Trading position (short-term; our opinion): Long positions (stop loss at $37.23; next upside target at $49.60) are justified from the risk/reward perspective.

On Thursday, crude oil gained 2.88% as a bullish weekly crude oil inventories report and hopes that major producers could reach a deal next month continued to support the price of the commodity. As a result, light crude climbed to $49. Will we see a test of the barrier of $50 in the coming days?

Let’s take a look at the charts and find out what we can infer from them (charts courtesy of http://stockcharts.com).

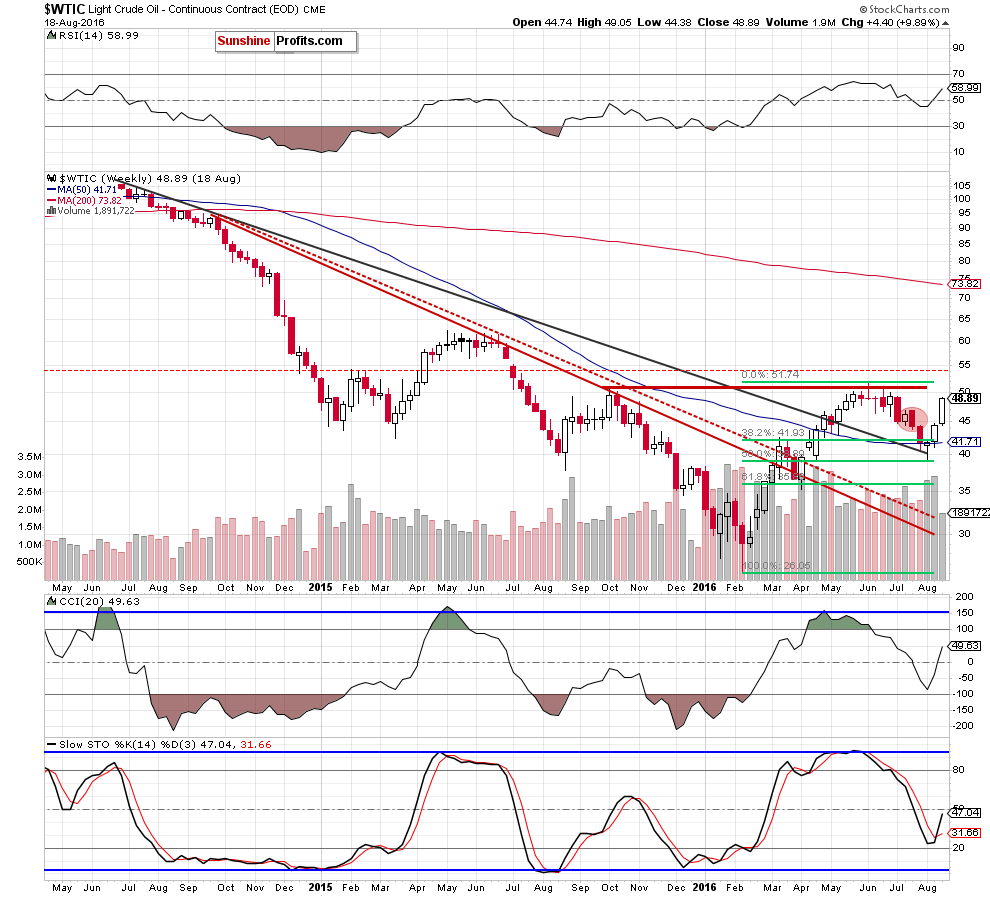

From the medium-term perspective, we see that this week’s rebound took crude oil above $46.84, which means that the bearish engulfing pattern (marked with red) was invalidated, which is a positive signal (especially if we see a weekly closure above this level, which is very likely, looking at the current price of the commodity). Additionally the CCI reversed and the Stochastic Oscillator generated buy signal, which increases the probability of further improvement.

Having said he above, let’s focus on the very short-term changes.

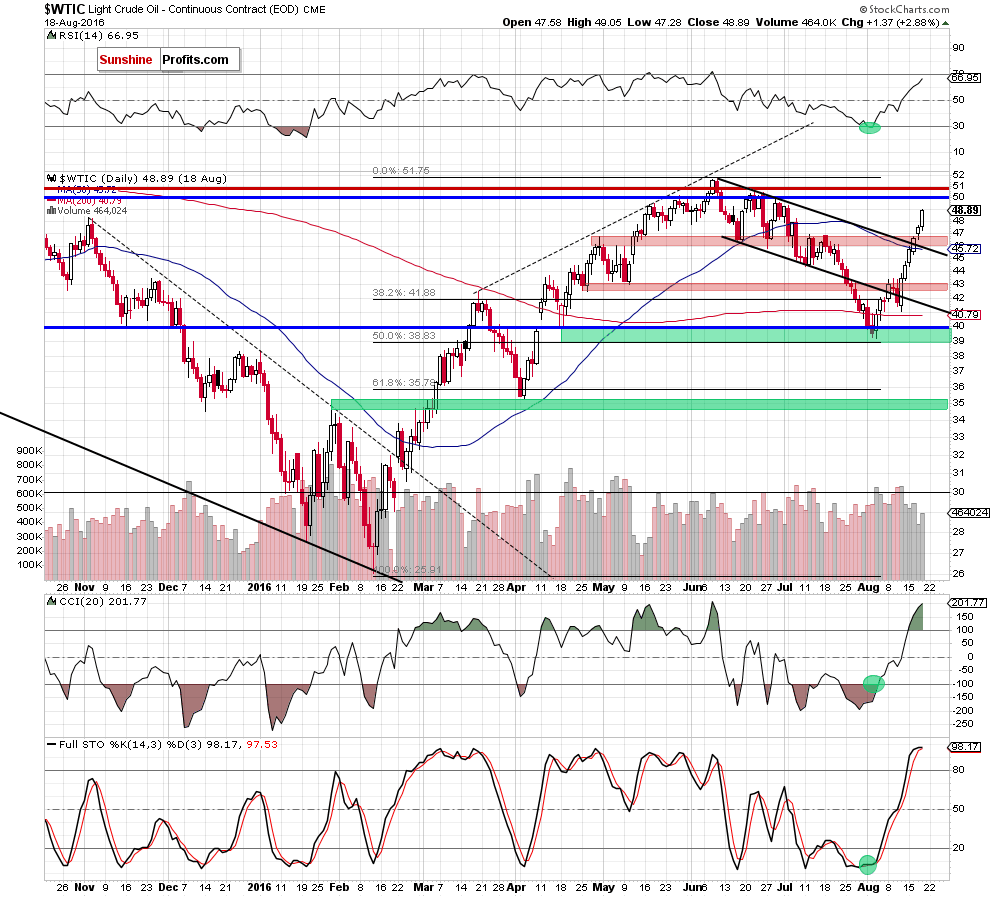

From today’s point of view, we see that crude oil extended gains above the previously-broken upper red resistance zone and the upper border of the black declining trend channel, which is a bullish signal that suggests a test of the late-Jun highs and the barrier of $50 in the coming week.

Nevertheless, we should keep in mind that the RSI approached the level of 70, while the CCI and Stochastic Oscillator moved to the overbought areas, which suggests that a pause in the coming day(s) should not surprise us. However, there were numerous situations (as visible on the above chart) when they stayed overbought for days and the top was not in (crude oil kept on rallying) until RSI moved above or very close to 70. Therefore, as long as there won’t be negative technical factors (for example, a tiny volume during another upswing or weekly closure below $46.84) further improvement is more likely than not.

Summing up, crude oil moved higher once again and even though a pause could still be seen, the rally is not likely to really end (or a bigger consolidation is not likely to be seen) until crude oil moves close to the $50 level. Therefore, long positions (which are already profitable) continue to be justified from the risk/reward perspective.

Very short-term outlook: bullish

Short-term outlook: bullish

MT outlook: bullish

LT outlook: mixed

Trading position (short-term; our opinion): Long positions (with a stop loss order at $37.23 and next upside target at $49.60) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts