Trading position (short-term; our opinion): Long positions (with a stop-loss order at $42.95 and initial upside target at $50) are currently justified from the risk/reward perspective.

On Wednesday, crude oil gained almost 3% after another decline in crude oil inventories. Thanks to these circumstances, light crude invalidated earlier breakdowns and closed the day above the 50-day moving average. What does it mean for the commodity?

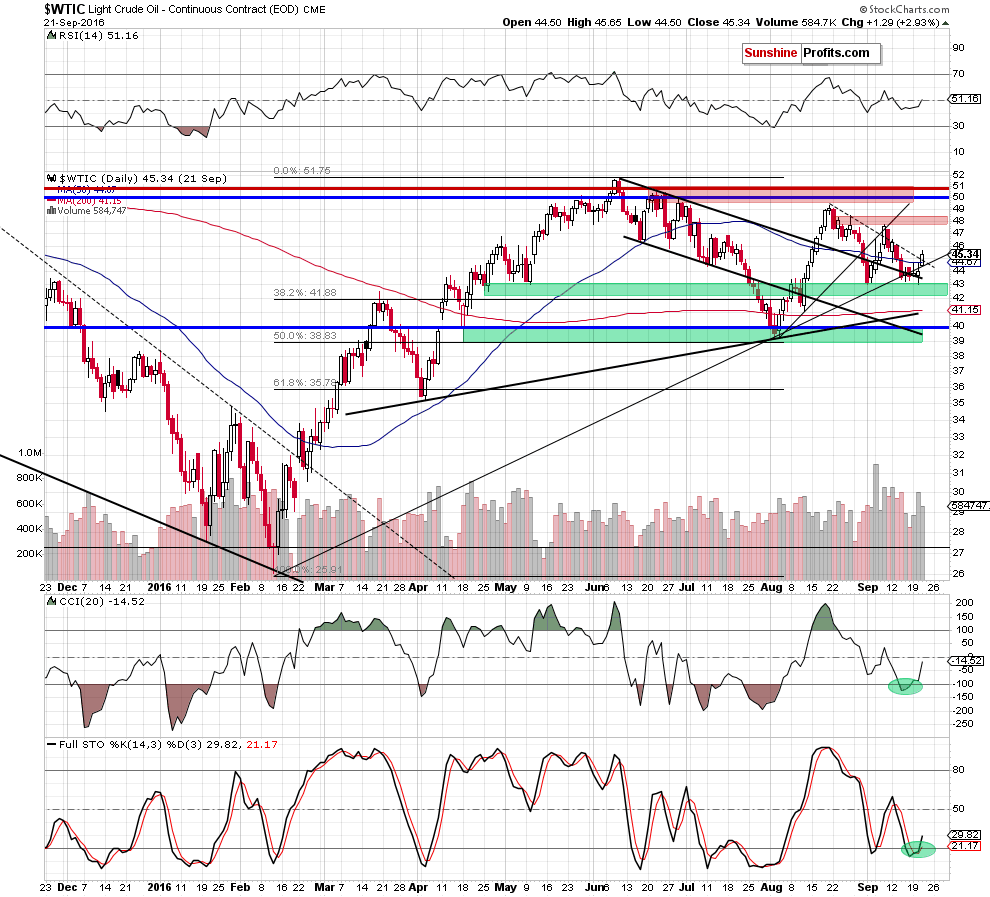

Although the U.S. Energy Information Administration showed that distillates stocks increased by 2.238 million barrels, the report also showed that crude oil inventories declined by 6.2 million barrels and gasoline stockpiles dropped by 3.204 million barrels. Thanks to these bullish numbers, light crude invalidated earlier breakdowns and closed the day above the 50-day moving average. What does it mean for the commodity? Let’s check the very short-term chart and find out (charts courtesy of http://stockcharts.com).

On Tuesday, we wrote the following:

(…) What’s next? The current position of the indicators (the CCI generated a buy signal, while the Stochastic Oscillator is very close to doing the same) suggests that the space for declines is limited and reversal is just around the corner.

Nevertheless, in our opinion, another move to the upside will be more likely if light crude closes today’s or one of the following sessions not only above the upper border of the black declining trend channel, but also above the rising support line (based on February and August lows.

Looking at the above chart, we see that buy signals generated by the indicators encouraged oil bulls to act which resulted in an increase above $45. With yesterday’s upswing, light crude came back above the rising support line based on February and August lows and the 50-day moving average, invalidating earlier breakdowns.

Additionally, the commodity climbed above the black dashed line based on the Aug highs, which suggests further improvement in the coming days. If we see such price action, the initial upside target would be the rd resistance zone, which stopped oil bulls at the beginning of the month (around $47.75-$48.46). If it is broke, we may see a test of the barrier of $50 in the coming week.

Summing up, yesterday, crude oil extended gains and invalidated earlier breakdowns, which in combination with buy signals generated by the indicators suggests further improvement in the coming days. Therefore, in our opinion, opening long positions is justified from the risk/reward perspective.

Very short-term outlook: bullish

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Long positions (with a stop-loss order at $42.95 and initial upside target at $50) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts