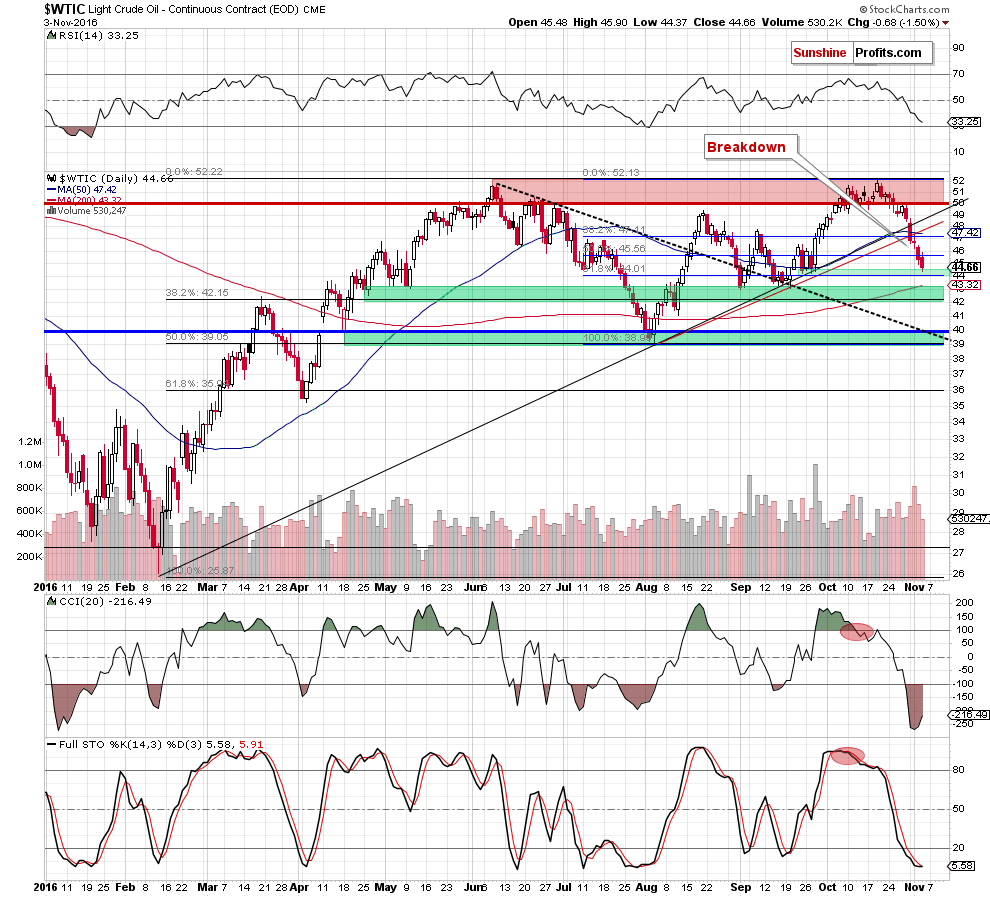

Let’s examine the daily chart and try to find out (charts courtesy of http://stockcharts.com).

Looking at the daily chart, we see that crude oil declined under the 50% Fibonacci retracement (based on the Aug-Oct upward move) and closed the day under below it, which suggests that the commodity will likely re-test the nearest support zone later in the day (maybe even its lower border based on the 61.8% Fibonacci retracement around $41.16).

Nevertheless, taking into account the fact that there are still no buy signals at the moment, it seems that crude oil could decline even to the next (and much stronger) support zone created by the 38.2% Fibonacci retracement (based on the entire Feb-Oct upward move), late Apr and early May lows, early Aug highs and Sep lows. This area is also supported by the 200-day moving average, which increases the probability of reversal and bigger rebound (in our opinion, to around the previously-broken red and black support/resistance lines) in the coming week.

Finishing today’s alert, it’s worth keep in mind that there is a negative divergence between the CCI and the price, while the Stochastic Oscillator dropped to its lowest level since early Aug. Back then similar situation encouraged oil bulls to act, which resulted in a rally above $49. On top of that, the size of volume has dropped in recent days, which suggests that oil bears may lose their strength, which could translate into rebound in a very near future.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts